Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has dropped 0.8% during the last 24 hours to commerce at $105,110 as of 4 a.m. on buying and selling quantity that rose nearly 3% to $70.22 billion.

That fall comes regardless of Vivek Ramaswamy’s Attempt buying 1,567 Bitcoin value about $162 million, a purchase order that vaulted it previous Galaxy Digital and into the highest 15 international company holders of Bitcoin. Attempt’s newest purchase brings its whole BTC stash to 7,525 cash, with Galaxy Digital lagging behind on 6,894, in response to BitcoinTreasuries.

JUST IN: 🇺🇸 Vivek Ramaswamy’s ‘Attempt’ buys 1,567 Bitcoin value $162 million. pic.twitter.com/2ER2bBFnru

— Watcher.Guru (@WatcherGuru) November 10, 2025

The BTC buy follows Attempt’s latest IPO on Nasdaq, the place its SATA most popular inventory offered out shortly. Funding from that IPO powered the brand new Bitcoin seize. The typical worth paid was $103,315 per coin.

Attempt updates:

1. SATA listed on Nasdaq following oversubscribed & upsized IPO.

2. Attempt acquired 1,567 BTC for ~$162M at ~$103,315 per Bitcoin. As of 11/10/25, we hodl 7,525 Bitcoin.

3. New $ASST & $SATA investor presentation launched.

4. $SATA dividends anticipated to be ROC…

— Attempt (@attempt) November 10, 2025

Bitcoin On-Chain Exercise Confirms Accumulation Development

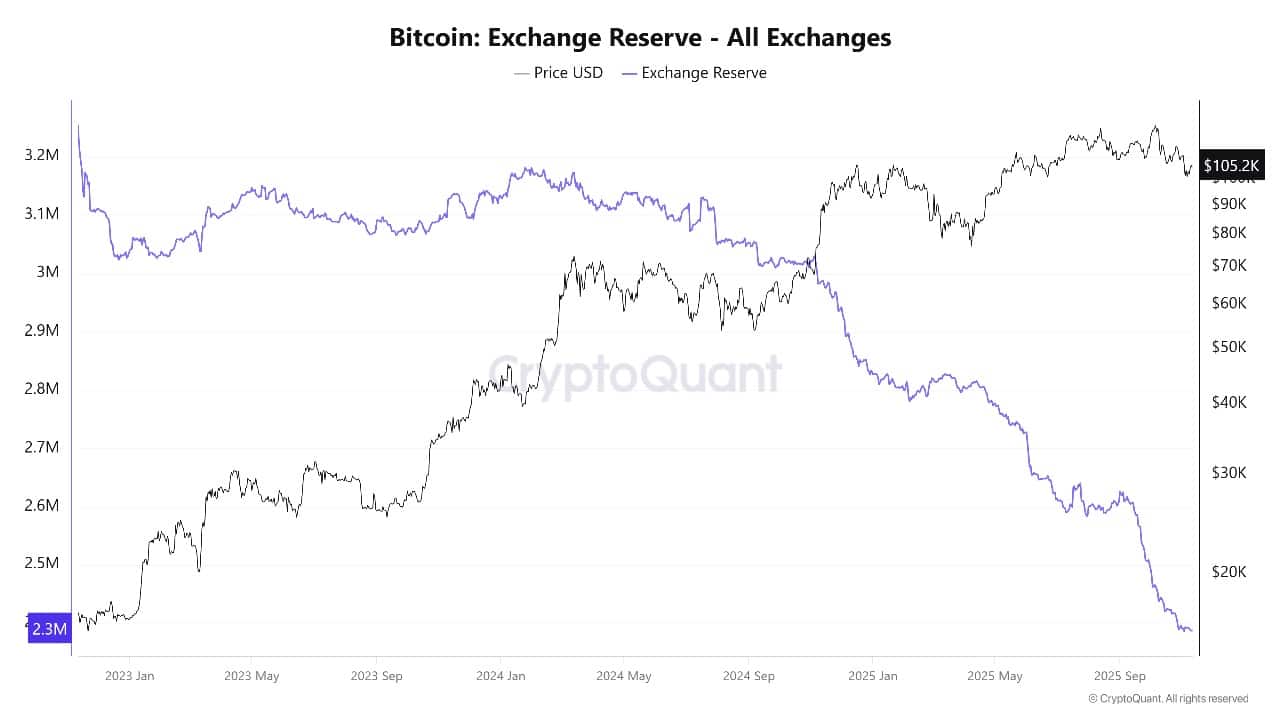

Bitcoin’s on-chain alerts spotlight contemporary accumulation. Main companies shifting cash to company wallets are boosting community exercise and serving to preserve promoting strain low.

Provide held by treasury companies continues to develop as extra corporations add BTC to their steadiness sheets. Elevated pockets balances and fewer cash on exchanges present long-term confidence.

Bitcoin Alternate Reserve: CryptoQuant

As extra public companies transfer Bitcoin into their reserves, investor engagement with on-chain property is rising.

This pattern offers assist for greater costs as new consumers proceed to enter. Community exercise, particularly from massive holders and company consumers, alerts ongoing demand. Lowered trade reserves additionally level to regular accumulation, decreasing the danger of speedy sell-offs.

BTC Worth Evaluation: Heading In the direction of $125K-$145K?

Trying on the BTCUSDT weekly chart, the value is buying and selling close to $104,900, simply above each the 50-week Easy Transferring Common (SMA) at $103,169 and properly forward of the long-term 200-week SMA at $55,361.

BTCUSDT Evaluation Supply: Tradingview

Bitcoin’s worth stays in a powerful uptrend, gently shifting greater after bouncing off key assist across the 50-week SMA.

BTC has shaped greater highs and better lows since mid-2024, displaying consumers stay lively and management the market route. Key assist sits at $103,169 (50-week SMA), which matches the typical entry worth of Attempt’s newest purchase.

Main resistance is within the $126,000 to $145,000 area, primarily based on the Fibonacci extension ranges seen on the chart. If consumers overcome the $126,199 excessive, Bitcoin might swiftly climb in direction of the $145,046 space, particularly if extra massive consumers step in.

Technical indicators give extra clues: The Relative Power Index (RSI) stands at 46.78, displaying momentum is constructive however not overheated but.

The MACD (Transferring Common Convergence Divergence) indicator is barely blended, with the blue line simply above the sign however nonetheless pointing up general. Whereas the Chaikin Cash Circulate (CMF) stays in constructive territory at 0.07, suggesting capital inflows are regular.

So long as Bitcoin holds above the 50-week SMA and retains making greater lows, the uptrend appears to be like protected. Dips to the $103,000 area are being purchased up shortly, displaying consumers’ dedication. If worth breaks above the present resistance at $126,000, extra features are doable within the coming weeks, with upside targets within the $130,000–$145,000 vary.

Nonetheless, if Bitcoin slips under the $103,000 degree, short-term promoting might push it towards the following assist close to the 200-week SMA at $55,36.

Holding above retains the bullish pattern alive. If dips come, consumers are anticipated to return shortly, locking in BTC for the long run as coin worth demand grows.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection