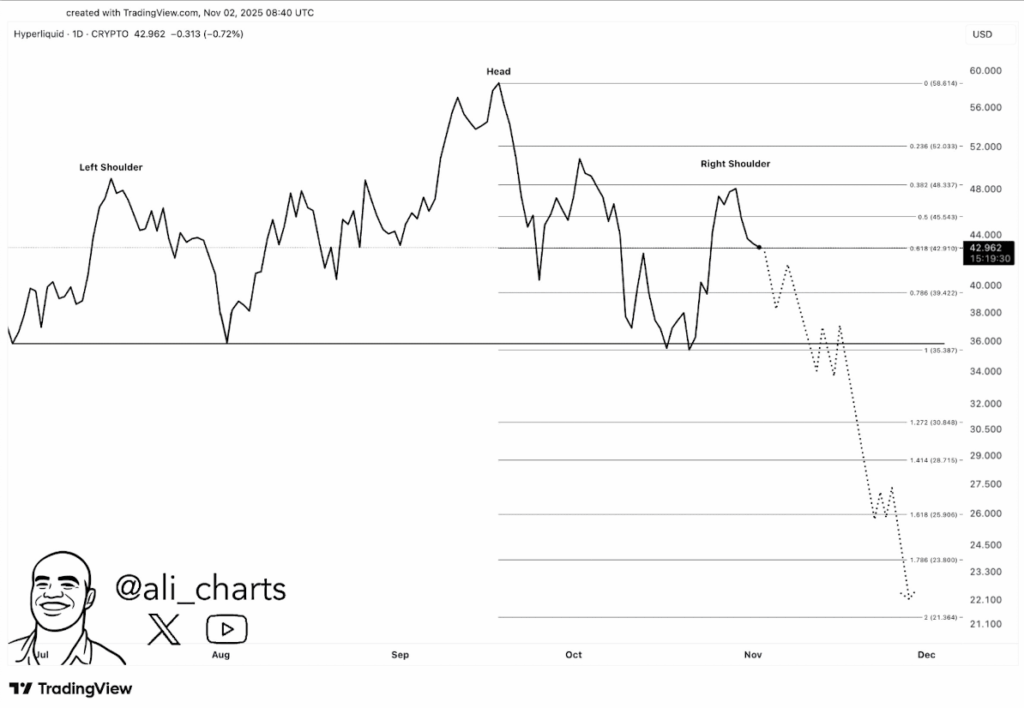

- Analyst Ali spots a head and shoulders sample forming on the HYPE chart.

- A breakdown under the neckline might ship value towards the low $20s.

- The brand new OKX itemizing might nonetheless flip issues round — if consumers step in quickly.

Hyperliquid simply scored an enormous win — it’s now listed on OKX Spot, a transfer that normally fires up shopping for stress and pleasure throughout the market. Most merchants anticipated that sort of momentum enhance to spark a rally. However as an alternative, the chart’s beginning to flash a warning signal.

Crypto analyst Ali identified one thing that’s making merchants nervous: a possible head and shoulders formation on the HYPE chart. It’s a type of basic bearish reversal patterns that always reveals up proper earlier than a development flips downward. If that sample confirms, issues might get tough for bulls — and quick.

HYPE Chart Exhibits a Traditional Warning Sample

Ali’s chart sketches out the entire construction: a left shoulder, a greater head, and a proper shoulder that’s now taking form. Under all of it sits a flat neckline — that key horizontal degree that acts as the ultimate line of protection.

Proper now, HYPE is sitting uncomfortably near that neckline. If value dips under it with robust quantity, that may formally affirm the bearish sample. The market normally treats that as a promote sign — one that may set off heavier draw back momentum.

Ali’s projection factors towards the low $20 vary if the breakdown performs out utterly. His dotted line on the chart hints that this wouldn’t be a gradual grind — it may very well be a collection of sharp drops in fast succession. Nonetheless, nothing’s confirmed but. If consumers handle to defend the neckline, they might flip the setup earlier than it collapses.

OKX Itemizing Brings Hope, However Not But a Breakout

Right here’s the twist: listings like this normally gasoline rallies. OKX provides liquidity, visibility, and a wave of latest merchants who need in — however surprisingly, that hasn’t occurred but.

The worth hasn’t responded with the same old post-listing pop, which leaves the market in a sort of ready zone. The subsequent few periods will likely be essential. If HYPE bounces off its neckline and prints a robust restoration candle, sentiment might shift rapidly, and shorts may get squeezed out. But when that degree cracks, the bearish setup possible takes over utterly.

What’s Subsequent for HYPE?

Hyperliquid stays one of many fastest-growing ecosystems within the on-chain buying and selling world. The basics haven’t modified — it’s nonetheless obtained a loyal person base and loads of consideration. However technicals transfer on crowd psychology, and proper now, the gang seems to be unsure.

So right here’s the breakdown:

- If HYPE breaks under the neckline, the trail towards $20 opens quick.

- If HYPE holds and rebounds, the OKX itemizing might flip into the catalyst that erases the bearish sample fully.

It’s a second of fact for the token. Merchants ought to preserve their eyes glued to that help degree — as a result of no matter occurs subsequent might determine whether or not that is only a quick pause earlier than the subsequent leg up… or the beginning of a deeper fall.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.