- Bitcoin weakens beneath $100K as U.S. trading-hour promoting continues.

- Merchants debate whether or not shutdown drama or broader sentiment is guilty.

- Crypto shares tumble, and analysts warn 2025 highs might already be in.

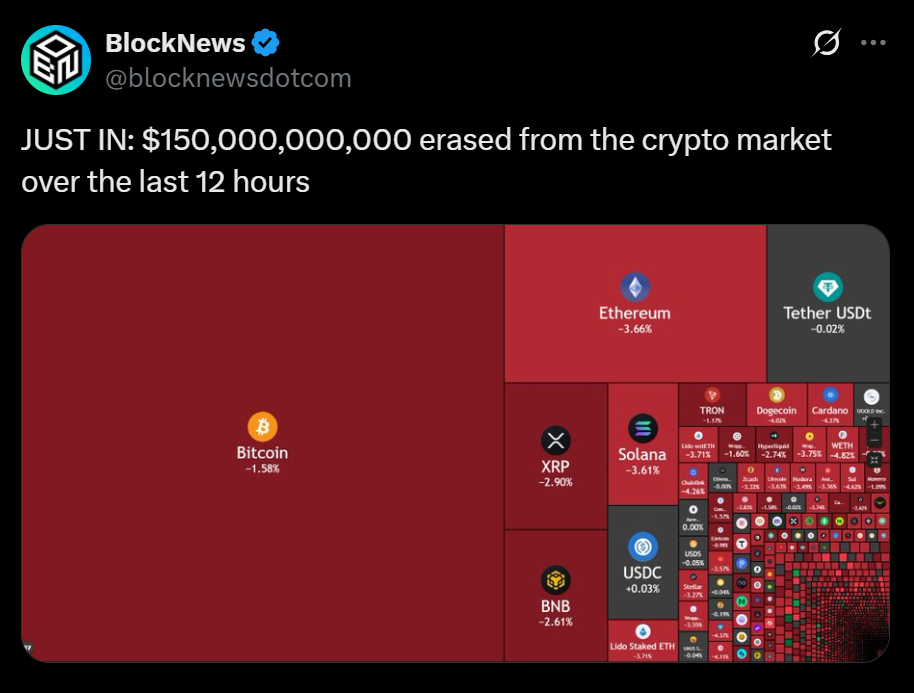

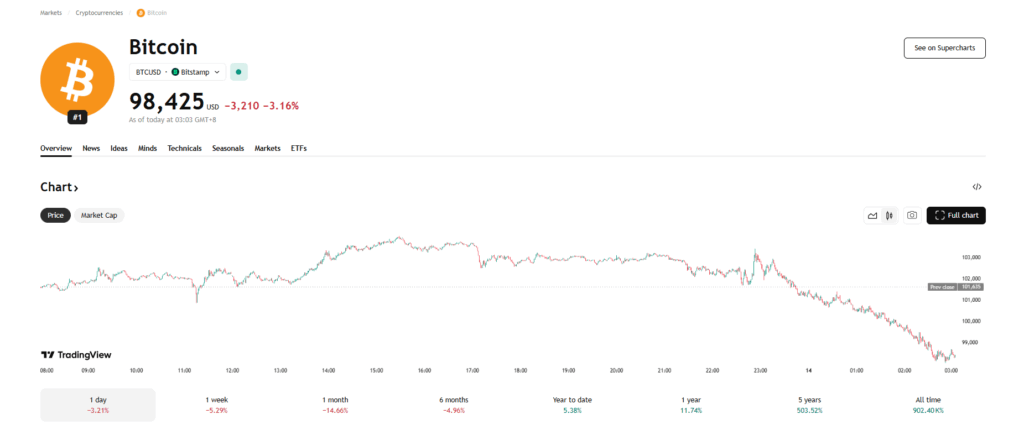

Bitcoin broke beneath $100,000 once more on Thursday, repeating a sample merchants are getting used to: energy throughout in a single day periods, adopted by sharp weak point the second U.S. buying and selling opens. The liquidity setting has tightened considerably, and the momentary authorities funding patch hasn’t eased market stress. Whereas headlines say the shutdown “ended,” merchants understand it’s solely a stopgap that kicks the issue into early 2026 — and that lingering uncertainty continues to stress danger property.

Merchants Cut up Over Shutdown Influence and Market Sentiment

Debate throughout X has intensified. Some analysts argue the market is reacting to the shutdown on a delay, claiming the funds extension doesn’t clear up something long-term and that buyers are waking as much as the shortage of an actual repair. Others disagree, saying the shutdown wasn’t a significant driver within the first place. As an alternative, they level to weeks of sentimental sentiment, persistent macro headwinds, and a short rally earlier this week that was fueled extra by emotion than fundamentals. Both means, merchants agree the market tone is drained — and that Bitcoin wants clear catalysts earlier than regaining momentum.

Crypto Shares Hit Arduous as Analysts Query 2025 Highs

The most important harm wasn’t in Bitcoin, however in crypto-linked equities. Miners corresponding to Bitdeer, Bitfarms, Cipher and IREN plunged 10%–19%, whereas Galaxy, Bullish, Gemini and Robinhood all booked steep declines. With the chance of a December Fed charge minimize now break up practically 50/50, the risk-off tone has accelerated. Some analysts imagine the highs for 2025 might already be behind us, except liquidity rebounds shortly. On the brilliant aspect, strategists observe that spending may enhance heading into subsequent 12 months, probably respiration life again into danger markets as soon as political uncertainty clears.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.