The crypto markets arrive at midweek beneath excessive rigidity. The macro driver is now not regulation or charges however capital exhaustion. Institutional patrons have slowed, and spot ETF flows now present 5 consecutive crimson classes. Bitcoin has dipped beneath the “Black Friday” value level, briefly dropping the psychological $100,000 zone.

TL;DR

- Bitcoin and Ethereum ETFs lose $797 million in a day after 5 straight outflow classes.

- Bitwise CIO Matt Hougan requires $125,000-$150,000 BTC earlier than 12 months’s finish.

- 3% XRP ETF from Amplify formally listed on DTCC beneath ticker XRPM.

- Institutional demand cooling sparks warnings from Charles Edwards.

$150,000 for Bitcoin in 2025? Bitwise says sure

With everybody panicking on social media a few new “crypto winter,” Bitwise CIO Matt Hougan gave a very totally different message, saying that retail traders are “in most despair mode,” promoting into each dip and leaving the market solely.

Based on Bitwise’s inner circulate knowledge, that is precisely how the ultimate capitulation earlier than pattern reversals usually appears to be like. Compelled liquidations and revenue exits are the secret in retail, however institutional desks are holding their very own. Hougan identified that main advisory companies, funds and ETF desks are nonetheless shopping for into Bitcoin as a substitute of promoting.

He talked about that cash retains flowing into IBIT, FBTC and GBTC, even throughout market corrections. In the meantime, the Solana Spot ETF (BSOL) raised over $400 million in its first week, despite the fact that there was a basic transfer away from danger — an indication that capital rotation is occurring, not capital flight.

Bitwise thinks the worst of the promoting is about to finish. Hougan reaffirmed two goal ranges:

- Practical: $125,000-$130,000 BTC earlier than the tip of the 12 months.

- Optimistic (Saylor-level): $150,000 BTC if institutional confidence stabilizes earlier than December.

For him, all of it appears to be like like a repeat of 2020’s consolidation earlier than the breakout, when sentiment collapsed proper earlier than the following leg larger.

Distinctive 3% XRP ETF achieves key DTCC itemizing

The Amplify XRP 3% Month-to-month Choice Earnings ETF (XRPM) has formally been listed on the DTCC. For individuals who are unfamiliar with it, registration is the ultimate step earlier than buying and selling begins. With out it, brokers and market makers can not course of fund transactions.

Itemizing beneath the XRPM ticker confirms that the ETF is cleared for integration into brokerage techniques. That is anticipated to set off the primary XRP-based income-generating product on U.S. markets.

The ETF is designed to ship a yield of about 3% per thirty days by lined name methods on XRP positions. Its construction mimics that of well-liked fairness earnings ETFs, bringing a passive-income instrument to digital belongings like XRP for the primary time.

Based on the preliminary prospectus, the new XRP fund will commerce on Cboe BZX and redeem shares solely in institutional “creation models.”

If every thing goes in keeping with plan, XRP will turn out to be one of many few belongings, alongside Bitcoin and Ethereum, with each direct and by-product ETF infrastructure within the U.S. pipeline.

Bitcoin and Ethereum lose $800 million in someday

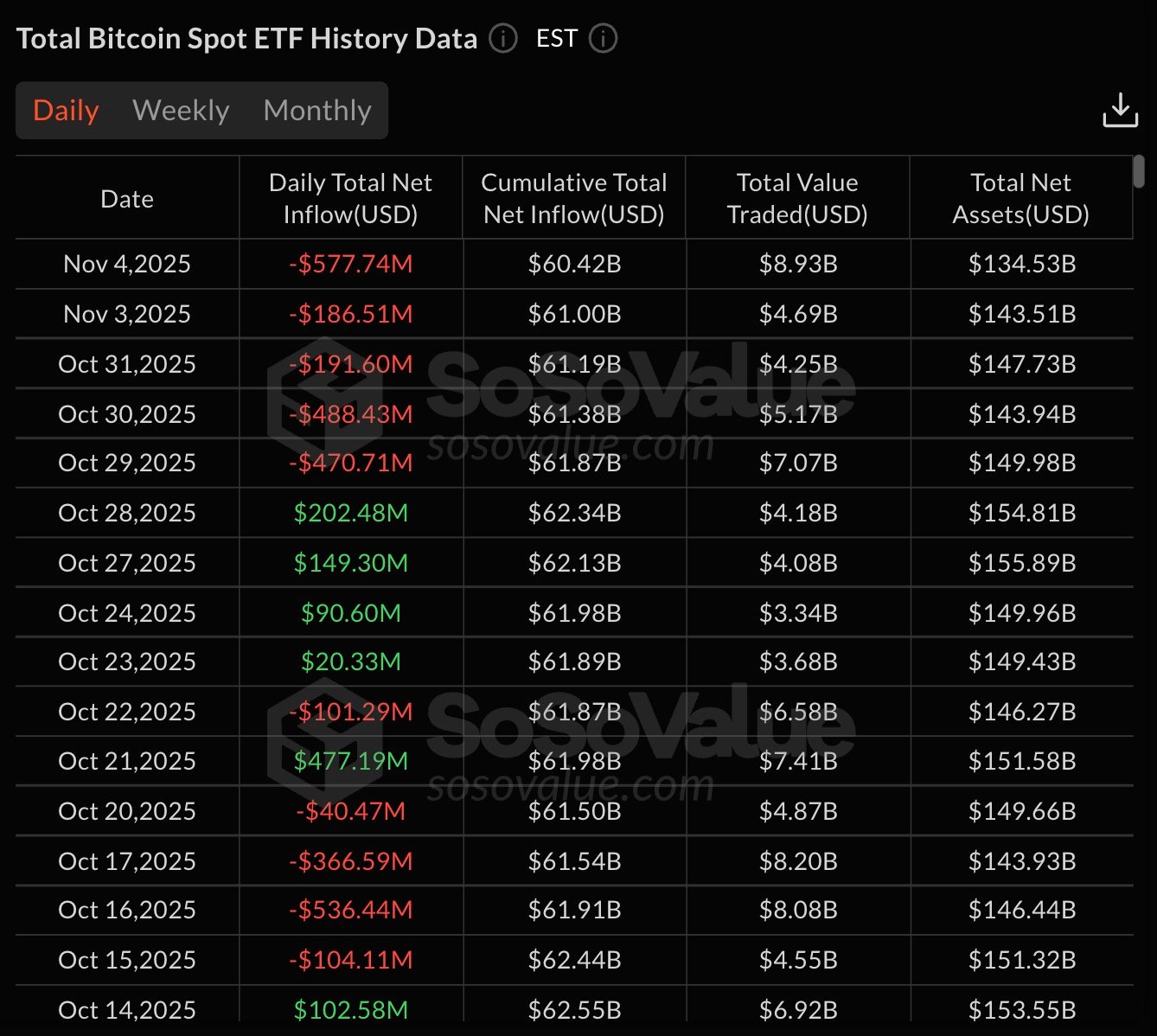

The ETF knowledge for Nov. 4, 2025, is pure ache.

- Spot Bitcoin ETFs: $577.7 million in web outflows.

- Spot Ethereum ETFs: – $219.3 million in web outflows.

That may be a mixed $797 million withdrawn in 24 hours — the most important synchronized crimson print since mid-September.

Over the past 5 buying and selling classes, each BTC and ETH funds have seen consecutive web withdrawals, chopping Bitcoin’s cumulative web inflows all the way down to $60.42 billion and Ethereum’s to $14.01 billion. The earlier week had already proven stress, with BTC down $798.95 million and ETH barely constructive.

Market response has been rapid. Bitcoin traded beneath $100,000 in a single day earlier than recovering to $101,800 by Wednesday morning. Ethereum held round $2,900, down from current $3,200 checks.

Analyst Charles Edwards from Capriole Investments summarized the priority in his latest thread, highlighting that for the primary time in seven months, web institutional shopping for has fallen beneath the each day mined provide — an indication of distribution overpowering accumulation. His warning: “When establishments cease shopping for, run.”

The sample at SoSoValue knowledge backs this up. Bitcoin’s weekly web influx fell $764.25 million, whereas Ethereum misplaced $355.13 million, marking probably the most extreme mixed decline in This autumn.

Night outlook

For now, the crypto market appears to be like fragile, however the subsequent few classes might resolve whether or not this correction matures right into a full reversal or deepens into an actual crypto winter.

- Bitcoin (BTC): Bulls should defend the $100,000 level to stop cascade promoting into $93,000. Holding that vary may arrange a rebound to $112,000, the place main resistance now sits.

- Ethereum (ETH): Strain builds beneath $3,300. If it holds, a short-term restoration to $3,700 remains to be in play. However failure there shifts focus to the $2,500 assist and a colder This autumn outlook.

- XRP: Trades in a fragile consolidation close to $2.2, however assist above $2 retains ETF-driven optimism alive. A detailed over $2.50 would verify pattern revival, whereas a drop beneath $1.90 would cancel it.