- Ethereum consumers proceed defending the $3,150 accumulation zone, with 2.53M ETH held on this vary and regular absorption signaling sturdy demand.

- Alternate Reserves dropped 9.75% and spot outflows hit $50.9M, reinforcing a bullish accumulation pattern as provide leaves exchanges.

- Binance high merchants sit 73% lengthy, aligning with on-chain energy and supporting the case for a breakout towards $3,659 if ETH exits the descending channel.

Ethereum slipped all the way in which all the way down to about $3,155 after a pointy 10% each day drop, however apparently… consumers haven’t flinched. As a substitute, they hold stepping in across the $3,097–$3,200 accumulation zone, nearly like this space has change into a line within the sand for each retail and whales. And actually, it form of has.

The price-basis heatmap reveals practically 2.53 million ETH sitting proper inside this vary, making it one of many strongest demand pockets on the chart. Every time ETH drops towards this zone, you possibly can actually see merchants absorbing promote stress nearly immediately — a conduct that often solely reveals up throughout high-conviction accumulation phases.

All of this alerts one thing easy however necessary: folks aren’t panic-selling at these ranges. They’re shopping for quietly, ready for a response, perhaps even a breakout, as soon as the market lastly will get its footing once more.

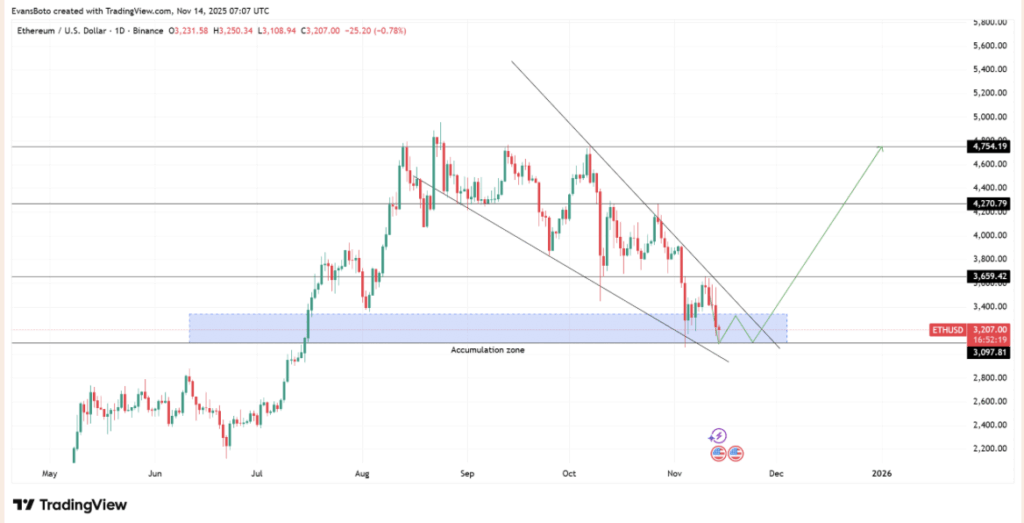

Ethereum Coils Inside a Descending Channel — However Patrons Preserve Catching the Ground

ETH has been caught in a downward-sloping channel for some time now, however the fascinating half is the place the channel’s decrease boundary lands — proper on high of the key accumulation space. Each time value approaches the channel ground, consumers hit the gasoline pedal.

This mixture of structural assist + historic demand is mainly a dream setup for high-conviction merchants. And the chart even reveals a projected breakout path, with $3,659 exhibiting up as the primary apparent upside goal if ETH manages to interrupt out cleanly.

And it’s not some random guess — earlier channel breakouts have triggered sturdy rallies earlier than. Merchants shall be watching intently for the one factor ETH nonetheless wants: rising quantity to gas an actual breakout try.

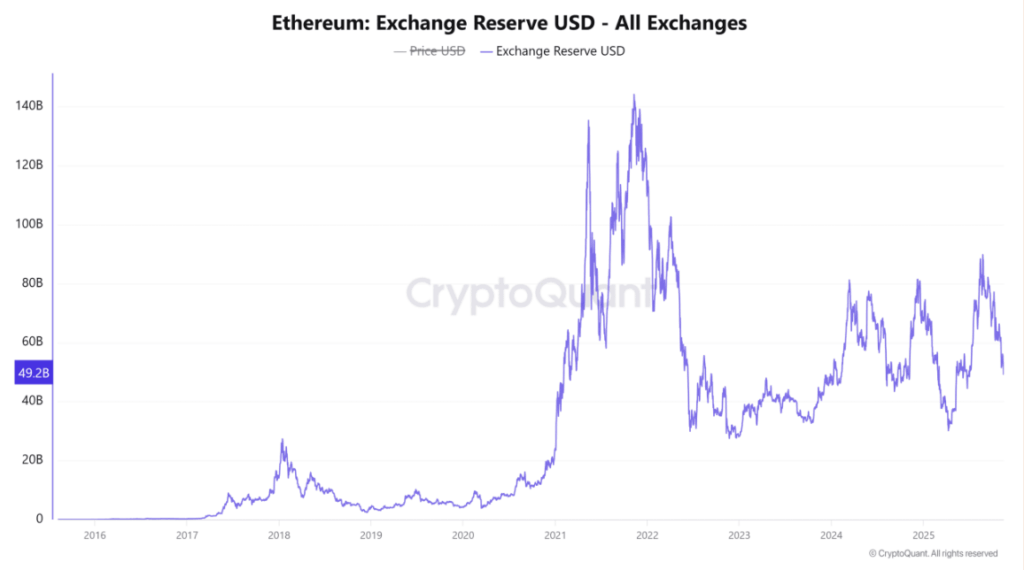

Alternate Reserves Are Dropping Arduous — And That’s Normally Bullish

Now right here’s the place issues actually begin stacking collectively…

Alternate Reserves (in USD) have dropped a large 9.75%, signaling a pointy discount in ETH held on buying and selling platforms. When merchants count on decrease costs, they ship cash to exchanges. Once they count on larger costs, they pull them out.

Proper now? ETH is leaving exchanges quick.

This type of conduct often reveals up throughout accumulation phases — and it amplifies upward stress as a result of much less provide means each purchase order hits more durable. The truth that this pattern traces up completely with the protection of the $3,150 space strengthens your complete bullish argument.

Spot Outflows Hit $50.9M — One other Sturdy Accumulation Sign

Spot move knowledge reveals one other bullish signal: a large $50.91 million outflow in a single session. The chart is actually crammed with purple bars — constant outflows — which counsel that sellers are shedding momentum whereas consumers hold scooping up provide.

This sample is extraordinarily much like previous moments proper earlier than Ethereum recovered sharply. The timing, mixed with the drop in reserves, paints a transparent image: the market is positioning for a rebound as an alternative of a breakdown.

Prime Merchants Are Leaning Closely Lengthy — 73.16% Lengthy vs. 26.84% Brief

Over on Binance, the “top-trader” knowledge reveals an enormous lengthy bias: 73.16% lengthy publicity in comparison with simply 26.84% quick.

This issues lots as a result of these merchants often regulate their publicity earlier than the typical dealer notices something. Once they load up on longs close to a significant demand zone, it’s usually a sign that they count on a bounce, perhaps even a pattern shift.

This long-heavy positioning completely matches every little thing else we’re seeing: shrinking trade reserves, sturdy spot outflows, and a defended accumulation zone.

Last Ideas

Ethereum is flashing energy throughout a number of essential metrics — accumulation zones holding agency, trade reserves dropping, spot outflows rising, and derivatives merchants flipping aggressively lengthy.

Patrons are clearly defending the $3,150 zone with confidence, and if ETH breaks out of the descending channel, the trail towards $3,659 and better turns into very practical.

For now, the market nonetheless wants that clear breakout. However the basis is undeniably bullish, and the stress constructing underneath the floor appears prefer it’s solely getting stronger.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.