Privateness cash are constructed to protect transaction particulars from public view. In contrast to Bitcoin, the place anybody can hint pockets addresses, privateness cash make use of methods akin to ring signatures and zero-knowledge proofs to hide the sender, receiver, and switch quantity.

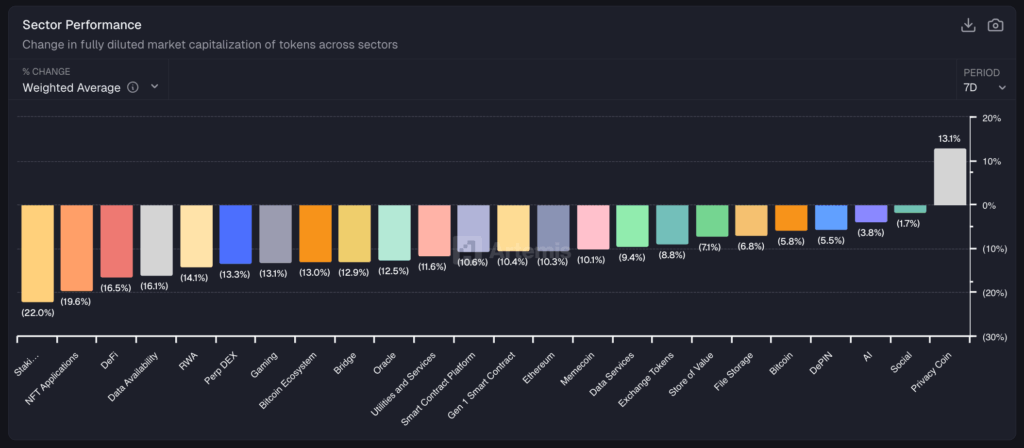

And proper now, these cash are performing effectively. Whereas the broader market is bleeding, they’ve simply posted the strongest seven-day efficiency of any sector. This variation reveals rising demand for monetary anonymity.

Sprint, Monero, and Aster are main the way in which, every posting features previously week regardless of selloffs elsewhere. For buyers, this might sign an entry level right into a sector that’s lastly getting consideration after years of regulatory strain.

However there’s one other angle price contemplating. Greatest Pockets Token (BEST), the native token of Greatest Pockets, presents privacy-focused utility with out the compliance challenges that face pure privateness cash. It’s in presale now, and has already raised over $16.7 million.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Privateness Cash Simply Posted the Solely Inexperienced Numbers in Crypto

Privateness cash gained 13.1% in weighted common fully-diluted market cap over the previous seven days, in keeping with Artemis knowledge. That makes them the one sector in optimistic territory out of the 24 sectors that Artemis tracks.

Three forces are coming collectively to drive this optimistic efficiency. First, monetary surveillance considerations are pushing customers towards cash that cover transaction particulars, particularly as regulators tighten scrutiny worldwide. For instance, privateness cash are up 192% year-to-date in comparison with Bitcoin’s 18.4%.

Expertise upgrades are additionally enjoying a job. Zcash not too long ago rolled out options akin to momentary addresses and {hardware} pockets fixes, driving each the value and shielded provide larger. The coin even briefly flipped Monero in market cap at a complete valuation of $6.2 billion.

Market rotation is the third piece of the puzzle. After October’s flash crash, buyers pivoted into undervalued niches that don’t observe Bitcoin’s each transfer – pushing the privateness coin sector’s market cap above $50 billion.

Is Now the Proper Time to Purchase Sprint, Monero, or Aster?

The numbers look tempting, nevertheless it’s necessary to weigh every choice right here. Sprint sits at $85.80 proper now, down 4% as we speak however nonetheless up 64% over the previous week. Monero is holding $350 with spot volumes up 24% previously day. And Aster climbed 27% yesterday earlier than falling again earlier as we speak.

The bullish case for privateness cash has substance. Sprint’s no-founder mannequin and cross-chain options give it structural resilience. In the meantime, Monero’s use in non-public transactions retains demand regular. Plus, Grayscale’s $150 million Zcash Belief and CZ’s newest $2 million ASTER funding point out legitimacy.

However the dangers are actual. A complete of 73 exchanges worldwide have delisted privateness cash as regulators tighten anti-money-laundering guidelines. Monero’s default privateness makes it a main goal for enforcement.

Additionally, ASTER has already begun to dump after the hype round CZ’s funding – which may sign a fast pump-and-dump greater than sustainable progress. That’s why buyers focused on privateness cash should weigh short-term momentum in opposition to longer-term dangers.

Greatest Pockets Token Affords Privateness With out the Regulatory Points

Privateness cash clear up one drawback – nameless transactions – however Greatest Pockets Token (BEST) tackles your complete lifecycle of crypto administration with out handing over your identification. The token powers Greatest Pockets, a non-custodial pockets app that requires zero KYC.

Meaning no passport uploads, no verification delays, and no private knowledge sitting on a server someplace. You management your non-public keys, and the Greatest Pockets app by no means touches your crypto.

Greatest Pockets’s setup mirrors the privateness ideas of Monero however extends them past simply transfers. You’ll be able to retailer, swap, and spend crypto – together with privateness cash themselves – with out compromising your anonymity. Plus, security measures like 2FA and Fireblocks’ MPC tech hold your belongings secure with out centralized intermediaries.

Holding the BEST token unlocks perks that pure privateness cash can’t match. For instance, you possibly can earn as much as 8% cashback on purchases made utilizing the upcoming Greatest Card and luxuriate in decreased swap charges throughout 60+ supported chains.

You additionally achieve advance entry to vetted presales by means of the Upcoming Tokens portal, permitting you to enter new initiatives earlier than most people. And if that wasn’t sufficient, governance rights and staking rewards (78% APY) add much more causes to carry.

Early buyers should buy BEST earlier than the DEX itemizing for simply $0.025885 within the presale. Analysts like Borch Crypto imagine the token may ship large returns as soon as it hits the open market. So, if you need privateness publicity with added utility, Greatest Pockets Token may be a wiser wager than Sprint, Monero, or Aster.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.