Ethereum (ETH) had a robust run by way of most of this yr. The token climbed above $4,900 in late August – a brand new all-time excessive caused by institutional demand and whale accumulation, together with one investor who reportedly dropped $90 million on ETH.

However now Ethereum is pulling again laborious. ETH is buying and selling round $3,330 – down 12% this week and 28% over the previous month – marking its lowest degree since mid-July. The sentiment change has been sharp.

Nonetheless, there’s a case for a rebound. Our Ethereum value prediction sees a possible path again to $4,000 by the top of November if a couple of key components align, like stabilizing ETF flows and a reclaim of the $3,500–$3,600 provide zone.

In the meantime, some buyers are eyeing earlier-stage tasks with clearer near-term catalysts. Bitcoin Hyper (HYPER) is certainly one of them, having raised over $26 million in presale for a brand new Bitcoin Layer-2 scaling resolution.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Why Ethereum Has Been Tanking This Week

It’s been a tough week to be an ETH holder. Spot buying and selling volumes dropped one other 50% in the present day, and open curiosity has slid to $17.1 billion. Sentiment is firmly bearish proper now.

The macro backdrop hasn’t helped both. U.S. rate-cut expectations had been dialed again after some surprisingly hawkish Fed messaging, souring urge for food for threat property, together with crypto. Add in some troubling tariff headlines and a weak tone in equities, and it’s straightforward to see why ETH has been dragged decrease.

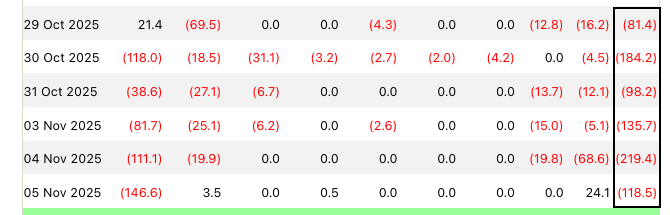

Spot ETF flows are additionally regarding. U.S. spot Ethereum ETFs have now logged six straight periods of web outflows, totaling roughly $830 million. BlackRock’s ETHA has led the every day exits.

These outflows have coincided with Ethereum’s value slide, making a suggestions loop that’s capping each rally try. And leverage has solely made issues worse – over $91 million value of ETH has been liquidated previously 24 hours.

Ethereum Value Prediction – Can ETH Rebound to $4,000 in November?

ETH might climb again to $4,000 by month-end – however it’s removed from assured. Three issues must occur: spot ETF flows have to show constructive, ETH must reclaim and maintain above the $3,500–$3,600 provide zone, and macro threat urge for food must stabilize.

With out these, the extra probably state of affairs is to consolidate between $3,100 and $3,600. That’s as a result of promoting strain nonetheless outweighs shopping for demand within the rapid time period.

The bottom case is that ETH grinds sideways between these ranges for the remainder of November as ETF outflows ease however don’t flip constructive. However the bull case – possibly a 25% to 35% likelihood – is that outflows gradual or reverse, triggering a brief squeeze previous $3,600, with momentum carrying ETH to $4,000 by month-end.

Bitcoin Hyper Might Be the Higher Purchase Proper Now After Passing $26M in Presale

With Ethereum caught underneath ETF outflow strain, some buyers are rotating into earlier-stage tasks. That development explains why Bitcoin Hyper has already raised over $26 million in its presale – with HYPER tokens priced at $0.013225 – and it’s nonetheless pulling in tens of hundreds of {dollars} every day.

Bitcoin Hyper manufacturers itself as a Bitcoin Layer-2 community powered by Solana Digital Machine (SVM) know-how to ship parallelized throughput and sub-second confirmations. Transactions periodically settle again to Bitcoin for added safety.

Its “canonical bridge” locks customers’ BTC on the mainnet and points wrapped BTC on the Bitcoin Hyper Layer-2, unlocking DeFi, meme coin buying and selling, tokenized RWAs, and NFTs with low charges. Safety audits by Coinsult and SpyWolf discovered no vital vulnerabilities with this setup.

And unsurprisingly, a number of analysts are pumped about that. For instance, Aiden Crypto and Borch Crypto have each praised Bitcoin Hyper, and protection from ICOBench frames it as one of many prime crypto presales of 2025. Even CoinSniper has featured the HYPER token.

Whereas Ethereum continues to face ETF outflow strain that limits rebound makes an attempt, Bitcoin Hyper’s presale mechanics – together with its 45% staking yield – are nonetheless attracting robust curiosity from retail buyers. It’s a undertaking that many are watching intently this November.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.