- Bitcoin plunged to $98K, triggering almost $658M in liquidations — with $533M wiped from lengthy positions alone.

- Heavy U.S.-based promoting and ETF redemptions pushed BTC under $100K, ending its 189-day streak above the extent.

- Prediction markets now give a 66% probability that Bitcoin will hit $95K earlier than the top of November.

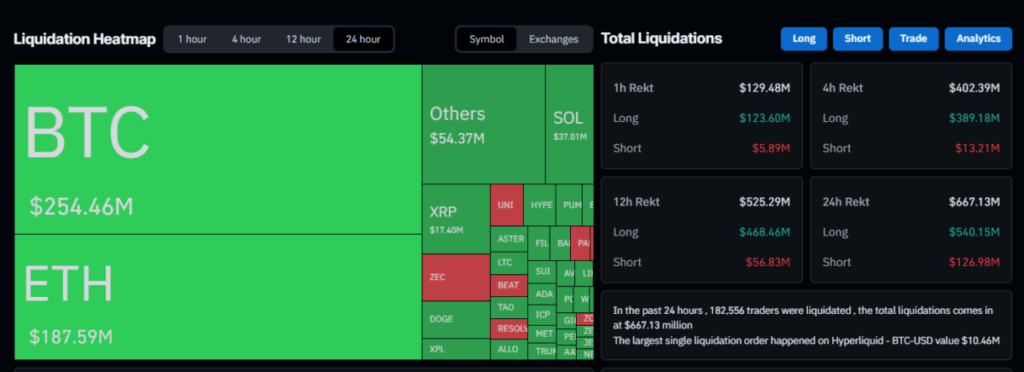

Bitcoin took a pointy dive under the six-figure line once more, slipping to round $98,377 on Nov. 13 — and the drop wasn’t mild in any respect. The transfer triggered an enormous $657.88 million in crypto liquidations in simply 24 hours, with lengthy positions getting hit the toughest. It was a kind of market moments the place every part occurs too quick, and merchants barely have time to blink earlier than positions begin vanishing.

A Brutal Liquidation Wave

CoinGlass information confirmed that out of the almost $658 million washed out, a staggering $533.57 million got here from lengthy merchants who had been positioned for extra upside — and acquired fully blindsided. Shorts solely took about $124.31 million in injury, that means the bulls actually ate the majority of this one. The cascade sped up all through the day too, leaping from $513 million on the 12-hour mark into full-blown chaos as BTC misplaced its grip on $100K once more.

In keeping with CoinGecko, this was already Bitcoin’s third dip under $100K in November alone, following earlier drops to $99,607 and $99,377. From its peak of $126,080 on Oct. 6, BTC is now down roughly 22%, which is a fairly steep retrace for one thing that felt unstoppable simply weeks in the past. Different majors slid too — Ethereum traded close to $3,267, Solana round $147.91, and XRP slipped to $2.36.

Why Did Bitcoin Break Beneath $100K?

Analysts pointed fingers in a number of completely different instructions, however one theme saved popping up: U.S. promoting strain. Satoshi Stacker highlighted that the “Coinbase BTC low cost” widened once more, exhibiting heavy U.S.-based promoting dragging costs down.

Dealer Maartunn famous that the $100K zone was an enormous liquidity pocket — as soon as BTC cracked under it, the market rushed to fill orders decrease, ending a 189-day streak of Bitcoin closing above $100K. That streak stretched all the way in which again to Could 8.

And strategist Liz Thomas identified one thing attention-grabbing: greenback weak point didn’t assist Bitcoin in any respect — however it did assist gold. A sort of bizarre divergence for a market that often strikes with macro narratives.

Merchants Brace for Extra Draw back

Prediction markets aren’t precisely optimistic proper now. On Polymarket, merchants positioned a 66% probability that Bitcoin will contact $95,000 someday in November. Over on Kalshi, members gave 37% odds that one other S&P 500 firm will announce BTC purchases earlier than year-end — a element that exhibits some suppose institutional demand would possibly nonetheless present up, even when it’s not right here at this time.

ETF outflows and redemption strain additionally performed a task in pushing Bitcoin decrease, making this the largest liquidation occasion of This autumn thus far. It was a kind of traditional domino-effect moments: value dips → liquidity cracks → longs flushed → deeper dip → extra panic.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.