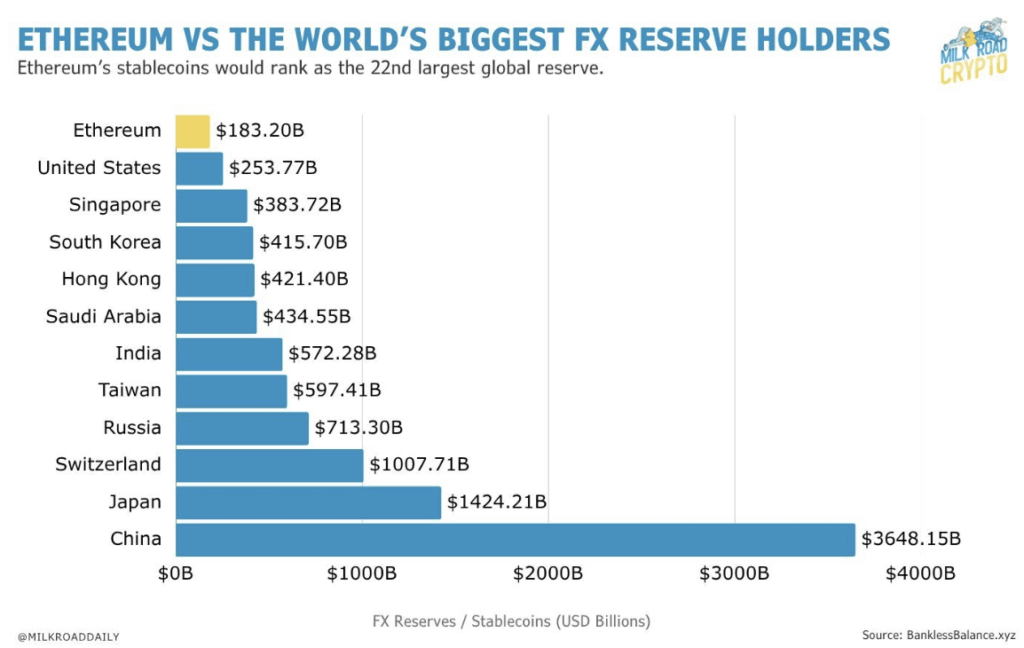

- ETH-based stablecoins now rank because the world’s twenty second largest reserve, surpassing main nations.

- A prime dealer with a 100% win document opened a $151M ETH lengthy place.

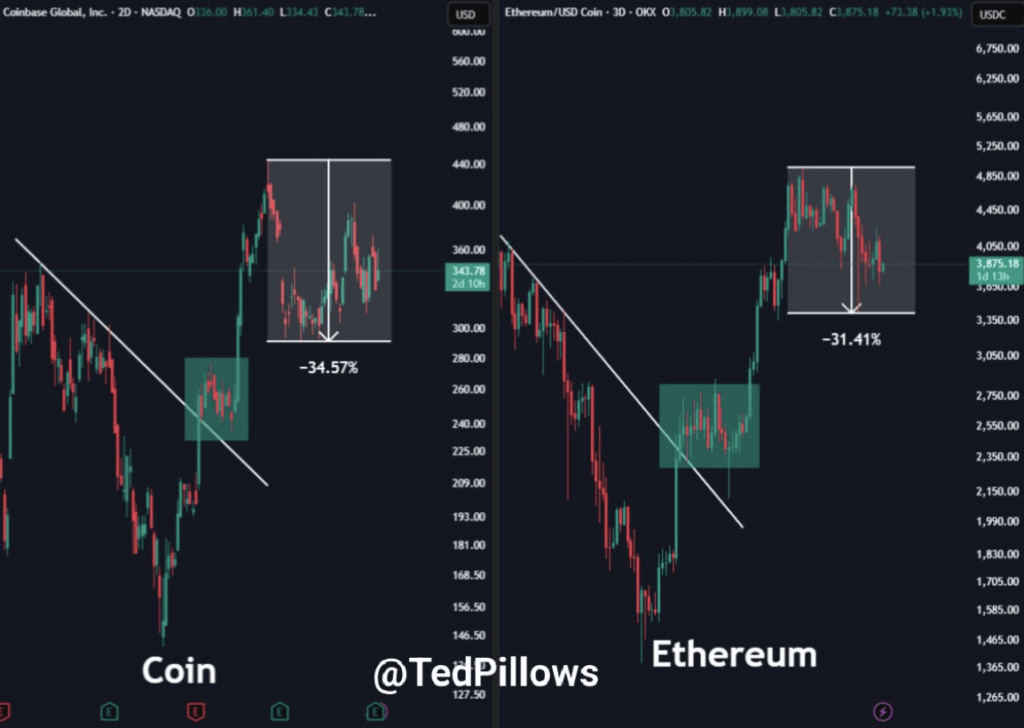

- Coinbase’s value actions proceed to reflect Ethereum’s breakout construction.

Right here’s the loopy half — Ethereum isn’t only a blockchain anymore. It’s turning into one thing larger, one thing nearer to a reserve foreign money. Sounds wild, however the information backs it up. ETH-based stablecoins now make up a reserve stack bigger than what most nations maintain in international change. Yeah, you learn that proper. Ethereum’s digital liquidity pile simply ranked twenty second globally, sitting forward of Singapore, South Korea, and even India.

Ethereum’s International Weight Is Rising Quick

ETH’s stablecoin ecosystem now totals about $183 billion. That quantity doesn’t simply make it an enormous participant in crypto—it really locations it amongst main nationwide reserves. For context, nations like Hong Kong and Saudi Arabia maintain much less in FX. Solely the mega gamers like China ($3.6 trillion), Japan ($1.4 trillion), and Switzerland ($1 trillion) sit comfortably forward.

That form of scale adjustments the dialog. Ethereum isn’t simply the “tech layer” of Web3 anymore—it’s turning into a part of the worldwide financial system. It’s the settlement layer for worth throughout chains, and now, doubtlessly throughout economies. If ETH actually is popping right into a reserve denominator, then any significant breakout right here isn’t only a crypto rally—it’s a macro occasion.

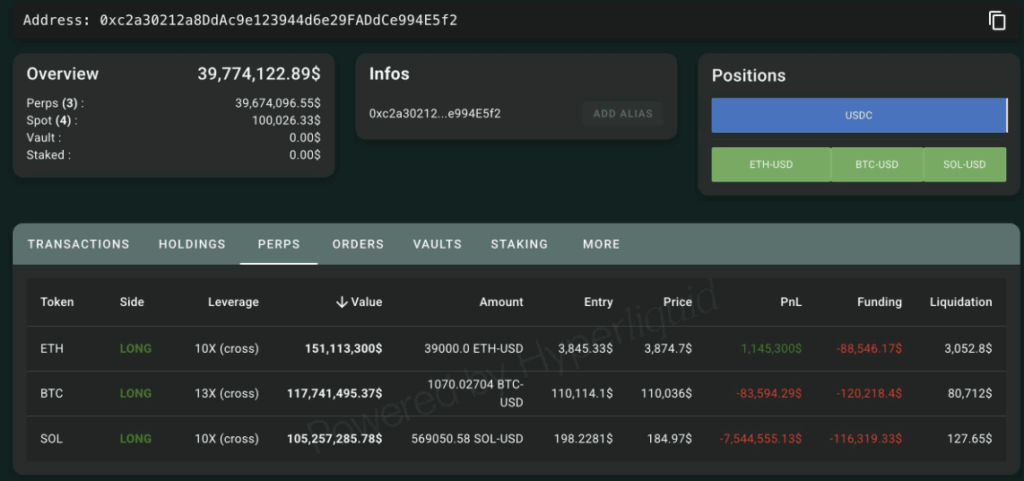

The Whale Betting $151M on ETH’s Comeback

Amid all of the noise, one dealer appears to know precisely what they’re doing. Handle 0xc2a3 has opened a large 39,000 ETH lengthy place price round $151 million, utilizing 10x leverage. What’s wild is that this isn’t some reckless degenerate transfer — this identical dealer reportedly has a 100% win fee throughout main market swings, in keeping with Lookonchain.

And it doesn’t cease there. They’ve additionally opened $118M in BTC longs and $105M in SOL positions, however the largest guess sits squarely on Ethereum. That’s the place they’re leaning the toughest. It’s like essentially the most environment friendly whale of the cycle is looking the underside on ETH — quietly, whereas the remainder of the market nonetheless argues about “weak momentum” and “sideways value motion.”

The Hidden Sign: COIN’s Value Motion

There’s one other sample hiding in plain sight, and barely anybody’s speaking about it. Coinbase (COIN) led the final huge transfer, rallying first earlier than pulling again 34%. Ethereum adopted nearly completely, mirroring the identical construction with a 31% cooldown. And now, each charts are sitting inside the identical form of consolidation zone.

Analyst TedPillows identified that each time COIN breaks into a brand new all-time excessive, ETH has adopted nearly tick-for-tick. If that relationship holds once more, then Ethereum’s subsequent transfer may already be written in Coinbase’s chart.

Last Ideas — A Storm Constructing in Silence

Proper now, the headlines are about reserves, whales, and cautious merchants. However beneath that, one thing larger appears to be forming. Ethereum isn’t simply one other altcoin grinding by means of a dip. It’s sitting on one of many largest liquidity bases on this planet — and the neatest cash on the market appears to be loading up quietly.

So whereas everybody debates short-term sentiment, the true story could be this: Ethereum is slowly taking its place within the world monetary order. And if historical past rhymes, the following breakout gained’t simply be one other crypto pump—it’ll be a press release.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.