Bitcoin is struggling to carry the $100K stage, with bulls unable to reclaim momentum as concern and uncertainty dominate the market. The value continues to commerce close to essential help, and regardless of robust on-chain fundamentals, sentiment stays fragile. Based on prime analyst Darkfost, the market is present process a profound transformation — one which’s making many conventional on-chain indicators much less dependable.

“With time, we are able to clearly see that the construction and dynamics of the market are evolving,” he notes. Whereas retail habits and alternate flows as soon as outlined market cycles, the rising affect of establishments, ETFs, and long-term buyers has modified the rhythm of Bitcoin’s value motion.

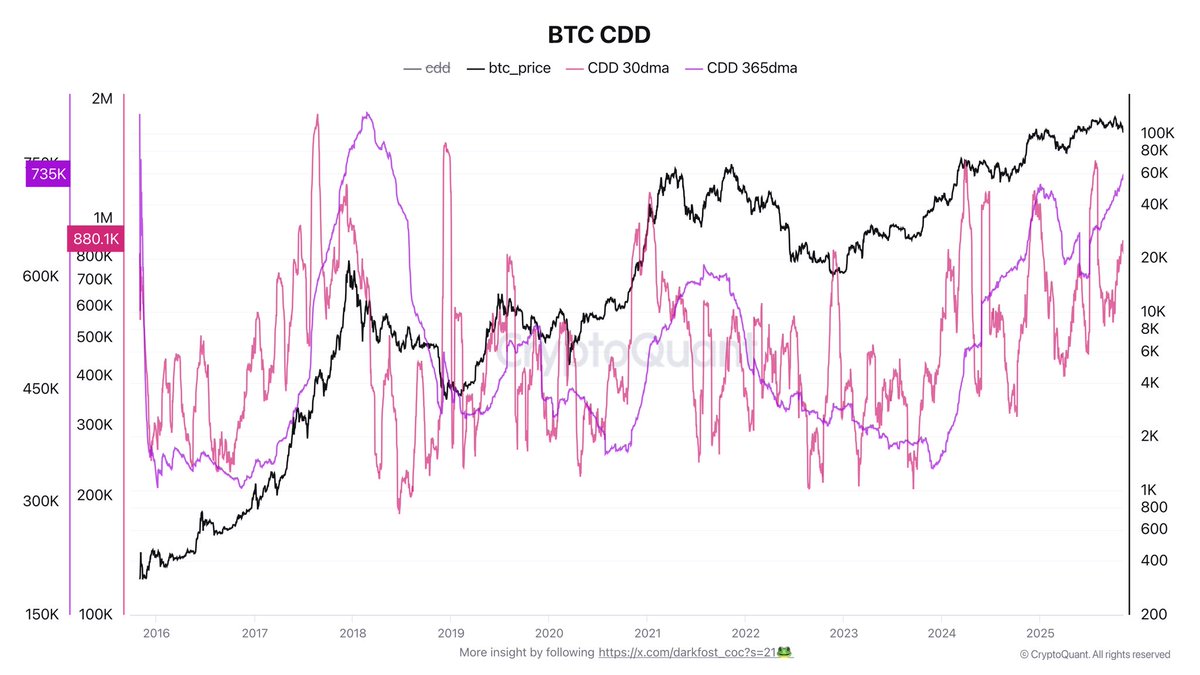

Nonetheless, some metrics stay very important, and probably the most insightful, in line with Darkfost, is Coin Days Destroyed (CDD) — a measure of long-term holder exercise. “It’s one of many indicators I comply with essentially the most as a result of long-term holders are nonetheless driving this market,” he says.

At the moment, between 75% and 80% of all Bitcoin provide is held by long-term holders, signaling that almost all of buyers stay strong-handed regardless of volatility. This consolidation amongst affected person holders could finally set the stage for the following main development as soon as short-term concern fades.

Lengthy-Time period Holders Drive Market Dynamics By means of Rising CDD

Based on Darkfost, the Coin Days Destroyed (CDD) metric stays probably the most useful instruments for understanding Bitcoin’s market construction. It gives a transparent visualization of long-term holder (LTH) exercise and the potential promoting stress they exert. Basically, CDD measures how lengthy cash have been held earlier than being moved — and when older cash begin circulating once more, it’s usually an indication that distribution is underway.

At the moment, the 30-day shifting common of CDD is steadily rising, having doubled since early summer time. Apparently, this metric declined earlier than Bitcoin’s final all-time excessive, serving to gas that rally, nevertheless it has continued to climb since — reflecting rising LTH exercise.

On an annual scale, CDD ranges have already surpassed the 2021 cycle and are approaching these from 2017, marking probably the most energetic long-term holder phases in Bitcoin’s historical past.

This development indicators a large switch of provide between market members. Regardless of this, Bitcoin stays above $100,000, exhibiting that at this time’s market is extra liquid, resilient, and institutionally pushed than in earlier cycles. LTHs now have the flexibility to distribute important volumes with out crashing costs, demonstrating how far Bitcoin’s maturity and market depth have advanced over time.

Bitcoin Battles to Maintain $100K Assist

Bitcoin is at the moment buying and selling close to $100,767, struggling to keep up stability after a risky week marked by aggressive promoting stress. The each day chart reveals that BTC has as soon as once more examined the $100K psychological help, a key stage that bulls should defend to forestall additional draw back momentum.

From a technical perspective, Bitcoin stays beneath its 50-day (blue) and 100-day (inexperienced) shifting averages, signaling that short- and mid-term momentum continues to favor the bears. The 200-day shifting common (purple) — now positioned barely above $106K — is appearing as dynamic resistance, reinforcing the broader correction part that started in late October.

If Bitcoin manages to shut above $103K–$104K, it may sign a short-term restoration towards $108K–$110K. Conversely, a decisive break beneath $100K may set off a sharper correction towards $95K, probably testing the market’s resilience as sentiment continues to waver between concern and cautious optimism.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.