Bitcoin is coming into the weekend below heavy stress as worth motion weakens throughout the board.

The benchmark asset continues to commerce under the important thing $100,000 degree, forcing merchants to reassess whether or not the market is experiencing a routine shakeout or one thing structurally deeper.

Bitcoin Worth In the present day: Momentum Slips, Concern Rises

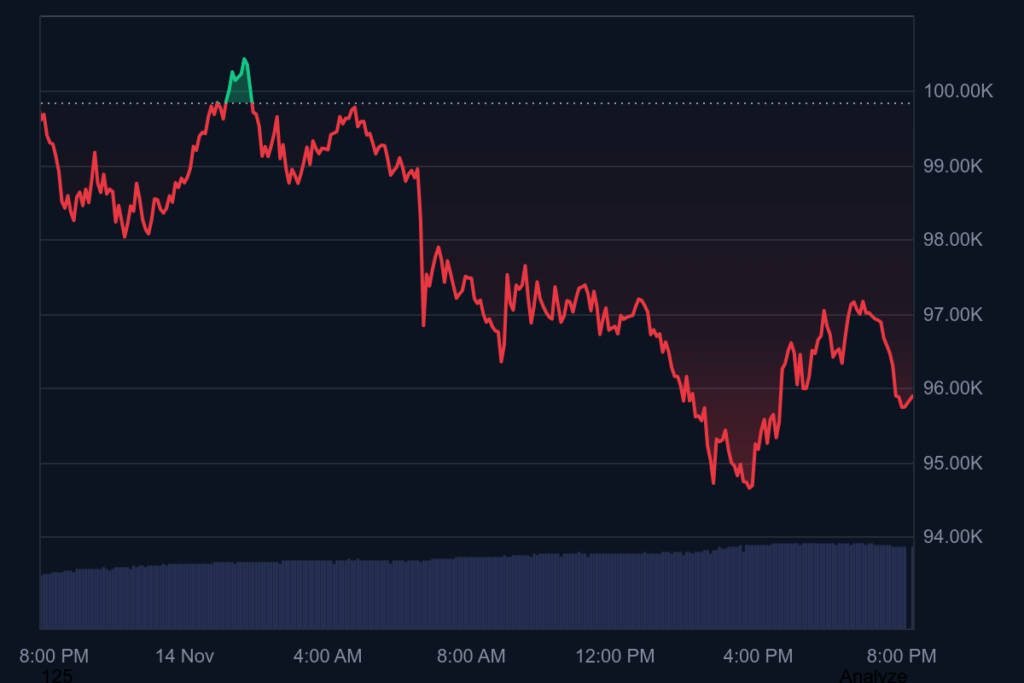

Bitcoin is altering palms round $95,900, extending its decline from earlier within the week. The transfer locations BTC firmly within the purple throughout all short-term timeframes:

- 24h: -3.5%

- 7d: -5.5%

- Market cap: $1.93 trillion

- 24h quantity: $127 billion

Sentiment has deteriorated considerably. The Concern & Greed Index has dropped to 22 (“Concern”), reflecting a market that’s more and more nervous about macro uncertainty, ETF outflows, and thinning liquidity on main exchanges. The broader crypto market can be feeling the burden, with whole capitalization slipping to round $3.28 trillion.

Technically, merchants are watching whether or not Bitcoin can reclaim $100,000, a degree that offered help for months earlier than giving method this week. A failure to rebound convincingly might hold promoting stress elevated into subsequent week.

Wyckoff Distribution Alerts Strengthen: Analysts Eye $86K

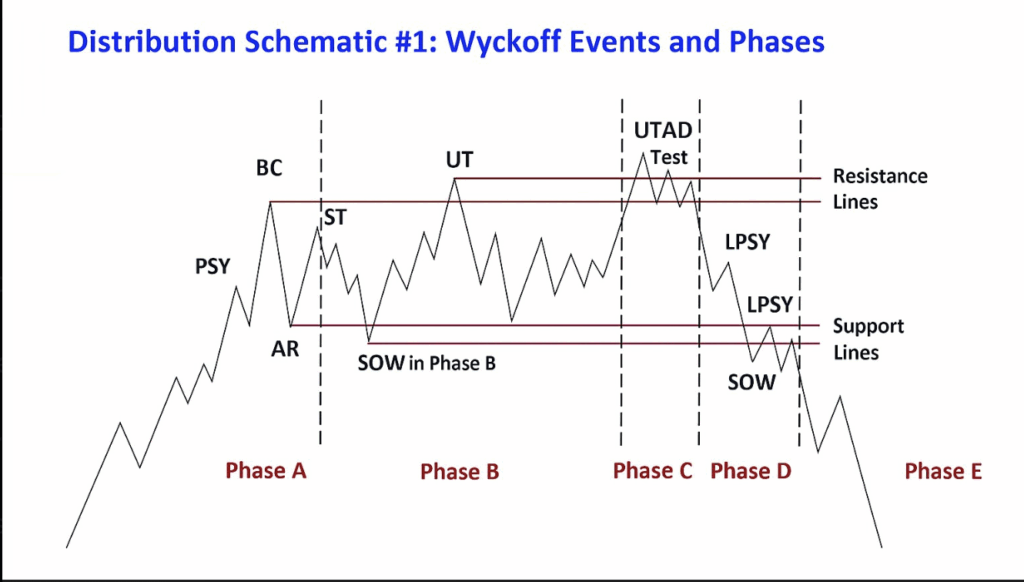

Alongside the weakening worth construction, a variety of analysts warn that Bitcoin’s latest conduct carefully resembles a Wyckoff Distribution sample, a formation typically seen close to main cycle tops.

The comparability means that Bitcoin’s surge towards $122,000 marked a shopping for climax, adopted by repeated failed makes an attempt to type greater highs – an indication consumers had been shedding power. The push above $126,000 in early October now seems, in hindsight, to be a basic “upthrust” — a closing bullish deviation earlier than the market turns down.

After shedding help close to $110,000, Bitcoin has now entered what Wyckoff describes because the markdown section, the place worth accelerates decrease as provide overwhelms demand. Underneath this interpretation, the measured draw back goal from the distribution vary factors towards $86,000.

Nonetheless, not all analysts consider the bull section is completed.

CryptoQuant CEO Ki Younger Ju argues that the pattern stays structurally bullish so long as BTC holds above $94,000, the typical price foundation of mid-term holders. A decisive break under that degree, he says, could be the actual set off for concern.

Bitwise’s Hunter Horsley provides that Bitcoin might have already endured a six-month inside bear section and may very well be approaching the tip of it – with robust long-term fundamentals ready on the opposite facet.