Bitcoin has entered a crucial section, with the worth falling from the $110,000 area to under $100,000 in underneath 48 hours. The sharp decline displays mounting concern throughout the market as aggressive promoting stress forces short-term holders to capitulate.

What started as a managed retracement has shortly advanced into panic-driven conduct, with merchants speeding to exit danger publicity. As volatility spikes and sentiment deteriorates, market individuals are carefully monitoring key assist ranges to evaluate whether or not Bitcoin can stabilize or whether or not a deeper draw back continues to be forward.

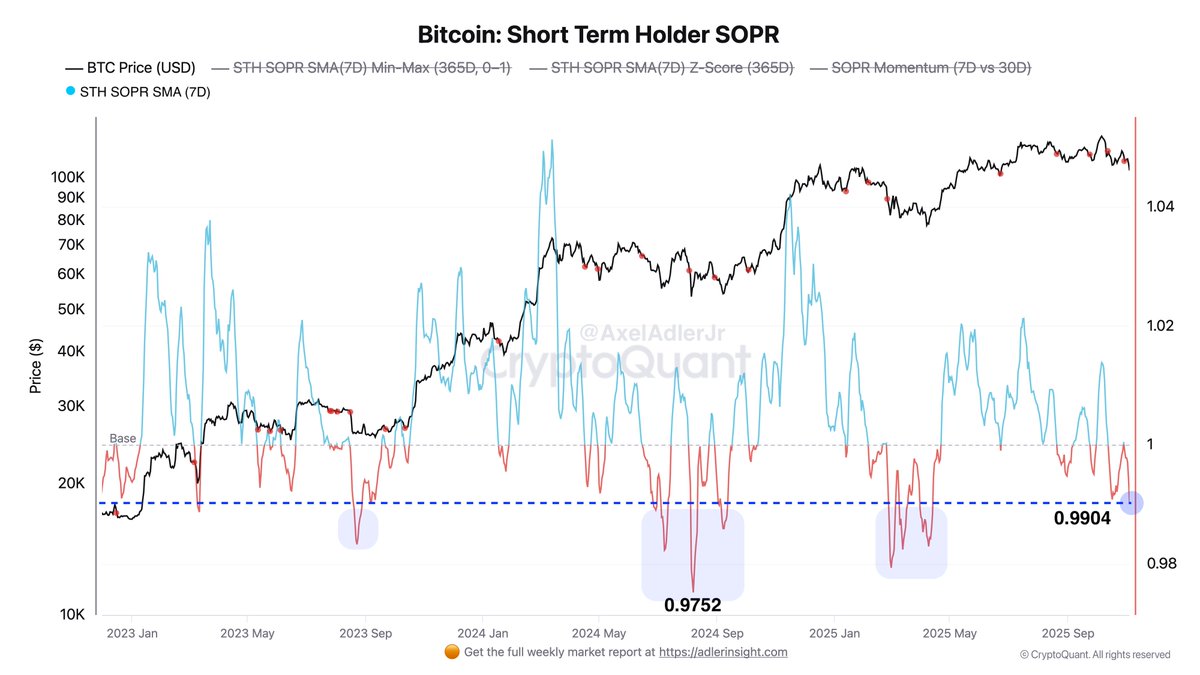

In line with high on-chain analyst Axel Adler, loss-making transactions amongst short-term holders are surging throughout this downturn. The 7-day Brief-Time period Holder Spent Output Revenue Ratio (STH-SOPR) presently sits at 0.9904, indicating that the majority cash moved by newer holders are being offered at a loss. This sustained breakdown under the crucial parity stage (1.0) alerts that reactive market individuals are offloading positions underneath stress, reinforcing the narrative of concern and liquidation-driven promoting.

Whereas this surge in realized losses highlights panic conduct, it additionally traditionally happens close to cycle stress factors the place weaker palms exit the market. The approaching days will decide whether or not this capitulation stress exhausts sellers — or whether or not additional losses nonetheless lie forward.

Brief-Time period Holder Stress Rising, However Not at Capitulation Ranges But

Axel Adler highlights that though Bitcoin is underneath significant promote stress, present on-chain stress has not but reached full capitulation. The STH-SOPR Z-score sits at −1.29, signaling rising loss realization amongst short-term holders. This destructive studying confirms mounting sell-side momentum, but Adler notes that the stress stage continues to be average in comparison with earlier main flushes.

For context, throughout the heavy correction in August 2024, the STH-SOPR dropped to 0.9752 with a Z-score of −2.43 — a studying in line with deep capitulation. By comparability, at the moment’s metrics replicate ache and concern, however not a full exhaustion of sellers. This essential distinction suggests the market should be within the center section of its correction relatively than at its terminal level.

Information additionally exhibits a gentle climb in loss-making exercise over current weeks, illustrating a sustained shift in sentiment as merchants unwind positions. Whereas the SOPR momentarily flipped above parity to 1.0005 on the finish of October — hinting at tried restoration — renewed promoting in early November shortly invalidated that momentum. Nonetheless, metrics haven’t but revisited earlier extremes.

In essence, the market stays underneath stress, however the traditional wash-out sign of full capitulation has not absolutely triggered — leaving room for both additional draw back, or a possible stabilization ought to consumers reclaim management.

Worth Motion Evaluation: Testing Deep Help After Sharp Breakdown

Bitcoin is trying to stabilize after a pointy breakdown that despatched the worth under the psychological $100,000 stage. The each day chart exhibits a notable acceleration in promoting momentum, with a number of long-bodied bearish candles forming on rising quantity — a transparent signal of aggressive distribution. After shedding the $110,000 area final week, consumers did not defend the cluster of assist across the 100-day and 200-day transferring averages, leading to a swift transfer down towards deeper demand.

Worth briefly dipped underneath $99,000 earlier than reclaiming the realm, suggesting preliminary purchaser curiosity close to these decrease helps. Nonetheless, the restoration to date lacks power, with candles closing weak and the 50-day and 200-day transferring averages now sloping downward above value — a structurally bearish alignment for the quick time period. The prior key demand zone round $105,000–$107,000 has flipped into resistance, and Bitcoin should reclaim this vary to shift momentum.

For now, BTC trades in a weak posture, and failure to construct assist above $100,000 might expose the following liquidity pocket towards $96,000–$98,000. Nonetheless, the sharp quantity spike on the lows might point out early accumulation makes an attempt. A sustained bounce requires consumers to step in decisively and defend present ranges because the market exams conviction underneath stress.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.