The digital asset market entered the day firmly within the crimson, with complete market capitalization falling greater than 6% to $3.29 trillion.

Sharp declines throughout main cryptocurrencies – led by Bitcoin and Ethereum – pushed sentiment into deeper worry territory, in response to real-time dashboard indicators.

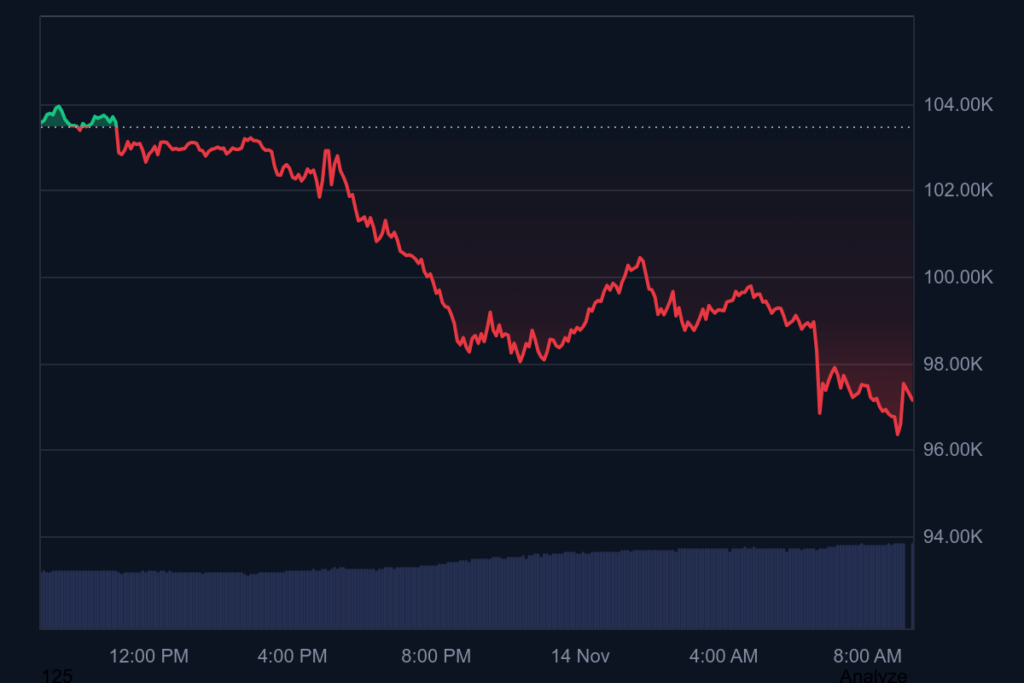

Bitcoin, which continues to dominate the sector, slipped to $97,080 after a 6.4% drop over the previous 24 hours. The main asset can be down practically 5% on the week, reflecting broad risk-off habits as merchants scale back publicity. Ethereum mirrored the droop, falling to $3,201 after a steep 9.7% every day loss.

Solana and BNB have been hit as effectively, retreating to $142.89 and $920.14 respectively, every closing out the day with declines above 4% to eight%. A number of different large-cap tokens – together with XRP, Dogecoin and Cardano – additionally posted notable drawdowns, contributing to the market-wide correction.

Key sentiment indicators present the temper weakening. The Worry & Greed Index sits at 22, signaling Worry, whereas the common crypto RSI reveals the market drifting into oversold territory. Merchants look like rotating out of leveraged positions, with volatility greater throughout a number of networks.

Regardless of decrease costs, buying and selling exercise stays sturdy. Bitcoin’s 24-hour quantity reached $112 billion, whereas Ethereum noticed over $52 billion in buying and selling turnover. Stablecoins held regular, with USDT and USDC sustaining their pegs as capital moved defensively into lower-volatility property.

Altcoin efficiency different, with some tokens trying intraday recoveries however failing to flee total downward momentum. The “Altcoin Season” indicator sits at 32/100 – effectively under the edge that might sign outperformance relative to Bitcoin.

With strain constructing throughout the highest 10 property and sentiment trending unfavourable, analysts count on volatility to stay elevated within the brief time period. Merchants can be watching whether or not Bitcoin can defend the mid-$90K zone and whether or not Ethereum can reclaim territory above $3,300. A break decrease, nevertheless, might result in additional unwinding because the market searches for stability.