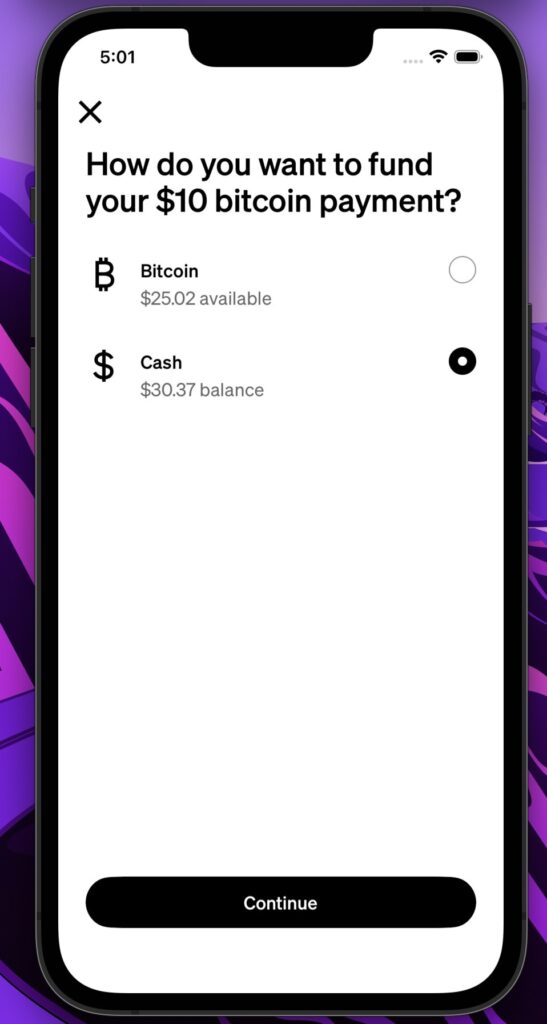

Money App is making bitcoin extra usable for on a regular basis funds. Beginning immediately, the app will allow you to pay with Bitcoin immediately — even should you don’t maintain any — by routinely changing your USD stability on the app into bitcoin for the service provider.

In a sequence of app options introduced immediately, the app will now spend bitcoin regionally, pay in USD over the Lightning Community, and ship or obtain stablecoins. All these updates are a part of Money Releases, the platform’s first bundled launch of recent options, the corporate shared with Bitcoin Journal.

With the brand new ‘Bitcoin Funds with USD’ function, customers could make prompt bitcoin funds even when they don’t maintain BTC. Money App will routinely convert USD from a consumer’s stability into bitcoin for the service provider.

In different phrases, this makes Bitcoin funds accessible to all 58 million month-to-month customers of Money App with out taxable occasions or lowering their Bitcoin holdings.

Sq. retailers profit too, with no charges or chargebacks, and the community operates with out middlemen. Customers can select any fee path — USD to USD, BTC to BTC, BTC to USD, or USD to BTC — all powered by the open Bitcoin community. It can encourage retailers to ask prospects to pay in bitcoin to keep away from card charges.

The system works wherever bitcoin is accepted, connecting tens of millions extra customers to quick, low-cost, borderless funds.

Money App’s bitcoin map

On prime of this bitcoin funds function, Money App rolled out a Bitcoin Map. Following Sq.’s bitcoin funds launch, the map reveals the place native retailers accepting BTC are positioned, letting prospects pay immediately by way of Lightning QR codes.

About 20% of People are open to utilizing bitcoin for every day transactions, the corporate mentioned, and Money App desires to make that transition seamless for each customers and companies.

Along with all this, Money App is introducing stablecoin assist. Prospects can now ship and obtain digital {dollars} globally.

Stablecoins preserve a one-to-one worth with the U.S. greenback whereas enabling near-instant transfers. Money App will routinely convert obtained stablecoins into USD.

“Bitcoin was created to be peer-to-peer money, and Money App is constructing instruments to make it work as supposed — quick, open, and borderless,” mentioned Miles Suter, Bitcoin Product Lead at Block.

When requested about stablecoins and whether or not they would possibly compete with Bitcoin, Suter instructed Bitcoin Journal that “legacy fiat methods are Cash 1.0: sluggish, costly, closed methods with banking hours and borders. Bitcoin is Cash 2.0, the final word purpose: actually decentralized, open, and permissionless. Stablecoins are Cash 1.5, a realistic software and a significant enchancment from conventional monetary rails, however we don’t see them as a competitor to bitcoin.”

He described stablecoins as a complementary software for customers, providing pace and stability whereas bitcoin stays the platform’s basis.

Money App will even improve their Auto Make investments function, the corporate mentioned. Scheduled bitcoin purchases now carry no charges or spreads, making it simpler and extra inexpensive for customers to speculate usually.

“Normal one-time purchases have charges and spreads,” Suter mentioned, “however we’ve constructed a whole ecosystem of how to stack sats at no cost, like Auto Make investments, Paid In Bitcoin, and Spherical Ups. The purpose is giving prospects a number of choices to construct their bitcoin place affordably.”

Since 2018, Money App has helped over 24 million lively customers purchase bitcoin, with options like Paid In Bitcoin enabling automated conversion of direct deposits into BTC.

Bitcoin funds by way of Sq.

Earlier this week, Sq. rolled out Bitcoin funds for U.S. sellers, permitting roughly 4 million retailers to simply accept BTC by way of their terminals with no processing charges till 2027.

The system enabled prompt transactions by way of the Lightning Community, first piloted at Compass Espresso in Washington, D.C. Retailers might obtain Bitcoin, convert it to USD, or routinely convert a part of every day gross sales into BTC.

When requested about criticism that platforms like Sq. or Money App is likely to be centralizing Bitcoin, Suter mentioned, “In order for you entry to the fiat banking system immediately, you want a centralized supplier. The top purpose is self-custody, which is why we constructed Bitkey. We’re constructing auto-sweeps to self-custody that can roll out later, and deep Bitkey integration with Sq. is coming in 2026 for self-custody of funds you obtain as funds or convert from every day card gross sales.”

Jack Dorsey’s Block Inc., previously generally known as Sq., has advanced right into a full-stack Bitcoin firm spanning funds, mining, open-source software program, and self-custody options.

By subsidiaries like Money App, Bitkey, Proto, Spiral, and Tidal, Block is driving Bitcoin adoption throughout each shopper and developer ecosystems.

The corporate holds over 8,780 BTC and continues to deepen its integration with Bitcoin, aligning its enterprise technique with the community’s long-term development.

In accordance with Suter, the corporate envisions Bitcoin turning into on a regular basis cash and a common monetary infrastructure enabling actually international commerce.