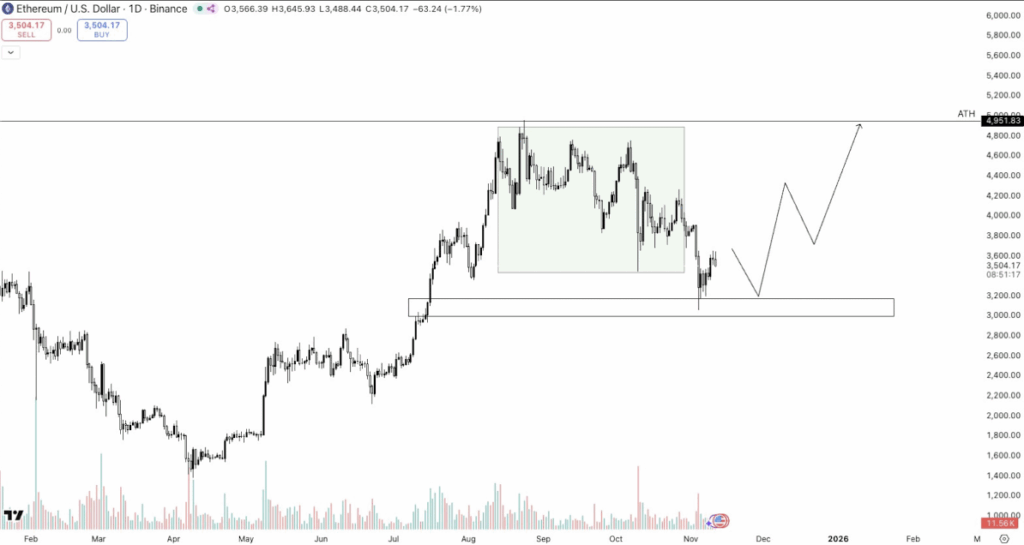

- Ethereum is consolidating across the $3,500 zone after a dip, with bulls fiercely defending the important thing $3,000 assist, retaining the door open for a possible rebound towards the $4,300 space if that flooring doesn’t break.

- On-chain information reveals renewed whale and institutional curiosity, together with a single purchaser scooping up over 75,000 ETH (~$269M) plus greater than $1.37B in November accumulation, hinting that massive cash is quietly positioning for the following leg.

- Brief time period, ETH should reclaim and flip the $3,700 area from resistance again into assist, whereas holding the $3,520–$3,348 band, with upside momentum prone to strengthen additional if Bitcoin additionally pushes greater.

Ethereum is again in that acquainted “holding the road” part. After a pointy dip and a stretch of uneven buying and selling, ETH is exhibiting recent indicators of resilience, with merchants zooming in on a couple of assist zones that might resolve the following massive transfer. Worth has been hovering across the 3,500 greenback space, and each retail and institutional gamers appear to be quietly paying consideration once more, not fairly euphoric, however undoubtedly not checked out both.

For now, the large line within the sand remains to be the three,000 greenback degree. Analysts preserve circling this zone because the essential base for the present bullish construction. If it holds, the broader narrative factors towards a possible push again up towards the 4,300 area within the coming weeks. Market exercise appears like cautious optimism: whales are nibbling, ETF flows are nonetheless coming in, and even with short-term volatility, confidence hasn’t fully cracked.

Worth Chops Round $3,500 In A “Wholesome” Pullback

After a mid-November slide down towards roughly 3,400 {dollars}, Ethereum slipped right into a consolidation part, hovering close to the three,500 deal with. Crypto analyst Crypto Caesar summed it up fairly properly, noting that momentum has cooled, however bulls are nonetheless defending that broader vary fairly aggressively. In the meanwhile, ETH trades round 3,564 {dollars}, exhibiting small day by day losses whereas quantity picks up beneath the three,590 mark.

On the charts, this appears loads like a range-bound reset quite than a full-on breakdown. Many analysts see it as a “wholesome pullback” inside a much bigger uptrend that began when ETH bounced from the two,800 lows earlier in 2025. So long as the three,000 greenback assist doesn’t crack, the construction leaves room for Ethereum to re-align with that bigger pattern and try one other leg greater towards 4,300. If that flooring provides method, although, the tone flips rapidly from “wholesome” to “uh-oh.”

Whales Quietly Stack ETH As Establishments Re-Interact

Whereas retail merchants argue over ranges on social media, on-chain information reveals the larger wallets making clear strikes. Current flows spotlight renewed accumulation from what appears very very similar to institutional and deep-pocketed consumers. One verified whale, for instance, snapped up 75,418 ETH in simply 12 hours through Binance — roughly 269 million {dollars} price — bringing whole holdings to about 266,901 ETH, valued near 949 million {dollars}.

Market analyst Ted Pillows commented that whales “have gotten inquisitive about Ethereum once more,” which is often a well mannered method of claiming massive cash is positioning early. These buys aren’t occurring in isolation both. Throughout November, whales reportedly collected greater than 1.37 billion {dollars} in ETH whilst the value dropped round 12%. That form of conduct usually acts as a tender backside sign: it doesn’t assure an instantaneous moonshot, however it does say the neatest wallets don’t see this vary as overvalued.

The $3,700 Stage Flips From Buddy To Foe

Help isn’t the one story right here; resistance is getting cussed too. Market commentator Sjuul from AltCryptoGems identified that the three,700 greenback zone — which beforehand acted as dependable assist — is now vulnerable to flipping into resistance. The Bitfinex ETH/USDT chart highlights no less than three bounces from this horizontal band since late October, making it a reasonably necessary line within the sand.

Proper now, ETH is buying and selling just under it, close to 3,565 {dollars}. That leaves Ethereum in a barely awkward spot: sturdy sufficient to not disintegrate, not sturdy sufficient to interrupt cleanly above. The short-term outlook from many merchants is “fastidiously bullish however not blind.” A decisive transfer via 3,700 with quantity may open up a clearer path greater, whereas repeated rejections there would possibly entice value in a irritating sideways chop or set off one other leg down earlier than any significant rally.

Brief-Time period Technicals: Help Bands And Wave Counts

On decrease timeframes, intraday evaluation reveals Ethereum hovering over a assist band between roughly 3,520 and three,348 {dollars}. There’s additionally a cluster of lengthy liquidation leverage stacked between about 3,507 and three,460, which suggests if value slides into that space, you can see some sharp wicks as leveraged longs get flushed.

Elliott Wave projections from merchants like pejman zwin recommend ETH is ending up a corrective wave, doubtlessly setting the stage for renewed bullish momentum as soon as the construction completes. Rapid resistance zones are marked close to 3,631, 3,665, and three,707 {dollars}. If Ethereum can chew via these ranges, particularly with Bitcoin pushing greater on the similar time, the likelihood of a sustained rebound improves noticeably. BTC’s conduct nonetheless performs the position of “massive brother” right here; if it breaks up, ETH usually follows.

Outlook: ETH Nonetheless At The Coronary heart Of The 2025 Bullish Narrative

Massive image, Ethereum remains to be sitting proper on the heart of most 2025 bull cycle conversations. The three,000 greenback assist degree, plus regular whale accumulation and continued ETF inflows, provides ETH a sturdier base than the day-to-day noise would possibly recommend. On-chain information stays supportive too: round 32% of the whole ETH provide is staked, and greater than 15 billion {dollars} has flowed into Ethereum ETFs since approvals in 2024, which is a reasonably sturdy vote of confidence.

Ultimately verify, ETH was buying and selling close to 3,477.63 {dollars}, down just below 1% during the last 24 hours — nothing dramatic, simply extra chop. Going ahead, merchants are being informed to look at three issues intently: key assist and resistance ranges, whale conduct, and Bitcoin’s pattern. These three indicators collectively will probably dictate whether or not Ethereum grinds sideways, breaks decrease briefly, or lastly makes a convincing run towards 4,300 and past.

For now, the consensus tone is cautiously optimistic. Nobody is looking victory but, however only a few severe analysts are writing Ethereum off both. If assist retains holding and huge consumers keep energetic, ETH nonetheless has an actual shot at revisiting its highs — and perhaps even writing new ones — earlier than this cycle is over.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.