The Czech Nationwide Financial institution disclosed a $1 million buy of Bitcoin alongside a USD stablecoin and a tokenized deposit as a part of a check portfolio held outdoors its official reserves, geared toward gaining hands-on expertise with custody, settlement, safety, and AML underneath actual circumstances.

Officers emphasised this can be a pilot, not a strategic reserve allocation, although the transfer makes CNB one of many first central banks to publicly affirm a direct BTC purchase; ESMA-era European oversight and MiCA implementation present the regulatory backdrop for such experiments.

Native and syndicated protection notes that the board authorised the initiative just lately, with findings to be shared over the subsequent 2–3 years; the scale won’t be expanded for now, and the property are ring-fenced from worldwide reserves.

Key element: whereas prior feedback floated the concept of bigger BTC reserves, the financial institution reiterated that they made no resolution to incorporate Bitcoin in official reserves at this stage.

The The place’s and Why’s of the Czech Bitcoin Portfolio

The CNB listed 4 core causes for creating the $1M check portfolio:

- Acquire sensible, hands-on expertise with buying, holding, settling, accounting for, auditing, and securing blockchain-based property, together with key administration, multi-level approvals, disaster drills, and AML/KYC checks.

- Consider Bitcoin particularly from a central financial institution perspective and assess its potential position in future reserve diversification, whereas conserving the pilot ring-fenced from official reserves.

- Discover the way forward for funds and asset tokenization by evaluating BTC, a USD stablecoin, and a tokenized deposit, and check how these devices can be utilized and settled in operations.

- Construct and switch inside experience throughout groups and publish learnings over 2–3 years, with out growing the portfolio measurement past the preliminary $1M through the pilot interval.

What Merchants Are Shopping for as Crypto Treasuries Arrive in Europe

As governments construct their treasuries with main cryptos, retail merchants even have a wide range of choices to select from. A micro-scale pockets may also be worthwhile for those who select correctly. So what are as we speak’s picks for an investor’s portfolio? Let’s begin with one thing near Bitcoin, after which diversify.

Bitcoin Hyper: L2 That Goes With a Bang

Bitcoin Hyper is a Layer-2 answer for Bitcoin, and as such, is said to the foremost crypto. Whereas it gained’t attraction to authorities, it definitely has its deserves for builders and minor merchants. It opens the best way to dApps, memecoins, sooner and cheaper transactions, and all this with Bitcoin-like safety degree.

And it’s not solely retail traders who come to appreciate this. $HYPER is attracting whale buys to a shocking extent: the final 12 hours noticed a significant purchase of virtually $500,000, as evidenced on Etherscan. That mentioned, the BTC Hyper presale has surpassed $27.5M and counting, however there’s nonetheless an opportunity to leap on that bandwagon – excellent news for individuals who have simply found they need to purchase Bitcoin Hyper in spite of everything..

Hedera’s Liquidity Raise: WBTC Reside, USDC Rising, EU Ramps Opening

In the present day’s bull case for Hedera facilities on recent utility catalysts, enterprise-grade economics, and enhancing fiat/stablecoin rails that may translate into sustained on-chain demand.

Wrapped Bitcoin (WBTC) simply launched on Hedera, piping BTC liquidity into Hedera DeFi and widening collateral choices for lending, buying and selling, and yield – a direct TVL and exercise tailwind if integrations stick.

Secondly, stablecoin momentum is accelerating: USDC provide on Hedera has surged in latest months, and funds/on-ramp tooling retains enhancing, which traditionally correlates with larger transaction counts and stickier liquidity.

As regards to the above, MiCA’s rulebook plus ESMA centralization are accelerating compliant ramps (Aave, Revolut) and shifting exercise towards regulated issuers and venues, making stablecoins a extra credible funds and settlement rail within the EU. Because the stablecoin panorama is changing into extra beneficial, Hedera, with its value of $0.1545, appears like a viable possibility for retail merchants.

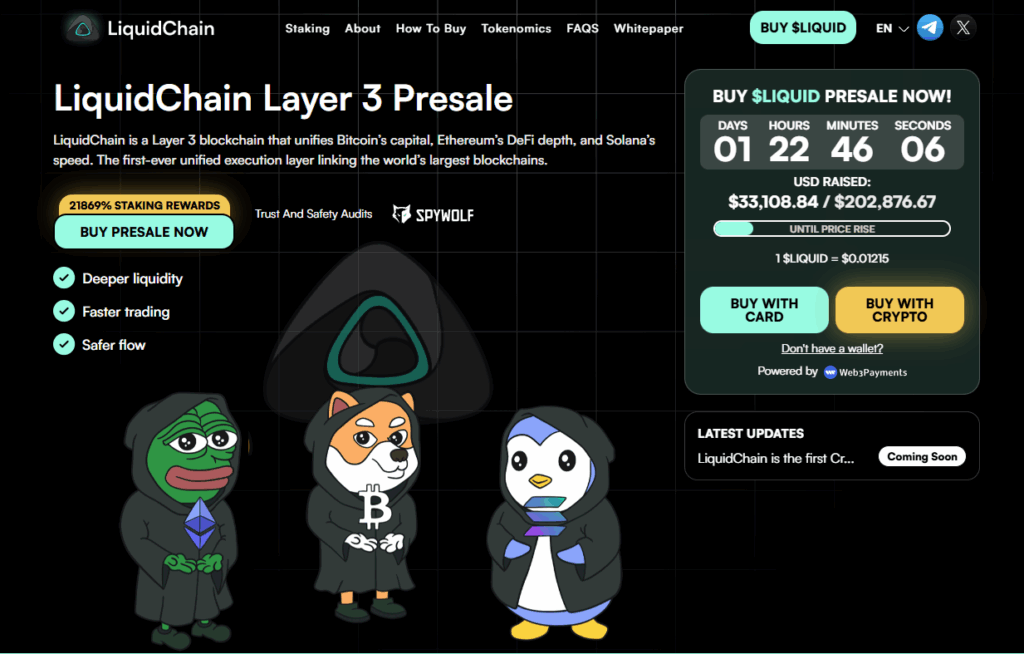

LiquidChain: When Layer 2 Is Not Sufficient, Enter Layer 3

Layer-2 options have hardly made their method to the crypto market, when Layer 3 is already on the go. LiquidChain presents even sooner and cheaper transactions – it poses as a unifying layer that connects main chains and their liquidity.

As such, it’s bridging Bitcoin, Ethereum, and Solana so property and apps can work together throughout what are at the moment siloed ecosystems. It guarantees instant entry to mixed liquidity swimming pools from a number of chains to allow deeper liquidity, sooner execution, and higher pricing for trades and DeFi exercise.

Since this can be a child token – the presale has just lately gone dwell – we’re but to find its full potential. As it’s, our three contenders for as we speak share the same profile: all of them intention at enhancing consumer expertise.

Bitcoin Hyper’s whale-fueled presale momentum, Hedera’s rising liquidity from WBTC and stablecoin rails, and LiquidChain’s cross-chain liquidity imaginative and prescient collectively sign how retail, enterprise, and interoperability narratives are converging, simply because the Czech Nationwide Financial institution’s $1M Bitcoin pilot underscores the shift from idea to institutional experimentation.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, straight or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.