Be a part of Our Telegram channel to remain updated on breaking information protection

CleanSpark shares plunged 6.5% after the Bitcoin mining agency stated it might upsize its convertible bond providing to $1.15 billion.

It introduced the Convertible Senior Notes providing, which is being led by Cantor Fitzgerald and BTIG, on X, after earlier saying it might increase $1 billion.

Shares within the providing received’t pay any curiosity and in addition received’t enhance in worth over time.

https://t.co/MdSn9YxoMh

— CleanSpark Inc. (@CleanSpark_Inc) November 11, 2025

The corporate estimated that will probably be in a position to increase roughly $1.13 billion in web proceeds, or $1.28 billion if the preliminary patrons train their full choices to buy extra convertible notes in the course of the 13-day possibility interval.

Of these estimated proceeds, Cleanspark stated it should use $460 million to repurchase frequent inventory from buyers. The corporate stated that it’s going to interact in “privately negotiated transactions” for these repurchases at a share value of $15.03 or the Nasdaq closing value on Monday.

The remaining proceeds shall be used to broaden the corporate’s energy and land portfolio, in addition to develop knowledge middle infrastructure, repay its excellent Bitcoin-backed credit score balances, and canopy normal company bills.

The providing is predicted to shut on Nov. 13, topic to passable closing situations. CleanSpark can even not be capable to redeem the notes till 2029, except sure situations are met, however buyers can power the corporate to purchase the notes again if there are any main company modifications.

This newest providing follows almost a yr after the corporate raised $550 million in the same non-public convertible be aware providing that closed on Dec. 17 final yr. It additionally mirrors related choices by Terawulf and Galaxy Digital.

Bitcoin Mining Corporations Develop Into AI

CleanSpark is the second-largest Bitcoin mining agency globally after Marathon Holdings, with an working hashrate of 46.60 exahashes per second (EH/s), knowledge from Bitcoinminingstock.io exhibits.

In current months, a number of main mining firms have been increasing into AI knowledge infrastructure as a part of an effort to diversify their income streams. That is partly because of stress from the most recent Bitcoin halving occasion, which slashed mining rewards in half.

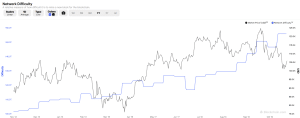

Amplifying the stress on miners is the hovering Bitcoin community issue and the decline in BTC’s value in current weeks.

Bitcoin community issue in comparison with Bitcoin value (Supply: Blockchain.com)

On Oct. 20, when CleanSpark first introduced its AI growth, its share value soared 13%.

Competing Bitcoin mining firm IREN expanded into AI earlier within the yr, and introduced that it signed a five-year settlement valued at $9.7 billion to supply Microsoft with entry to Nvidia GPUs which might be hosted in IREN’s knowledge facilities.

Extra just lately, Rumble introduced that it’s buying Northern Knowledge AG, which incorporates a big Bitcoin mining operation and greater than 20,000 Nvidia H100 GPUs.

In the meantime, in June, Core Scientific introduced a $3.5 billion cope with AI cloud supplier CoreWeave to supply an extra 200 megawatts of infrastructure to host the agency’s high-performance computing operations.

That AI growth might have saved Core Scientific’s enterprise, given the agency filed for Chapter 11 chapter again in 2022. Two years later, the corporate was relisted on the Nasdaq forward of its transfer into the AI sector.

In keeping with a current report by BitBo, roughly 70% of the top-10 Bitcoin mining corporations at the moment are producing income from AI and high-performance middle initiatives.

One other report confirmed that mining shares tied to AI pivots are seeing outsized a number of uplifts in comparison with pure mining friends. It stated that firms which have made AI strikes are buying and selling at round $6 million per megawatt capability, in comparison with round $3 million for pure Bitcoin mining corporations.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection