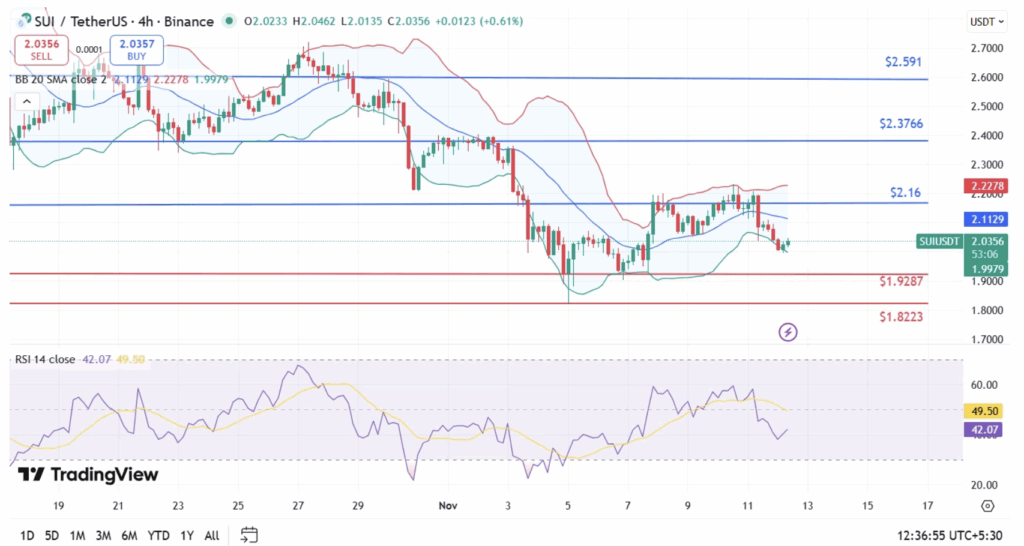

- Sui lately spiked 10% however gave again a lot of the transfer, slipping beneath the $2.07 pivot and slicing weekly positive factors to round +0.45%, with a contemporary -3.36% every day drop.

- Indicators present blended alerts: RSI close to 42.07 and a optimistic MACD histogram, however the MACD line nonetheless beneath the sign, whereas an in depth beneath $2.00 may drag SUI towards the $1.85–$2.00 help vary.

- If $2.00 holds, bulls could drive worth towards $2.16 and $2.37 over the subsequent 5–7 buying and selling days, with analysts calling the present zone a “very good setup” for a possible sturdy transfer.

Sui’s worth motion has been a little bit of a rollercoaster, and proper now it’s sitting at a type of make-or-break zones merchants love and hate on the identical time.

Sui cools off after shock 10% pump

Final week, Sui (SUI) exploded upward with a quick 10% transfer, catching a number of merchants off guard with how shortly it ran. That form of sudden spike nearly all the time attracts profit-taking, and this time was no completely different. As sellers began locking in positive factors and the chart broke down technically, SUI slipped again beneath the important thing $2.07 pivot degree. Now that the mud has settled a bit, that sturdy weekly achieve has mainly been chopped all the way down to round +0.45%, whereas the final 24 hours present a -3.36% drop, leaving worth hovering awkwardly across the $2.00 space.

Alongside the worth retrace, Sui’s market cap has shrunk by roughly 3.52% to about $7.49 billion. That pullback in valuation hints that confidence cooled off shortly after the technical breakdown. Even so, a number of crypto analysts are nonetheless watching SUI intently. The present zone appears prefer it might be the early stage of an even bigger setup — if, and this can be a huge if, the $2.00 area holds as help and consumers step again in with some vitality.

Key ranges and indicators on the Sui chart

Wanting on the Sui worth chart, just a few issues soar out immediately. SUI has slid beneath each its $2.07 pivot and the 7-day easy shifting common (SMA) round $2.08, which clearly reveals that bulls misplaced management of the short-term construction. From a pattern perspective, that’s a warning signal. On the momentum facet, the RSI-14 is sitting close to 42.07, which means that SUI has been recovering from barely oversold situations however hasn’t flipped again into sturdy bullish territory but. It’s prefer it’s attempting to face again up after getting knocked down, however nonetheless a bit shaky.

Curiously, the MACD histogram has turned optimistic with a studying close to +0.011, signaling that bearish strain has eased a bit beneath the floor. Nevertheless, the MACD line remains to be working beneath the sign line, which implies total momentum nonetheless favors the bears for now. So long as that crossover hasn’t totally flipped, sellers technically have the higher hand. The actual hazard line could be very easy: a clear every day shut beneath $2.00 may invite aggressive promoting, dragging SUI towards its Fibonacci retracement help space within the $1.85–$2.00 vary.

What occurs if $2.00 holds — or breaks

On the present 12-11-25 snapshot of worth, that $1.85–$2.00 help band appears just like the battlefield. If this zone holds up, there’s a stable probability we see SUI stabilize and begin forming a base, with potential upside into subsequent week. From that area, any convincing bounce may give the bulls room to launch a reasonably sharp restoration transfer. The primary apparent goal on the upside would sit round $2.16, adopted by a push towards roughly $2.37, which strains up as an intraday resistance zone.

By way of timing, these ranges — $2.16 and $2.37 — are real looking goals over the subsequent 5–7 buying and selling days, assuming SUI defends the $2.00 mark and sentiment doesn’t utterly collapse. In a extra bearish situation, if worth loses that $2.00 flooring with a powerful candle shut, the draw back may speed up shortly, making $1.85 the subsequent main line within the sand. On the flip facet, if consumers soar in aggressively whereas the RSI dips deeper towards oversold, the bounce might be fairly sharp, nearly snap-like, with worth probably speeding again into that $2.16, then $2.37 resistance stack in a brief window.

Analysts eye a “very good setup” on SUI

Some analysts appear to love what they’re seeing right here, even with the latest pullback. Analyst James, for instance, echoed this view in a latest put up on X, calling the present construction a “very good setup.” His view is that if SUI can maintain a rally off these help ranges, the follow-through might be intense, with huge proportion swings on the desk as soon as momentum returns.

So proper now, Sui is in that basic crypto limbo: worth is parked close to a key spherical quantity, momentum is tilted however not totally determined, and sentiment is cautious however nonetheless curious. If $2.00 holds and bulls push again, we’d look again at this zone because the launchpad for the subsequent huge leg up. If it cracks, although, the market could must reset decrease earlier than any critical pattern can resume.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.