- BNB trades round $933 after rejecting resistance close to $975 and holding $930 help.

- On-chain knowledge reveals 82M lively addresses and $120B DEX quantity in October.

- Liquidity pressures from U.S. fiscal tightening weigh on danger belongings, together with BNB.

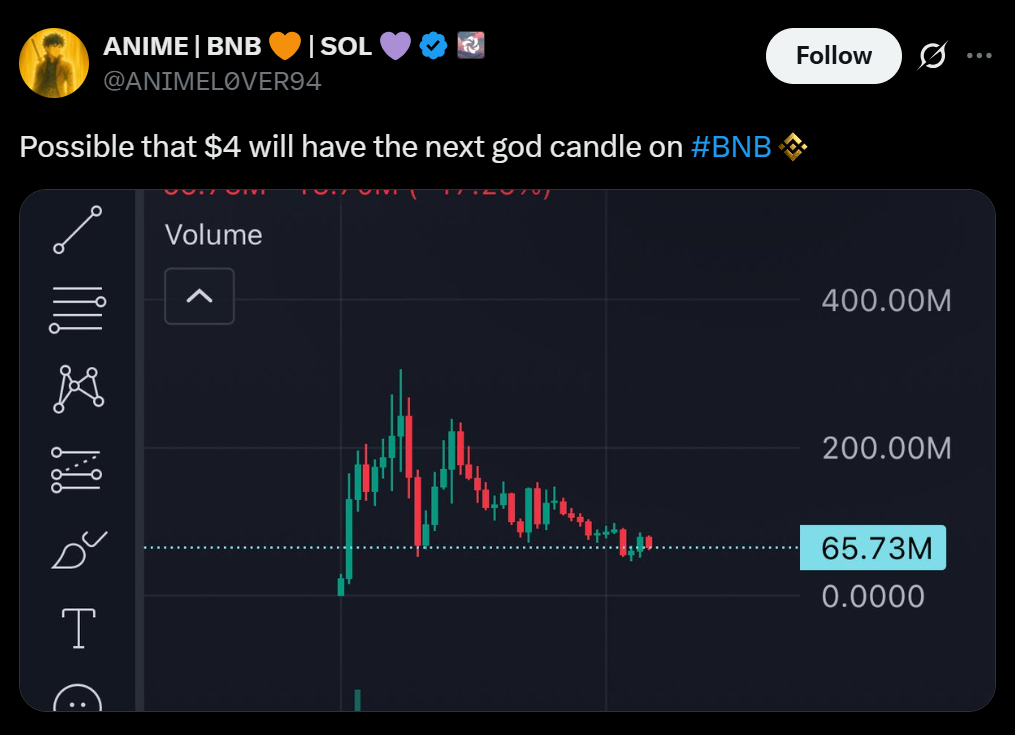

BNB, the native token of the BNB Chain, has managed to remain above a crucial $930 help stage whilst broader crypto markets present pressure from tightening world liquidity. The token slipped 0.33% to $933 after briefly touching $974, consolidating inside a slender $46 buying and selling vary whereas trade quantity surged 71% above its 24-hour common, based on CoinDesk Analysis knowledge.

Technical Image: Consolidation Amid Volatility

BNB’s value motion stays range-bound between $930 and $975, with the latter appearing as a short-term ceiling. The rejection at $975 signaled vendor power, however patrons have repeatedly defended the $930 stage — an space that has now change into a crucial help ground. Analysts be aware {that a} decisive breakout above $975 may reopen the trail towards October’s native highs, whereas a breakdown under $930 may expose the token to deeper retracements.

Regardless of the subdued value efficiency, on-chain metrics stay strong. “BNB’s capacity to carry help mirrors the broader power we’re seeing on-chain,” mentioned Johnny B., founding father of BNBPad.ai. “The BNB Chain noticed 82 million lively addresses in October, marking a brand new all-time excessive, and DEX volumes neared $120 billion based mostly on DeFiLlama knowledge.”

Macro Liquidity Pressures Form Market Sentiment

BNB’s resilience comes towards a difficult macro backdrop. A U.S. Treasury money rebuild and a $500 billion decline in financial institution reserves since July have squeezed market liquidity, prompting traders to rotate away from danger belongings. The CoinDesk 20 index fell 0.9% prior to now 24 hours, whereas Bitcoin struggled to carry the $100,000 stage.

Conventional markets mirrored the crypto downturn: the Nasdaq 100 dropped 4.7% this week, and the S&P 500 slid 2.7%, as tightening monetary situations drained momentum throughout speculative sectors.

Adoption Offsets Market Weak point

Even amid these headwinds, the BNB ecosystem’s fundamentals stay robust. The continued progress in consumer exercise and decentralized trade quantity means that BNB’s community adoption could also be cushioning its value from a steeper correction. New decentralized functions like Asper have additionally contributed to consumer retention and ecosystem growth.

A sustained protection of the $930 zone may reinforce confidence amongst merchants, however momentum stays fragile. A push above $975 is now the important thing set off to substantiate renewed upside momentum, whereas extended macro stress may take a look at patrons’ resolve within the weeks forward.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.