For years, merchants regarded to international M2 cash provide as a key gauge of liquidity and danger urge for food. Nevertheless, in keeping with on-chain analyst Willy Woo, that period is over.

Liquidity is a elementary driver for danger property like Bitcoin, creating the capability for worth motion, however psychology determines when that motion occurs.

Sponsored

DXY Emerges as Main Bitcoin Macro Indicator, Says Analyst Willy Woo

Willy Woo argues that the US Greenback Index (DXY), not international M2, is now essentially the most correct indicator for Bitcoin’s route.

“Markets don’t comply with the growth of worldwide M2; they’re speculative. Threat property lead M2… BTC acts like a liquidity-sensing mechanism. M2 is a flawed metric as a result of it’s measured in USD, however solely 17% of worldwide liquidity is definitely {dollars},” Woo wrote on X (Twitter).

The analyst added that the DXY, which tracks the greenback’s energy towards a basket of main currencies, presents a far clearer view of worldwide danger sentiment and Bitcoin’s inverse correlation to it.

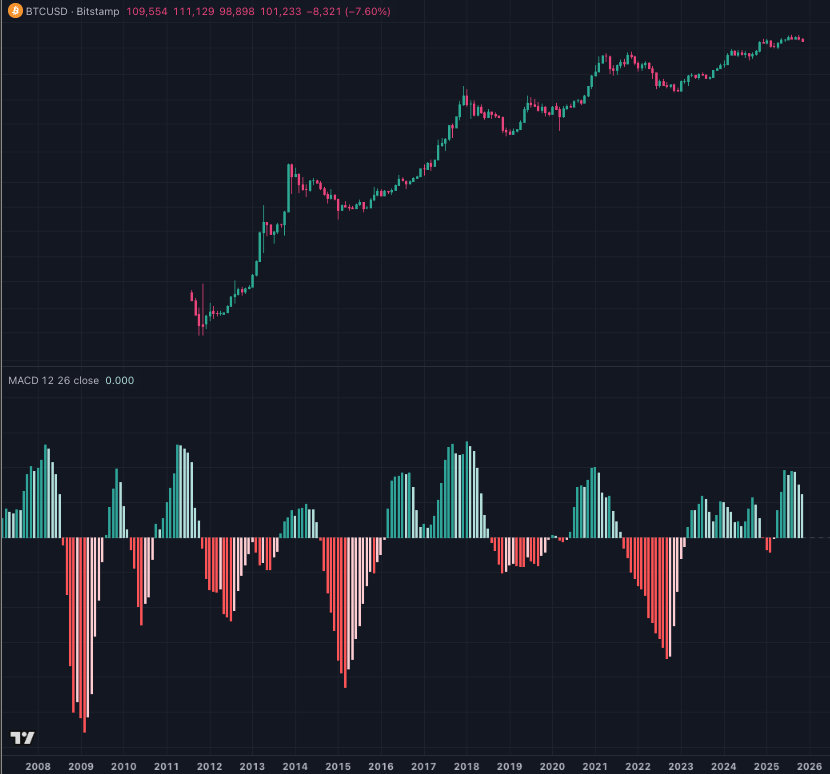

Woo’s up to date mannequin highlights that the Bitcoin and inverse DXY charts now present a robust MACD divergence.

Sponsored

He says this confirms the market’s rising reliance on the greenback’s motion as a sign of liquidity.

“Excessive DXY (sturdy greenback) means a flight in direction of security and risk-off sentiment…USD is taken into account a safe-haven forex (by no means thoughts in very long time frames it debases at 7% per yr),” Woo defined.

In essence, when the greenback strengthens, liquidity tightens, and Bitcoin’s worth tends to weaken. When DXY falls, danger urge for food returns, and Bitcoin rallies as international liquidity expands.

Sponsored

Analysts Cut up on DXY’s Subsequent Transfer

Whereas Woo positions DXY as Bitcoin’s new compass, analysts disagree on which method it’s pointing.

Macro dealer Donny Dicey believes that the greenback is near rolling over, a setup that would unleash Bitcoin’s subsequent breakout.

“Gold has telegraphed what’s coming for DXY — it has been main DXY… Gold sometimes front-runs DXY’s development… It tends to smell out easing situations forward of time, because it reacts on to liquidity expectations, slightly than the official coverage shifts. Gold’s breakout is signaling that the market expects the U.S. to weaken the greenback,” Donny defined.

Dicey provides that DXY’s current rounded backside mirrors Bitcoin’s rounded prime, suggesting an inflection level. “As soon as DXY drops, liquidity floods again, and BTC reacts explosively,” he added.

Nevertheless, not everybody shares that optimism. Analyst Henrik Zeberg forecasts that DXY might climb to 117–120 by year-end, warning that the “King Greenback” narrative nonetheless holds weight.

Sponsored

“A robust greenback means ache for danger property,” echoed investor Kyle Chasse, citing Zeberg’s mannequin.

Such a surge would strain each equities and Bitcoin, reinforcing Woo’s thesis that monitoring DXY, not M2, is the smarter play for merchants chasing the subsequent macro cycle.

As international liquidity hinges on the energy of the US greenback, the DXY-Bitcoin correlation could grow to be the defining chart of 2025.

If Donny’s easing thesis performs out, a weaker DXY might set off Bitcoin’s subsequent leg increased. Nevertheless, if Zeberg’s “King Greenback” state of affairs wins, danger property could face one other squeeze earlier than aid arrives.

Both method, buyers should conduct their very own analysis and watch the greenback, not M2, as a result of in at the moment’s speculative markets, Bitcoin strikes consistent with the buck.