- Whales now maintain 68.6% of all BTC, however have bought ~23K BTC since October highs.

- Bitcoin trades close to $110.8K, under 20-week EMA however above long-term assist.

- Reclaiming $111K–$112K might spark a rally; shedding $100.9K dangers deeper correction.

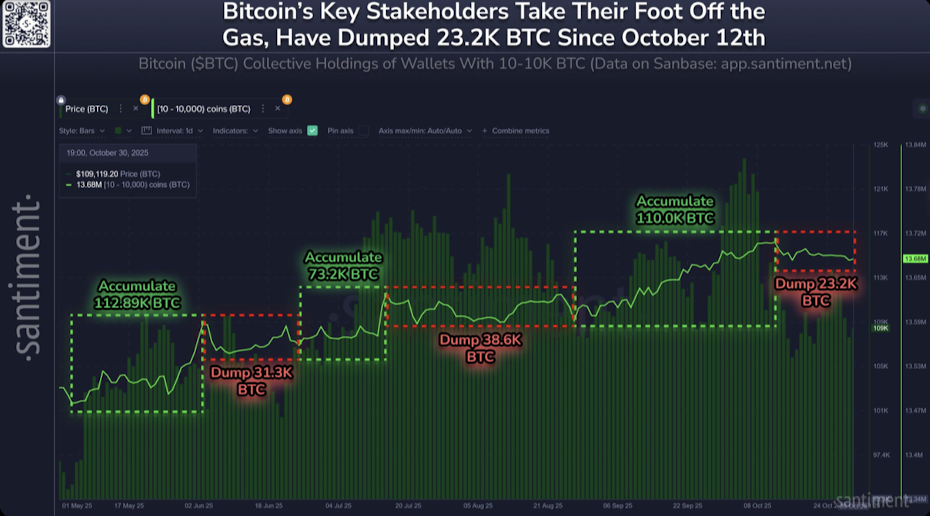

Recent information from Santiment paints an attention-grabbing image for Bitcoin proper now. Wallets holding between 10 and 10,000 BTC — usually known as the “whale zone” — now management roughly 13.68 million BTC, which is about 68.6% of the whole provide. That’s an enormous chunk of the pie. However what’s catching everybody’s consideration is their newest transfer: a small however noticeable sell-off.

Earlier than Bitcoin’s final all-time excessive, these wallets added round 110,000 BTC between August and mid-October. Since then, although, they’ve offloaded about 23,200 BTC. It’s not panic promoting, however it does present a shift in tone — whales are getting a bit extra cautious. Traditionally, that’s the sort of sign that hints at short-term corrections or a minimum of some sideways consolidation.

On the time of writing, Bitcoin’s sitting round $110,795 — slightly below its 20-week EMA at $111,425 and nonetheless comfortably above the 50-week EMA at $100,863. The long-term pattern construction is unbroken and bullish, however you possibly can really feel the market’s getting drained after such a robust push. It’s like everybody’s catching their breath earlier than the subsequent transfer.

Key Ranges and Fibonacci Zones to Watch

Bitcoin’s pulled again about 10.6% from its current excessive of $123,731, which truthfully, isn’t a lot contemplating the rally that got here earlier than it. The 20-week EMA now acts as speedy resistance close to $111K, whereas the 50-week EMA at $100.8K serves as a robust cushion under. If that fails, the subsequent security zones are round $84,794 (100-week EMA) and $66,219 (200-week EMA) — deeper correction territory.

Fibonacci retracements line up fairly neatly with this construction too. The 0.236 degree close to $112,087 is the short-term resistance to beat. A breakout above that might counsel consumers are again in management, opening a path towards retesting the $123K area. On the flip facet, shedding $100.9K might drag worth down into the $84K vary, aligning with the 0.382–0.5 retracement zone — the place previous corrections have tended to seek out footing.

Market Conduct Suggests a Wholesome Cooldown

Zooming in a bit, the Cash Movement Index (MFI) reads 43.6 proper now — neither scorching nor chilly. Meaning we’re seeing mild promoting, however not the type that indicators panic or exhaustion. Weekly candles are additionally displaying smaller our bodies and longer wicks, a visible cue that the market’s in that “wait-and-see” mode.

So, in plain English — Bitcoin’s taking a breather. Consumers are locking in income, and merchants are ready for a transparent course earlier than leaping again in. If the worth can reclaim that $111K–$112K zone and shut the week above it, momentum might reignite fairly quick, pushing us again towards $123K. But when we shut under $100.9K, that’s the place the warning lights begin flashing — it’d trace at a medium-term correction part.

Ultimate Ideas — Calm Earlier than the Subsequent Wave

At this level, Bitcoin feels prefer it’s in a peaceful stretch between storms. Lengthy-term construction? Nonetheless bullish. Brief-term temper? A bit cautious. Whales are trimming positions, however not fleeing. Indicators are cooling off, however not collapsing. It’s the sort of market that builds pressure earlier than the subsequent decisive transfer.

Whether or not that transfer is a push again above $112K or a slide towards $100K will set the tone for the remainder of the 12 months. For now, it’s all about persistence — as a result of in markets like this, the subsequent breakout (up or down) normally comes when everybody stops anticipating it.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.