Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth slipped a fraction forward of key US inflation knowledge tomorrow with merchants more and more unsure over the probability of a December fee minimize by the Federal Reserve.

BTC slid to as little as $102,457.33 prior to now 24 hours however has recovered to commerce at $104,555.73 as of 5:52 a.m. EST. Greater than $317 million in leveraged lengthy positions had been liquidated prior to now 24 hours, in keeping with Coinglass.

BTC worth (Supply: CoinMarketCap)

That’s left merchants targeted on the US CPI (Client Value Index) report back to be launched tomorrow. It will likely be a key gauge of what to anticipate from the Federal Reserve’s subsequent rate of interest resolution.

Market expectations for a December fee minimize have weakened, with the CME FedWatch instrument displaying the percentages dropping to 67.9%, from 85% final week, after Fed Chair Jerome Powell warned that extra cuts are “not a finished deal.”

A better-than-expected inflation studying may dampen hopes for additional easing, whereas softer inflation might revive threat urge for food throughout crypto markets.

POWELL SAYS A RATE CUT IN DECEMBER IS NOT A FOREGONE CONCLUSION.

BEARISH STATEMENT… pic.twitter.com/XvrRQQavr6

— Mister Crypto (@misterrcrypto) October 29, 2025

Including to the uncertainty is a Wall Road Journal report earlier at the moment that stated the US central financial institution has turn out to be more and more divided over a December fee minimize.

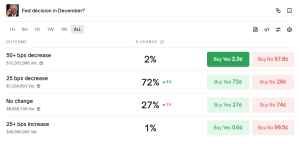

Contract asking what the Fed’s resolution can be in December (Supply: Polymarket)

Merchants on the decentralized predictions market Polymarket stay optimistic that there can be a fee minimize subsequent month. In a contract asking what the Fed’s resolution can be, Polymarket merchants have positioned 72% odds that there can be a 25 foundation factors minimize.

Bitcoin Value Checks Main Technical Barrier As Morgan Stanley Says Take Good points

From a technical perspective, the Bitcoin worth is making an attempt to beat a significant barrier on the $105,795 resistance degree.

Day by day chart for WBTC/USD (Supply: GeckoTerminal)

That worth degree is confluent with the 9 and 20 Exponential Shifting Averages (EMAs), that are presently performing as dynamic resistance ranges for BTC. As such, flipping the resistance degree into help would possibly result in a bullish reversal of the market chief’s present development. This might then lead to a climb to as excessive as $110,830 within the quick time period.

Nonetheless, failure to shut above the $105,795 resistance degree inside the subsequent 48 hours would possibly lead to a pullback to the closest help at $99,680.

Technical indicators on the each day chart, such because the Shifting Common Convergence Divergence (MACD) and the Relative Power Index (RSI), present that consumers are slowly making a comeback, however they nonetheless want to beat the $105,795 barrier earlier than they will ignite a rally.

Whereas Bitcoin tries to beat a significant technical barrier, Morgan Stanley funding strategist Denny Galindo has urged traders to take earnings in preparation for a crypto winter.

“We’re within the fall season proper now,” he stated. “Fall is the time for harvest. So, it’s the time you need to take your positive aspects. However the debate is how lengthy this fall will final and when the following winter will begin.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection