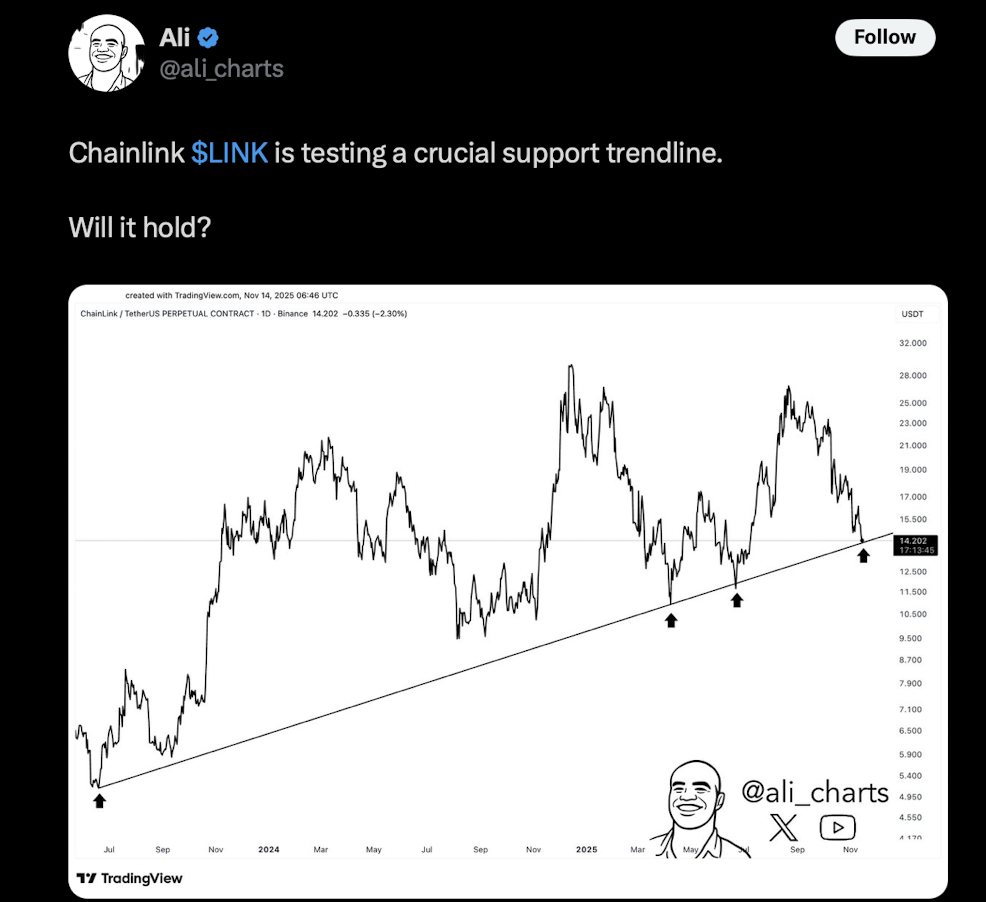

- Chainlink has dropped again to round $14, touchdown precisely on a long-term ascending trendline that has triggered each main LINK rebound since mid-2023.

- Quick-term charts nonetheless present a descending channel from the mid-$20s, however that channel’s decrease boundary now overlaps with this multi-year assist, making a high-conviction pivot zone.

- If LINK holds this space, it may rebound towards the mid-$20s once more; if the trendline lastly breaks, draw back opens towards the 11–12 greenback area and a deeper correction.

Chainlink has been sliding for weeks now, drifting decrease nearly prefer it’s working out of steam… however this newest drop isn’t simply “one other crimson candle.” The LINK worth has landed proper again on the one stage that has outlined each main comeback for greater than a yr. And now that worth is sitting on high of it once more, merchants are all of a sudden paying far more consideration.

LINK Is Touching a Trendline It Has Revered for Years

For those who check out Ali Martinez’s chart, the story turns into fairly clear. LINK is tapping the identical long-term ascending trendline that’s held sturdy since mid-2023. Each time this line was touched, the value didn’t simply bounce—it ripped. Typically for weeks straight, generally for months. Truthfully, it’s been one of many cleanest development helps LINK has ever had.

Proper now the LINK worth is hanging across the $14 zone, sitting straight on that multi-year trendline. If it holds once more, historical past says LINK may reset its complete bullish construction. If it breaks, nicely… that may be the primary actual violation of this sample in years, and that’s the place issues get messy.

Quick-Time period Charts Nonetheless Look Heavy, however a Pivot Zone Is Forming

Zoom in to DonaldTrade’s 1-hour chart and the story feels kinda completely different. LINK has been drifting down inside a large descending channel, dropping from the mid-$20s all the best way again to the place it’s now. It hasn’t damaged that downtrend but, so short-term sentiment nonetheless leans cautious.

However right here’s the half that’s really fascinating: the underside of Donald’s channel traces up nearly completely with Ali’s huge multi-year trendline. When a macro assist and a short-term construction collide like this, the zone usually turns into a purchaser magnet—you’ll see individuals betting on a bounce just because the setup is just too clear to disregard.

If LINK holds this space, it has room to shoot again towards the higher facet of the channel, possibly even revisit the mid-$20s. If bulls fail and that trendline cracks? The following sturdy assist doesn’t present up till across the $11–$12 pocket.

How Excessive Might LINK Go From Right here?

The entire play proper now hinges on whether or not LINK can defend that trendline that’s protected it throughout a number of cycles. If patrons step in once more—they usually’ve achieved it each different time to date—one other huge rebound from this actual zone is completely potential.

But when sellers lastly punch by way of it, the construction opens up for a deeper slide.

It’s a easy setup, however actually probably the most necessary ones LINK has confronted shortly. This isn’t simply any assist check. It’s the spine of the entire multi-year development. And judging by the velocity of this transfer, the market in all probability doesn’t have lengthy to attend. The following few days ought to inform us whether or not LINK flips or lastly breaks.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.