- “Right here is to maturity!”

- Timmer vs. McGlone

Jurrien Timmer, director of worldwide macro at Boston-based funding big Constancy, has opined that Bitcoin may “decide up the slack” now that gold’s rally has faltered.

“The value of gold continues to work off what looking back seems quite a bit like a blow-off that was not fairly justified by the rise in liquidity,” Timmer famous, predicting that the lustrous steel will now expertise a chronic interval of churn.

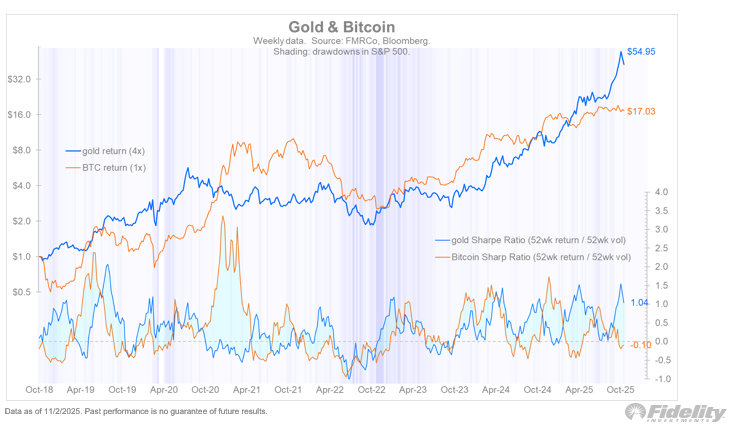

He has famous that their Sharpe ratios, which measure the risk-adjusted efficiency of the 2 property, have been transferring in reverse instructions for a while now.

“Right here is to maturity!”

As reported by U.Immediately, Timmer beforehand claimed that Bitcoin was akin to Dr Jekyll and Mr Hyde, the characters of the favored gothic horror novella written by Scottish novelist Robert Louis Stevenson, within the sense that it could possibly concurrently act as a risk-on and a risk-off asset.

In his most up-to-date put up, the distinguished analyst claims that Bitcoin is “turning into a extra mature and fewer precocious asset class.”

He has additionally famous that the present uptrend is a “regular” exponential one as a substitute of a euphoria-driven parabola, which might be typical for the cryptocurrency’s earlier cycles.

Timmer vs. McGlone

On the similar time, Mike McGlone, chief commodity strategist at Bloomberg Intelligence, not too long ago predicted that Bitcoin may doubtlessly lose as a lot as 60% of its worth towards gold.

In Might, as reported by U.Immediately, Timmer claimed that the yellow steel may go the baton to its digital rival within the second half of the yr. Nevertheless, this didn’t occur, and Bitcoin bears have been largely vindicated.

Regardless of the latest pullback, gold continues to be up by a whopping 54% on a year-to-date foundation. Within the meantime, Bitcoin is barely managing to stay within the inexperienced with a particularly modest 2025 achieve of roughly 9%.

Based on CoinGecko information, Bitcoin is at present altering arms at $103,285 after briefly plunging under the make-it-or-break-it $100,000 degree but once more earlier this Friday.