November has been tough for many of the market, and even a number of ‘made in USA’ cash have slipped considerably. The broader pattern has been weak, with few belongings holding their ranges whereas merchants anticipate a clearer course.

However because the market tries to stabilise, three of those US-based cash are displaying early indicators that they may rebound. One has a uncommon adverse correlation with Bitcoin. One other is forming a clear reversal construction. And the third coin has drawn sudden whale exercise. These elements make them value watching this week.

Litecoin (LTC)

One of many first made in USA cash to observe this week is Litecoin (LTC). It has climbed somewhat over 8% up to now 30 days and about 7% up to now 24 hours, displaying surprising resilience throughout a tough November.

Sponsored

Sponsored

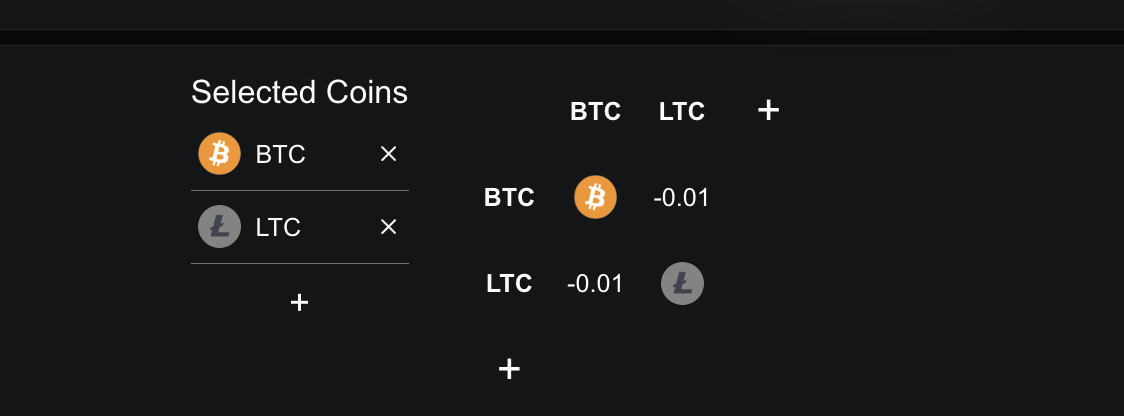

An enormous cause behind this power is its adverse correlation with Bitcoin. The Pearson correlation coefficient between LTC and BTC sits at –0.01 over the previous month.

The Pearson coefficient measures how two belongings transfer relative to one another; a adverse studying means they transfer in numerous instructions.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Since Bitcoin has dropped greater than 13.5% in the identical interval, Litecoin’s lack of correlation has really helped it maintain higher than most prime cash.

However correlation will not be the one issue right here. The chart can be forming a clear inverse head and shoulders sample, with the worth now hovering close to $102.

If LTC manages a each day shut above $119, it might full the sample and open the door to a transfer towards $135 or greater if broader circumstances enhance. This resistance degree has capped upside makes an attempt earlier than, so a break would sign actual momentum.

The Sensible Cash Index, which tracks how knowledgeable or early-moving merchants place themselves, has additionally begun turning up since November 13.

Sponsored

Sponsored

That shift reveals some early confidence returning as LTC pushes towards the sample’s neckline. The mix of a curling Sensible Cash Index and worth urgent right into a breakout zone makes this week particularly vital for this setup.

If patrons fail to carry Litecoin above resistance, the primary key assist sits at $93. A drop under that degree weakens the reversal construction, and falling beneath $79 would invalidate the sample totally.

Solana (SOL)

Among the many ‘made in USA’ cash gaining consideration this week, Solana (SOL) stands out for a distinct cause. It has had a tough month, dropping virtually 27% over the previous 30 days. Even so, the chart is beginning to present hints of a doable short-term reversal that merchants can’t ignore.

The sign comes from the Relative Power Index (RSI), which measures worth momentum to indicate when an asset could also be overbought or oversold.

Between November 4 and November 14, Solana’s worth fashioned a decrease low, whereas RSI fashioned a better low. This formation is named a bullish RSI divergence, and it typically seems simply earlier than a pattern makes an attempt to show, even when the reversal is transient.

Sponsored

Sponsored

If this divergence performs out, Solana’s speedy check is $162. It’s a sturdy resistance degree that has held since November 5 (breaking as soon as in between).

Breaking above $162 would open the door towards $170. And if momentum strengthens, the worth may push as excessive as $205 within the brief time period.

However the setup solely holds if patrons defend $135. A drop under that assist would weaken the construction and expose $126.

Chainlink (LINK)

The ultimate choose on this week’s checklist is Chainlink (LINK), which has had a troublesome month of its personal. It has declined by greater than 20% over the previous 30 days and has logged a further 10%+ drop throughout the previous week.

Even so, one thing uncommon has appeared in its holder exercise, making LINK a key token to observe this week because the market makes an attempt to stabilise.

Sponsored

Sponsored

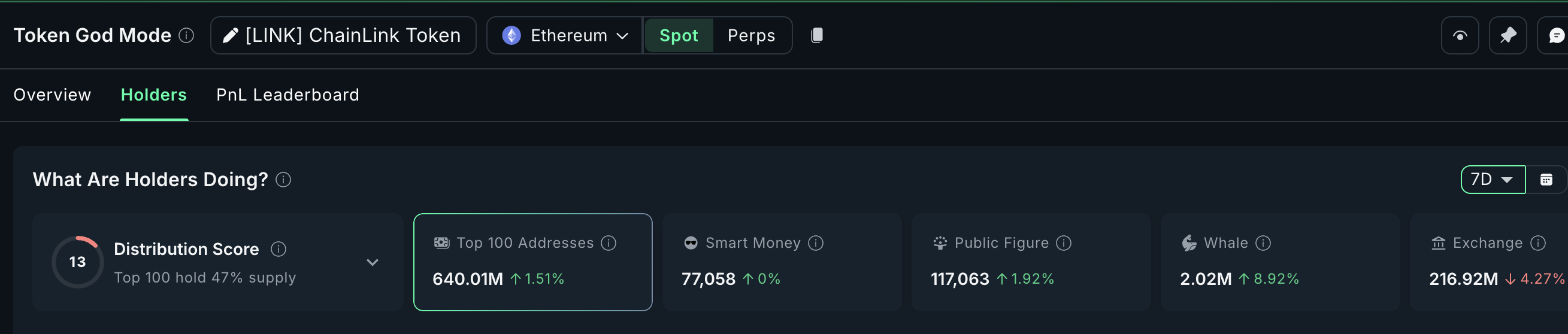

Regardless of the decline, whale accumulation has surged within the final seven days. Common whale holdings have jumped 8.92%, whereas the highest 100 addresses—bigger “mega whales”—have elevated their mixed stash by 1.51%.

When whales purchase into weak point as a substitute of exiting, it typically hints at early positioning for a possible reversal.

The chart explains why they might be stepping in. Between October 10 and November 14, LINK’s worth made a decrease low, whereas its RSI fashioned a better low. This created a typical bullish divergence. This is similar momentum shift seen in Solana, and it typically seems close to the early levels of pattern reversals.

For the setup to activate, LINK must reclaim $16.10, which requires roughly a 17% transfer from present ranges. Clearing $16.10 opens the trail towards $17.57.

If a each day shut varieties above that zone, LINK may stretch towards $21.64 or greater if broader market circumstances enhance.

If patrons fail to carry assist, the important thing degree to observe is $13.72. A each day candle shut under it might break the present construction and certain invalidate the bullish reversal sign. The reversal, then, must wait longer.