- Ripple and the SEC have formally ended their almost five-year authorized battle by collectively dismissing all remaining appeals, bringing ultimate readability to XRP’s standing on this case.

- The result reinforces that XRP programmatic gross sales on exchanges should not thought-about securities transactions beneath U.S. securities legislation.

- With the lawsuit behind it and $500M raised at a $40B valuation, Ripple is now targeted on progress, funds innovation, and increasing real-world adoption of XRP and its RLUSD stablecoin.

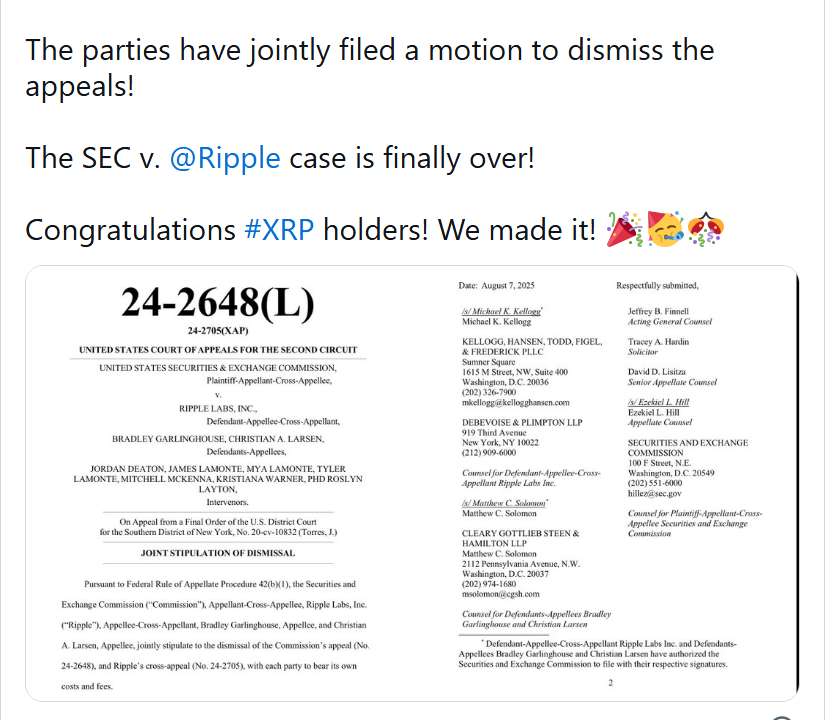

After years of back-and-forth filings, hearings, and headlines, Ripple Labs and the U.S. Securities and Change Fee have formally closed the guide on their authorized conflict. Each side filed a Joint Stipulation of Dismissal with the U.S. Courtroom of Appeals for the Second Circuit, agreeing to withdraw all remaining appeals and eat their very own authorized prices. That transfer formally ends a dispute that kicked off again in 2020 and has been hanging over XRP and the broader crypto market ever since.

The unique case centered on the SEC’s declare that Ripple carried out an unregistered securities providing by way of its gross sales of XRP. The uncertainty round whether or not XRP was a safety hit liquidity, scared off some exchanges, and weighed on sentiment for years. This joint dismissal doesn’t erase that historical past, nevertheless it does give the trade one thing it hasn’t had in a very long time round XRP: finality.

What the ultimate consequence actually says about XRP

One of the vital necessary takeaways from the case is the reinforcement of a key authorized discovering: programmatic gross sales of XRP on exchanges should not thought-about securities transactions. Which means typical secondary-market buying and selling of XRP doesn’t fall beneath U.S. securities legal guidelines in the way in which the SEC initially argued. It’s not a blanket free cross for each sort of XRP sale, nevertheless it’s an enormous step in clarifying how no less than one main token is handled beneath U.S. legislation.

Ripple’s management, together with CEO Brad Garlinghouse and government chairman Chris Larsen, has persistently maintained that they operated transparently and that XRP shouldn’t be categorised as a safety. With the appeals now dismissed, they lastly get to maneuver on from defending previous actions to doubling down on constructing future merchandise. For the broader crypto sector, this case will seemingly proceed to be cited in future debates round digital asset classification and token sale constructions.

From courtroom to capital: Ripple’s progress pivot

With the authorized cloud lastly cleared, Ripple is repositioning itself as a growth-story quite than a courtroom drama. The corporate lately raised $500 million in new funding, pushing its valuation to round $40 billion. Huge-name backers like Fortress Funding Group, Citadel Securities, Pantera Capital, and Galaxy Digital participated, signaling that main institutional gamers are nonetheless keen to guess closely on Ripple’s future.

On the similar time, Ripple is leaning into real-world monetary infrastructure performs. The corporate has teamed up with Mastercard, Gemini, and WebBank to pilot a bank card settlement system powered by its RLUSD stablecoin on the XRP Ledger. The aim is simple however bold: sooner, cheaper, and extra environment friendly cross-border settlements that enhance on conventional rails. If these pilots scale, they might flip Ripple’s tech into embedded infrastructure behind on a regular basis monetary transactions.

XRP’s future: now it’s all about adoption

For XRP holders, the tip of the SEC combat is mainly a psychological and structural reset. The token is not outlined by “the lawsuit” narrative; now its trajectory will rely on whether or not Ripple can drive actual adoption of its blockchain merchandise and fee options. Which means enterprise offers, monetary establishment integrations, and precise transaction quantity on the XRP Ledger matter greater than ever.

The authorized overhang being gone additionally offers Ripple extra room to restore its model and rebuild belief with establishments and retail traders who sat on the sidelines through the case. If Ripple can preserve executing on partnerships, increase the RLUSD stablecoin ecosystem, and place the XRP Ledger as core infrastructure in world funds, XRP may very well be one of many clearer regulatory tales in a still-messy U.S. crypto panorama. From right here on out, it’s much less about judges and extra about execution.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.