- Bitwise’s spot Chainlink ETF appeared on DTCC underneath ticker CLNK, signaling it could launch quickly.

- The ETF tracks Chainlink’s worth through the CME CF Chainlink–Greenback Reference Fee however nonetheless awaits SEC approval.

- Different asset managers like Grayscale and Franklin Templeton have additionally listed crypto ETFs, suggesting extra launches forward.

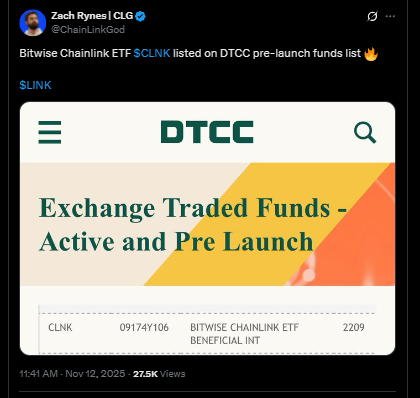

Bitwise Asset Administration, as famous by Zach Raynes, simply made one other huge transfer towards launching its spot Chainlink ETF, which lately confirmed up on the Depository Belief and Clearing Company (DTCC) registry. That’s often a stable signal the product’s getting near going stay, although it nonetheless doesn’t imply the SEC has given a full inexperienced mild but. The ETF, listed underneath ticker CLNK, alerts rising confidence in Chainlink’s position as one of many foremost information bridges driving crypto’s institutional facet ahead.

Getting Nearer to the End Line

The itemizing, noticed on November 11, positioned the Bitwise Chainlink ETF in DTCC’s “lively” and “pre-launch” classes — a standing usually seen shortly earlier than approval. Traditionally, funds that seem in these classes have been within the closing phases earlier than buying and selling opens, although the SEC’s nod remains to be the largest hurdle. Bitwise first filed for this ETF again in August via an S-1 registration, aiming to trace Chainlink’s worth efficiency through the CME CF Chainlink–Greenback Reference Fee (New York Variant), managed by CF Benchmarks.

Construction and Subsequent Steps

The ETF will probably be structured as a Delaware statutory belief, with its web asset worth (NAV) straight tied to LINK’s benchmark fee. Bitwise has but to file its Kind 8-A — one of many final steps earlier than an inventory can go stay — however as soon as that lands, a launch may occur quick. Whereas Bitwise hasn’t disclosed which U.S. trade will host the ETF, hypothesis factors towards main venues like NASDAQ or NYSE Arca, the place most crypto-related funds debut. The market’s watching intently now since related filings have rapidly adopted via to stay buying and selling as soon as DTCC registration went public.

The Greater ETF Push

Bitwise isn’t alone within the race. Different corporations like Franklin Templeton, 21Shares, Canary Capital, and CoinShares have additionally listed their spot XRP ETFs on DTCC, an indication that the marketplace for crypto-backed funds is heating up throughout the board.

In the meantime, Grayscale filed to transform its current Chainlink Belief right into a spot ETF, additional validating LINK’s rising place amongst institutional buyers. Whereas none of those merchandise are buying and selling but, these back-to-back DTCC appearances trace that a number of crypto ETFs — together with Chainlink’s — may lastly go stay inside weeks.

The put up Bitwise’s Chainlink ETF Exhibits Up on DTCC — Right here’s When It Would possibly Launch. first appeared on BlockNews.

BE READY

BE READY

|

| (@Xaif_Crypto)

(@Xaif_Crypto)