- 21Shares simply filed Modification No. 3 for its spot XRP ETF underneath Part 8(a), beginning a 20-day SEC evaluate window the place the fund may auto-approve round November 27 if the SEC does nothing.

- XRP jumped about 5% to $2.32 on the information, whereas Franklin Templeton, Grayscale, and Canary Capital all moved their very own XRP ETF plans ahead, concentrating on mid–late November launch home windows.

- RippleNet pushed $57.7B in cost quantity final quarter, XRP trades round $2.20 with a ~$134B market cap, and a spot ETF would put it on the identical shelf as Bitcoin and Ethereum for conventional traders.

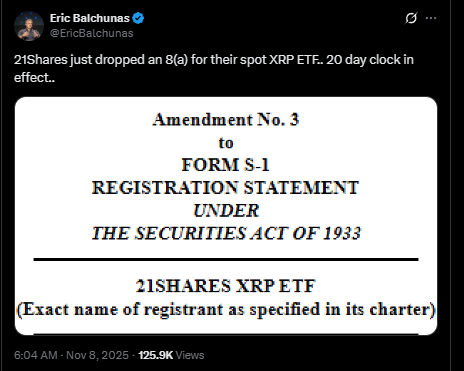

XRP jumped about 5% to $2.32 after 21Shares dropped Modification No. 3 to its Kind S-1 for a spot XRP ETF, and yeah, the market seen quick. The submitting was made underneath Part 8(a) of the Securities Act of 1933, which principally means a 20-day evaluate clock begins ticking the second it hits the SEC’s desk. If the SEC doesn’t step in with a delay, remark, or cease order throughout that interval, the ETF can technically go efficient routinely. ETF analyst Eric Balchunas flagged the transfer on X, whereas dealer Scott Melker identified that this setup may put a possible go-live date someplace round November 27 if regulators keep quiet.

The XRP group reacted in a fairly acquainted method: shopping for first, debating later. Buying and selling volumes pushed greater as worth moved up from its earlier degree, with some merchants already speaking about “god candles” if an approval or auto-effect date strains up with robust market sentiment. Folks nonetheless keep in mind July 2023, when Decide Analisa Torres issued a partial ruling favoring Ripple and XRP spiked round 70% nearly in a single day. That form of transfer sits behind each dealer’s thoughts when a brand new catalyst like an ETF pops up.

XRP ETF Race Heats Up: 21Shares, Franklin, Grayscale, Canary

21Shares isn’t transferring in a vacuum right here; its modification comes simply days after Franklin Templeton and Grayscale tweaked their very own XRP ETF filings. Franklin Templeton eliminated earlier regulatory language from its S-1, dropping the specific Part 8(a) clause that had beforehand required extra direct SEC sign-off earlier than launch. A number of analysts see that adjustment because the agency quietly positioning itself for a November rollout, relying on how the SEC temper swings.

Grayscale, in the meantime, filed a second modification for its XRP Belief conversion, locking in key executives and authorized counsel. That sort of housekeeping normally occurs nearer to an anticipated launch window, not on the very begin of a course of. On high of that, Canary Capital is aiming for a November 13 debut for its XRP ETF, pending last approval from Nasdaq. Put collectively, you’ve acquired a number of issuers circling related dates, which supplies this month a “one thing’s going to interrupt right here” form of feeling for XRP ETF watchers. If even one in every of these funds goes dwell, XRP would formally stand subsequent to Bitcoin and Ethereum within the spot ETF lineup.

XRP Fundamentals, Fee Quantity And Market Context

Past the filings and hype, XRP remains to be sitting in a fairly large ecosystem. RippleNet processed about $57.7 billion in complete cost quantity within the quarter ending September 30, 2025. That’s method smaller than PayPal’s $458.1 billion over the identical interval, however it nonetheless reveals significant utilization for a community that leans on pace and low charges quite than client branding. XRP is at the moment buying and selling round $2.20 after beforehand tagging an all-time excessive of $3.56 in July, which supplies it a market cap of roughly $134 billion primarily based on circulating provide.

In case you zoom out to the total 100 billion XRP created at launch, the absolutely diluted worth sits close to $220 billion, with Ripple nonetheless holding round 40 billion cash in reserve accounts. The variety of XRP accounts has stayed regular, and RippleNet continues to function as a world cost rail working with banking and fintech companions. If a number of spot XRP ETFs truly go dwell this month, they’d add a brand new on-ramp for institutional and retail capital that doesn’t need to cope with exchanges immediately. That doesn’t assure a “god candle” or something, however it positively modifications how simply large cash can rotate into XRP when the narrative heats up.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.