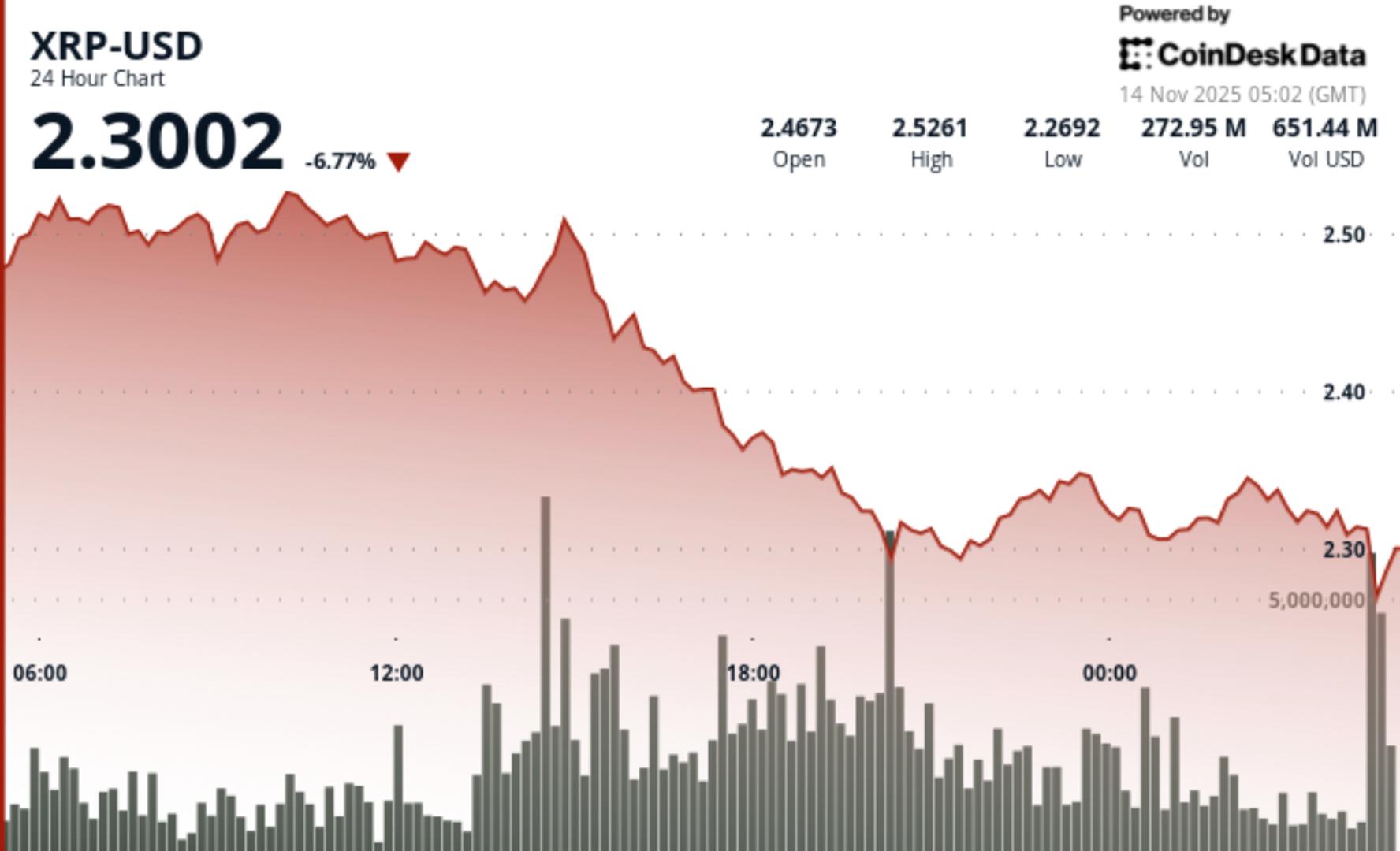

Brutal selloff breaks psychological $2.30 ground, erasing latest features as distribution overwhelms historic XRPC debut.

Information Background

XRP’s worst intraday decline in weeks coincided with a significant trade milestone: the launch of the primary U.S. spot XRP ETF, Canary Capital’s XRPC, now formally efficient on Nasdaq as of 5:30 PM ET. The itemizing marks a turning level for institutional XRP entry, however the debut arrived as broader crypto markets prolonged their medium-term downtrend.

Sentiment stays pinned at worry amid persistent macro risk-off flows. Analysts together with FxPro’s Alex Kuptsikevich warn crypto circumstances nonetheless resemble “a short-term rebound inside a bigger decline,” with market construction weak to deeper retracements. Massive-cap token flows echo that warning, and XRP’s on-chain knowledge confirmed 110.5M tokens moved between unknown wallets within the hours surrounding the breakdown, amplifying uncertainty throughout peak volatility.

Value Motion Abstract

XRP collapsed 7.3% from $2.48 to $2.30 over the 24-hour session, slicing by means of main help ranges at $2.46, $2.40, and $2.36. The decline spanned a violent $0.23 vary, with 157.9M XRP traded — 46% above the 24-hour common.

The core breakdown unfolded throughout a four-minute liquidation cascade from 04:32–04:35 UTC, when value plunged from $2.313 to $2.295 on 6.6M XRP quantity — 254% above baseline. The one-minute spike of 4.06M at 04:32 marked the session’s promoting climax. Liquidity briefly evaporated as buying and selling flatlined between 04:35–04:36, indicating both halted order circulate or extreme e book thinning.

Makes an attempt to stabilize above $2.31 failed, and XRP settled into slender consolidation close to $2.30–$2.32.

Technical Evaluation

The session confirmed a full technical breakdown with clear structural injury:

Assist/Resistance:

• $2.29–$2.30 turns into major help after breach of psychological ground

• Former help at $2.36, $2.40, and $2.47 now act as stacked resistance

• Invalidation for bulls requires a decisive reclaim of $2.36

Quantity Profile:

• Whole session quantity 157.9M (+46%) confirms institutional-grade distribution

• Breakdown sequence confirmed 254% hourly quantity spike, typical of liquidation-driven strikes

• No significant restoration quantity appeared throughout post-crash consolidation

Chart Construction:

• Descending triangle help failed decisively, killing prior reversal setup

• New decrease vary forming between $2.29–$2.33

• Breakdown aligns with medium-term downtrend in broader crypto indexes

Momentum Indicators:

• Oversold alerts rising intraday, however no affirmation of pattern reversal

• Breakdown occurred under key EMAs; 50D/200D cross continues to slope bearishly

What Merchants Ought to Watch

XRP now sits at a pivotal inflection level:

• Holding $2.29 is important — failure exposes a quick transfer into the $2.00–$2.20 demand zone

• Any restoration should first reclaim $2.36 earlier than bulls regain technical management

• ETF inflows will act as the subsequent volatility catalyst; early XRPC quantity throughout market open will point out whether or not establishments deal with the itemizing as an accumulation alternative or liquidity occasion

• On-chain flows across the 110.5M XRP whale transfers stay a wildcard — trade inflows would affirm further draw back danger

• Sentiment stays fragile throughout majors; beta-sensitive belongings like XRP will reply disproportionately to broader market weak point