- XRP dropped 9% after Ripple’s Swell convention regardless of main bulletins.

- Bear flag and dying cross patterns level to a possible retest of $1.65–$1.70 assist.

- Market-wide weak spot and profit-taking proceed to weigh on sentiment.

XRP has erased a lot of its post-conference momentum, falling over 9% to $2.19 simply hours after Ripple’s Swell 2025 occasion concluded in New York. Regardless of main bulletins, the token’s decline means that traders had been fast to take income, repeating a sample that has traditionally adopted Ripple’s annual flagship gathering.

Swell Bulletins Fail to Ignite Momentum

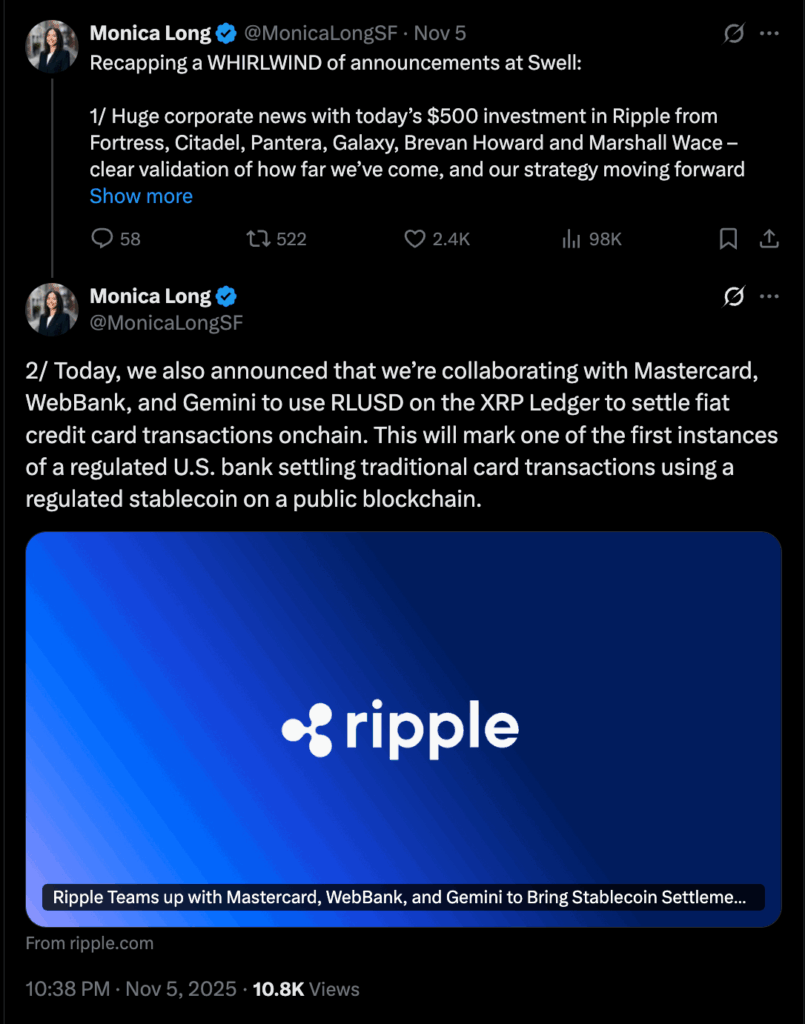

Ripple’s Swell convention unveiled a number of key developments, together with a $500 million funding spherical led by Citadel Securities and Fortress Funding Group, contemporary integrations for the RLUSD stablecoin, and early particulars of a decentralized lending protocol constructed on the XRP Ledger (XRPL).

Nevertheless, merchants responded coolly, with XRP dropping from a Nov. 5 peak close to $2.40 to $2.19, reflecting a traditional “purchase the rumor, promote the information” response. Traditionally, this sample has repeated throughout 4 of the final 5 Swell occasions since 2020 — every adopted by unfavorable worth motion by year-end.

Technical Breakdown: Dying Cross and Bear Flag

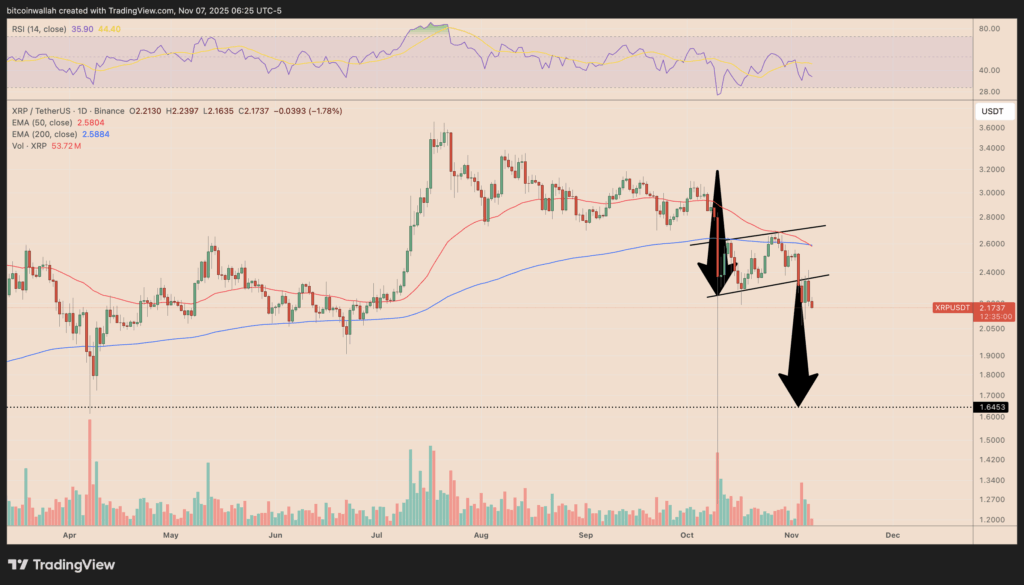

From a technical perspective, XRP’s chart is flashing a number of bearish indicators. The token not too long ago confirmed a bear flag continuation sample that shaped after its sharp decline from $3.60 in early September. Following a short upward consolidation, XRP broke under the decrease trendline, confirming renewed promoting stress.

Including to the draw back threat, XRP is on the verge of a dying cross, the place the 50-period EMA drops under the 200-period EMA, signaling a deeper pattern reversal. Analysts now see potential for the token to fall towards the $1.65–$1.70 zone, which aligns with April’s assist vary and the aggregated realized worth tracked by Glassnode — a degree the place long-term holders traditionally start accumulating.

Broader Market Stress Provides to the Slide

The sell-off additionally comes amid broader market weak spot. Bitcoin’s transient dip under $100,000 and tightening U.S. liquidity situations have dampened threat urge for food throughout altcoins. Whereas whale exercise round XRP wallets has slowed, change flows counsel cautious positioning quite than new accumulation.

If the $1.65–$1.70 vary holds, it might function a technical and psychological ground, however with out renewed quantity or a macro catalyst, XRP’s short-term bias stays tilted to the draw back.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.