Spot Bitcoin and Ethereum exchange-traded funds in america noticed a mixed $797 million in internet outflows on Tuesday, as institutional buyers repositioned throughout a broad crypto sell-off.

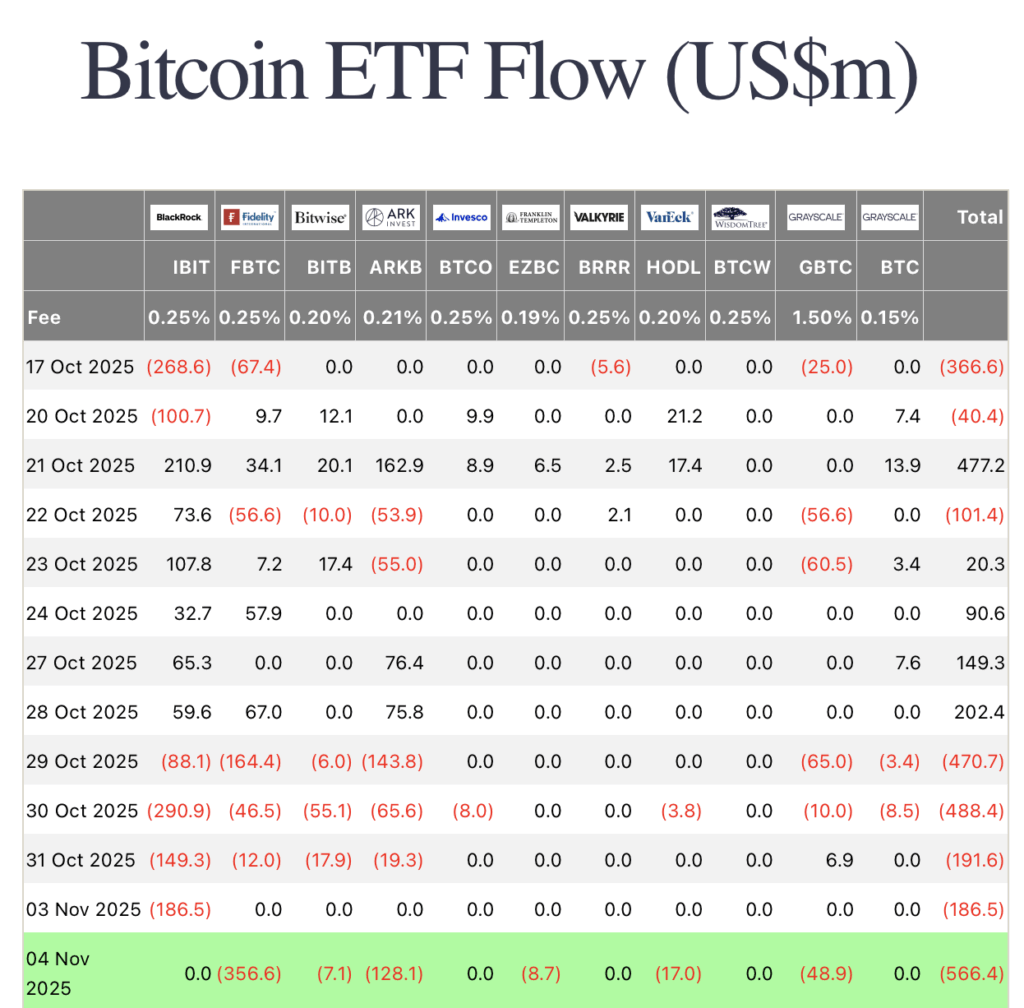

Knowledge from Farside Buyers reveals that Bitcoin ETFs misplaced $577.74 million, the most important single-day outflow since August 1. Constancy’s FBTC recorded $356.6 million in exits, ARK & 21Shares’ ARKB noticed $128 million withdrawn, and Grayscale’s GBTC misplaced $48.9 million. In whole, seven Bitcoin funds noticed adverse flows, extending the present outflow streak to 5 consecutive days and totaling $1.9 billion in redemptions.

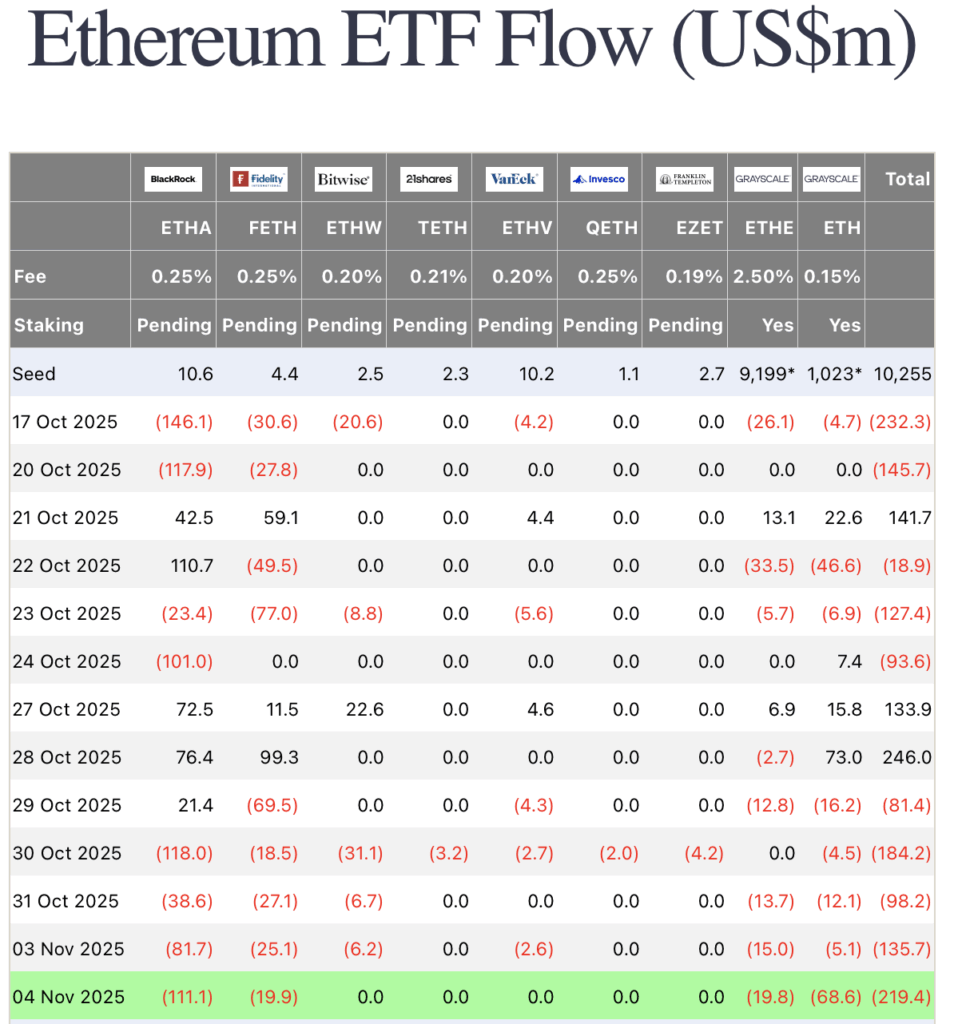

Ethereum ETFs additionally suffered, registering $219.37 million in internet outflows – led by BlackRock’s ETHA, which noticed $111 million withdrawn. Grayscale and Constancy’s Ether funds additionally posted outflows. In the meantime, Solana ETFs managed small inflows of $14.83 million, marking their weakest day since launch.

Crypto analyst Rachael Lucas from BTC Markets described the sample as a “decisive shift in institutional positioning,” noting that the promoting represents a strategic recalibration amid tightening macro circumstances. The U.S. greenback index (DXY) climbed above 100 after Federal Reserve Chair Jerome Powell’s hawkish remarks, dashing hopes for a December charge lower and sparking a broader risk-off sentiment.

The crypto concern and greed index dropped sharply to 21, signaling excessive concern. In response to Derek Lim, analysis lead at Caladan, Powell’s feedback and uncertainty over a possible U.S. authorities shutdown have added to the warning amongst buyers.

Nonetheless, Lim maintained a cautiously bullish long-term outlook, noting that whereas delayed charge cuts might weigh on costs within the brief time period, total macro circumstances stay supportive. “We’re nonetheless shifting towards the top of quantitative tightening,” he stated, suggesting that eventual charge cuts may restore momentum.

At press time, BTC traded at $101,685, down 2.72% in 24 hours, whereas ETH fell 5.73% to $3,302.