The previous few weeks haven’t been form to Bitcoin (BTC) holders. Value has drifted decrease, demand has fizzled out, and the market’s been caught in a irritating bearish development. However now we’re heading into the ultimate a part of the yr – and that is when crypto tends to make its largest strikes.

There’s a excessive probability we see one other rate of interest reduce in December, which generally acts as rocket gasoline for threat belongings like Bitcoin. With that in thoughts, we’ve dug into the charts and put collectively a Bitcoin value prediction for the remaining weeks of 2025.

Our prediction means that $140,000 is a practical goal if Bitcoin’s technical setup stays in place. Issues are lining up – and a number of the largest names in finance agree that one other rally is incoming.

However when you’re trying past Bitcoin for one thing with much more upside potential, Bitcoin Hyper (HYPER) is a well-liked various. The mission’s presale has raised almost $27 million as hype builds round this new Bitcoin scaling answer.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

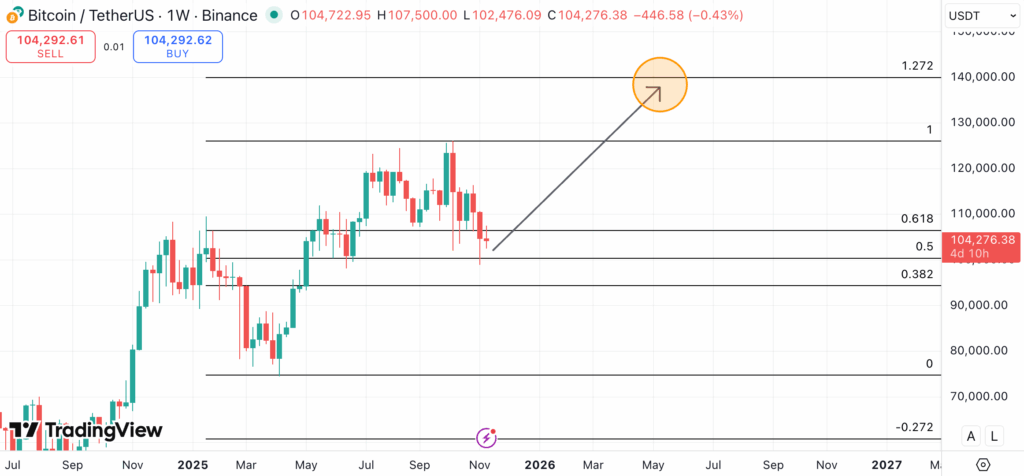

Bitcoin Value Prediction – Fibonacci Extension Factors to $140K Goal

Fibonacci retracements and extensions are fashionable instruments for anybody doing technical evaluation in crypto. Merchants use them to determine potential assist and resistance ranges – together with value targets – based mostly on mathematical ratios that present up in monetary markets.

Presently, Bitcoin’s weekly chart is displaying an attention-grabbing development. When you plot the Fibonacci device from April, when BTC’s rally first kicked off, all the best way as much as October’s peak, the 0.5 retracement degree strains up nearly completely with final week’s low.

That’s not random – it’s a key inflection level. And if Bitcoin rebounds cleanly from that degree within the coming weeks, it might retest its October excessive and doubtlessly push towards the 1.272 extension.

That extension is available in at round $140,000. So, assuming this Fibonacci sample performs out as cleanly because the chart suggests, Bitcoin might be taking a look at one other 34% rally from right here.

Institutional Gamers Align on Bullish Value Targets for Bitcoin

Among the largest institutional gamers and analysts are additionally pointing to excessive year-end targets for Bitcoin. Apparently, their reasoning strains up with what Bitcoin’s technicals point out.

Commonplace Chartered’s staff is on report with a $200,000 year-end goal, citing spot ETF inflows and a weakening greenback as the 2 primary drivers. In the meantime, VanEck’s staff is asking for $180,000, specializing in post-halving dynamics.

Even the extra conservative banks are bullish. For instance, Citigroup’s goal is $133,000 – nonetheless properly above at this time’s value. This goal is basically based mostly on the development of firms including BTC to their steadiness sheet.

So, you’ve acquired the Fibonacci extension pointing to $140,000 and the institutional outlook clustering across the identical degree (and even larger). When the charts and the large cash begin saying the identical factor, normally one thing is about to occur.

Bitcoin Hyper Might Supply Increased Upside as New BTC Layer-2 Community Goes Viral

Bitcoin hovering 34% can be nice – however low-cap altcoins with utility can publish even larger returns when the market turns bullish. Bitcoin Hyper is certainly one of these cash that’s been gaining momentum these days.

The mission’s presale has raised almost $27 million, with HYPER tokens at present priced at $0.013255 every. And simply this week, a crypto whale invested over $220,000 in a single transaction, which is normally an indication that high-net-worth gamers see one thing of worth right here.

So, why are they ? It’s primarily as a result of Bitcoin Hyper is a brand new Layer-2 answer designed to carry scalability and correct DeFi performance to Bitcoin with out forcing customers to swap out of BTC.

Bitcoin Hyper’s structure makes use of a canonical bridge to lock BTC and mint an equal on Bitcoin Hyper, the place transactions settle nearly immediately. Exercise will get batched and verified utilizing zk-proofs for safety, whereas the Solana Digital Machine (SVM) handles throughput.

Additionally, Bitcoin Hyper has a staking protocol (reside through the presale) providing 43% APY to HYPER holders. Over 1.2 billion HYPER tokens are already dedicated to the staking pool.

For traders prepared to tackle extra threat than BTC alone, Bitcoin Hyper’s mixture of low-cap positioning and Layer-2 potential makes it value keeping track of. It’s a mission that would ship outsized returns if the tech rolls out efficiently.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.