Issues occur shortly within the crypto market – and this week is a staunch reminder of that. Catalysts in US politics have pushed costs increased on Monday, with Bitcoin rising 4.4% within the final 24 hours,

It now trades at $106,500, which is a vital turning level for the asset. That’s as a result of it reclaimed a 50-week shifting common, which many imagine is an important indicator of whether or not BTC is in a bull or bear cycle.

As such, buyers are desirous to understand how far and the way shortly Bitcoin’s momentum might construct. And so we need to reply the query: Can Bitcoin hit $120,000 once more earlier than December?

After our Bitcoin value prediction, let’s have a look at what this would possibly imply for its ecosystem – particularly for Bitcoin Hyper, a brand new Bitcoin Layer 2 at present in presale and making ready to record on exchanges quickly.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Bitcoin’s Fundamentals and Technicals Align for Explosive Positive aspects

The important thing catalyst behind Bitcoin’s rally occurred in two elements: the US Senate voted to finish the federal government shutdown, and Trump tweeted that the federal government would supply residents with a $2,000 stimulus funded by tariff income.

The Home of Representatives additionally must approve the shutdown invoice earlier than Trump indicators it into legislation, so the closure nonetheless isn’t official. Nonetheless, this introduced much-needed reduction to the crypto market after months of macroeconomic uncertainty.

Analyst Ash Crypto famous that BTC surged 300% over 5 months following the final authorities shutdown in 2019, underscoring the huge potential if the Home approves the invoice this time.

Then, Trump posted on Reality Social claiming that the US is “taking in Trillions of {Dollars}” from commerce tariffs, and that “a dividend of no less than $2000 an individual (not together with high-income folks!) shall be paid to everybody.”

Analyst Bull Principle estimated that this might “inject practically $600 billion into the economic system,” which is near the $800 billion from the 2020 stimulus. He identified that the 2020 stimulus “was the gas behind one of many greatest bull runs in historical past,” throughout which Bitcoin, Ethereum, and altcoins noticed parabolic features.

🇺🇸 PRESIDENT TRUMP PLANS TO GIVE $2,000 STIMULUS CHECKS TO THE PEOPLE AS DIVIDEND FROM THE TARIFFS.

And the market is significantly underestimating what which means.

If applied, this could inject practically $600 billion immediately into the economic system, virtually the identical scale because the 2020… pic.twitter.com/Vn0y3jiNNV

— Bull Principle (@BullTheoryio) November 9, 2025

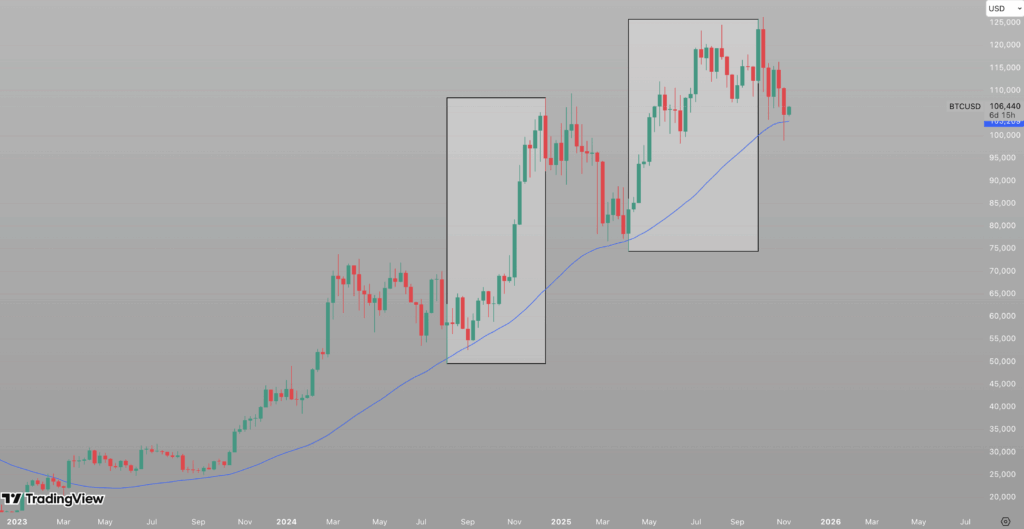

Aligning with this elementary perspective, Bitcoin’s value chart simply accomplished a vital transfer. It fell beneath the 50-week shifting common final week, and a detailed beneath that degree would have signaled a bear market.

As an alternative, it reclaimed the extent and closed above, turning it into help. The final two occasions this occurred, BTC rallied 118% over 19 weeks and 70% over 25 weeks. Coupled with favorable macroeconomic circumstances, this closure above the 50-week MA marks a large tailwind for BTC, signalling that it might properly attain $120,000 earlier than December.

Analyst Sykodelic suggests BTC might go even increased, together with his forecast on X pointing to a transfer towards $140K after bouncing from MA ranges.

Undecided what number of time I have to maintain saying this…

However the prime is just not in.

Regardless of what number of doom posters are on the market and irrespective of how many individuals have flipped bearish this final week…

It would not change the onerous goal information.

It’s important to do not forget that simply because… pic.twitter.com/fU16uzYSNM

— Sykodelic 🔪 (@Sykodelic_) November 9, 2025

However as Bitcoin rose 4.4% as we speak, the altcoin market has additionally gained momentum, with quite a few tasks outperforming the market chief. Wanting forward, analysts are backing Bitcoin Hyper as a promising Bitcoin various, with its new Bitcoin Layer 2 infrastructure providing completely new methods to make use of BTC and, subsequently, probably a a lot greater alternative to generate features.

Skilled Suggestions Bitcoin Hyper for 100x Positive aspects as Presale Crosses $26M

This cycle’s bullish Bitcoin development has primarily been pushed by institutional and company buyers shopping for it as a long-term retailer of worth. However what if BTC might do greater than that? What if it turned programmable cash that powered a digital economic system?

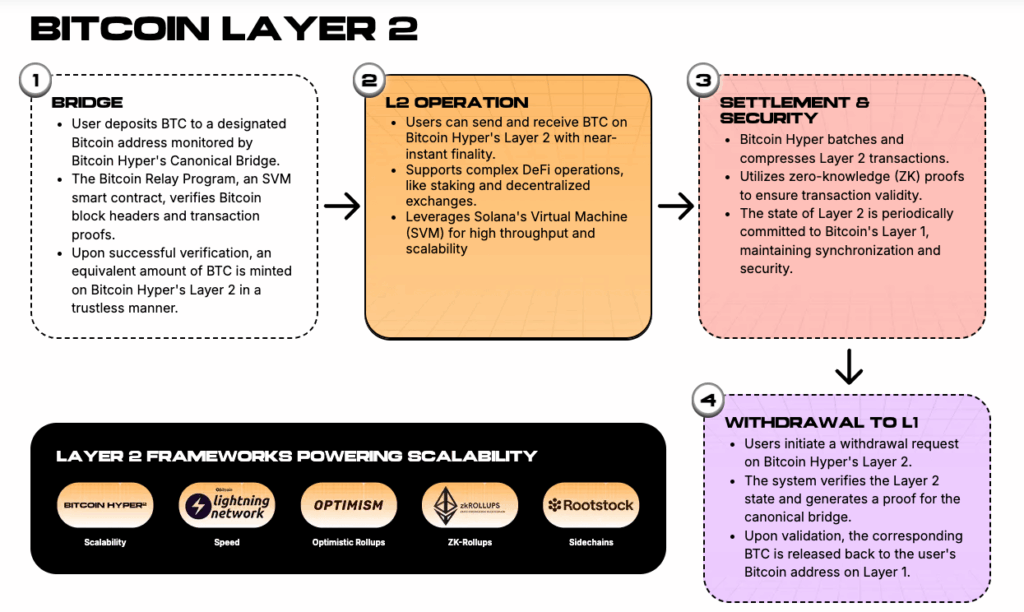

That’s the imaginative and prescient of Bitcoin Hyper, which is growing a sensible contract Layer 2 for Bitcoin utilizing the Solana Digital Machine (SVM). Like Solana, it could possibly deal with 1000’s of transactions per second (TPS), nevertheless it differentiates itself by relaying transactions to the Bitcoin base layer by way of ZK-rollups, enabling it to profit from Bitcoin’s immutability and safety.

This setup might allow superior purposes like DeFi, AI, RWA, meme cash, and stablecoins throughout the BTC ecosystem, probably unlocking billions of {dollars} in new worth.

For this reason the market is buzzing about Bitcoin Hyper, with its ongoing presale elevating $26.4 million to this point. It has additionally attracted curiosity from revered analysts, with Borch Crypto lately suggesting it has 100x potential.

Presently, Bitcoin Hyper is accessible to buy at $0.013245, however the value will rise because the presale continues.

With a use case that redefines Bitcoin, robust market help, and an early-stage value, every part seems aligned for HYPER to grow to be one of the vital thrilling crypto launches of the yr.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any harm or loss induced or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.