Bitcoin (BTC) is hovering round a precarious stage under the $100,000 psychological stage as provide in revenue simply crashed to a brand new 2025 low. Amid this decline, Glassnode analysts Chris Beamish, Antoine Colpaert, and CryptoVizArt spotlight a fancy interaction of structural weak spot, cautious investor habits, and decreased institutional demand. Bitcoin additionally stays oversold; nevertheless, it has but to enter full capitulation. This implies that worth is fragile however not damaged, balancing between restoration and the danger of a deeper decline.

Bitcoin Provide In Revenue Crash Alerts Weak Demand And Worth

Bitcoin’s provide in revenue has fallen sharply, hitting its lowest stage of 2025 and reflecting the broader slowdown in market momentum. Glassnode analysts notice that this decline signifies fading demand and persistent promote strain because the BTC worth consolidates close to $100,000, after falling 21% from its all-time excessive above $126,000.

Associated Studying

In accordance with the report, roughly 71% of Bitcoin’s provide stays in revenue, close to the decrease fringe of the everyday 70% – 90% vary seen in mid-cycle slowdowns. This drop marks the bottom chance stage of the yr, suggesting that BTC’s worth stability and restoration might rely upon whether or not recent demand can return to the market within the coming weeks.

The evaluation additionally disclosed that Bitcoin has damaged under the Brief-Time period Holder’s price foundation of roughly $112,500, and is now struggling to recuperate, confirming that its earlier bullish section has ended. They are saying that the market has been unable to regain a strong footing for the reason that October 10 flash crash and reset, with costs hovering simply above the Lively Investor’s Realized Worth at $88,500.

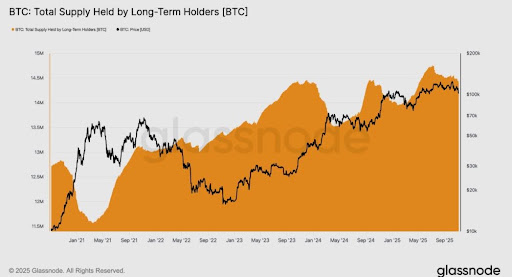

Moreover, on-chain information reveals that long-term holders are contributing to the bearish strain. Since July, Bitcoin’s complete provide has decreased from 14.7 million BTC to 14.4 million BTC, representing a internet discount of roughly 300,000 cash. Glassnode analysts estimate that round 2.4 million BTC have been spent throughout this era, which is roughly 12% of its circulating provide.

Not like earlier out there cycle, these long-term holders at the moment are promoting into weak spot quite than power, signaling fatigue and diminished sentiment, possible because of the constant market declines. Whereas the Relative Unrealized Loss stays average at 3.1%, Glassnode analysts spotlight that the mix of declining profitability and regular long-term distribution leaves the Bitcoin worth in a weak place close to $100,000.

Associated Studying

ETF Outflows And Unsteady Derivatives Deepen Market Warning

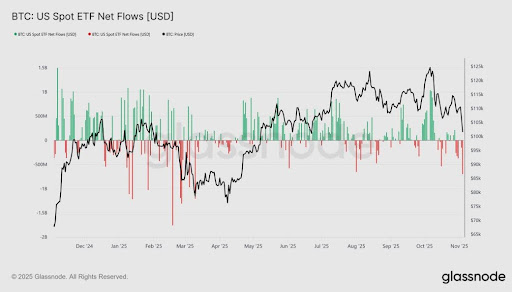

Along with the decline in Bitcoin’s provide in revenue, off-chain indicators additionally level to warning. Glassnode analysts notice that US Spot Bitcoin ETFs have seen internet outflows between $150 million and $700 million per day over the previous two weeks, reversing the sturdy influx streak from September and early October. This slowdown displays a big decline in institutional urge for food, with capital rotating out of Bitcoin publicity as the worth declines.

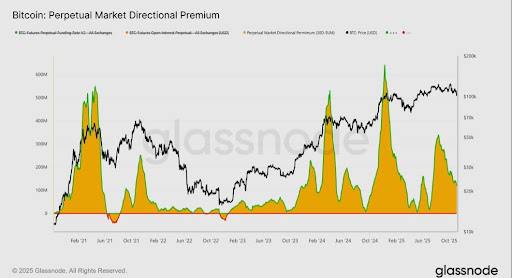

Bitcoin’s Cumulative Quantity Delta (CVD) has additionally turned adverse on Binance and main exchanges. In derivatives, analysts famous that the Perpetual Market Directional Premium has declined from $338 million in April to $118 million per thirty days, indicating that merchants are pulling again on threat and avoiding aggressive lengthy positions.

For now, Bitcoin stays in a fragile place, oversold however structurally intact. Glassnode specialists have acknowledged that the following key check lies at $112,000 and $113,000, the place a sustained restoration would sign renewed demand, whereas additional weak spot might deepen the correction.

Featured picture created with Dall.E, chart from Tradingview.com