- VanEck’s ultimate SEC submitting (Type 8-A) indicators its Solana ETF may launch inside days, marking a significant step for U.S. buyers.

- Solana ETFs have attracted $370M in complete inflows, together with 13 consecutive days of latest investments regardless of market volatility.

- SOL value dipped to $143, however institutional curiosity is climbing with new merchandise like Grayscale’s GSOL choices buying and selling.

Solana ETFs simply obtained a significant increase. VanEck has formally filed its Type 8-A with the U.S. Securities and Trade Fee, which is principally the ultimate inexperienced mild earlier than a brand new monetary product hits the market. In different phrases… the VanEck Solana ETF would possibly start buying and selling any second now

.

VanEck Strikes Into Launch Place

This newest submitting is the final procedural step earlier than an ETF begins buying and selling on U.S. exchanges. It follows VanEck’s up to date S-1 kind from earlier, which revealed a 0.30% administration payment and laid out the fund’s plan to stake Solana (SOL) to generate yield for buyers.

With the Type 8-A now locked in, analysts say the ETF may technically launch at this time — all that’s left is the SEC’s ultimate nod. VanEck’s urgency reveals they’re leaning totally into the rising demand for Solana-based funding merchandise.

Solana ETF Demand Stays Scorching — Even Whereas Costs Drop

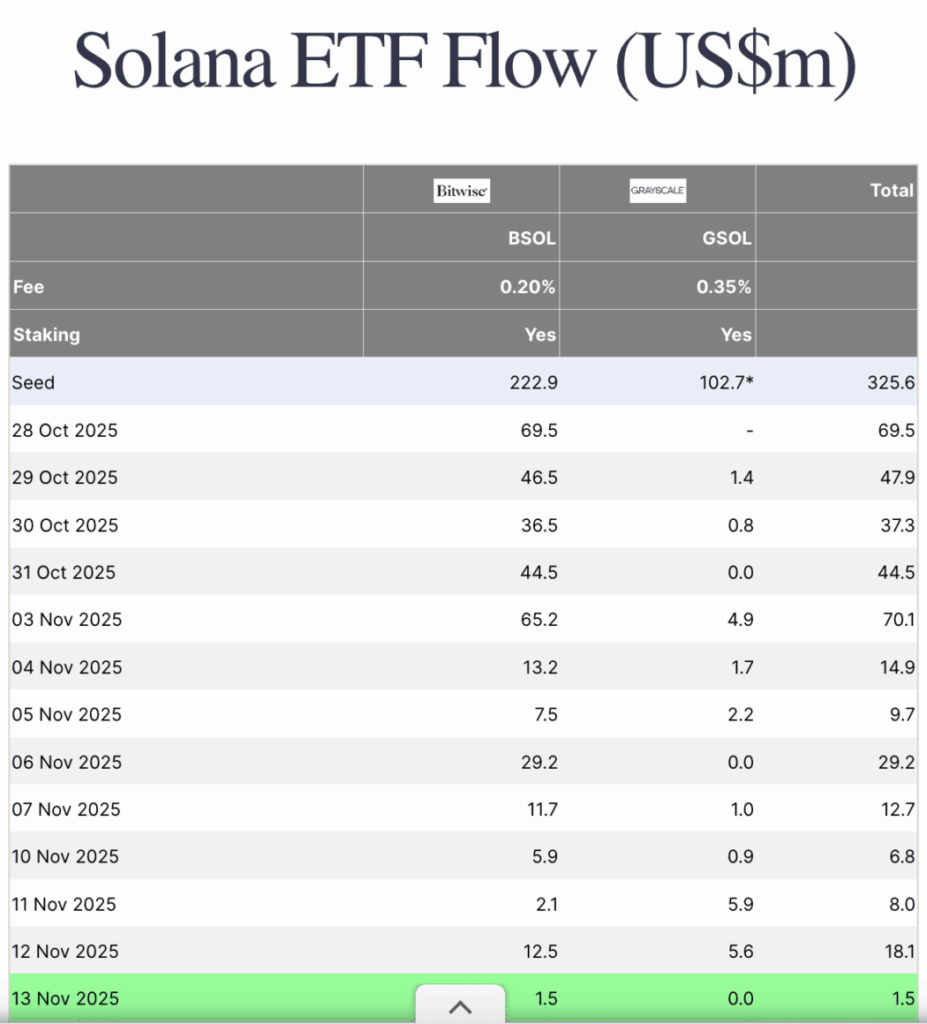

What’s wild is that Solana ETFs proceed seeing inflows regardless of the current market dip. Based on Farside Buyers, Solana funds noticed $1.49 million of latest cash on Thursday alone, marking 13 straight days of inflows.

Since Bitwise launched the very first Solana ETF (BSOL) on October 28, the entire inflows throughout all Solana ETFs have climbed to $370 million. Almost $200 million arrived within the first week of buying and selling.

Nick Ruck from LVRG Analysis known as Solana ETFs a “high-beta complement” to Bitcoin and Ethereum ETFs — which means they’re constructed for sharper upside throughout bullish circumstances (and yeah, sharper draw back throughout corrections).

Grayscale additionally expanded its Solana choices by launching choices buying and selling for GSOL, giving institutional buyers much more instruments to play with. This might push Solana deeper into the institutional highlight.

SOL Worth Dips to $143, However Lengthy-Time period Confidence Holds

Even with all this ETF pleasure, Solana’s value slipped about 6% at this time, touchdown close to $143. Nonetheless, SOL sits comfortably with a $79 billion market cap — an indication that long-term perception within the ecosystem stays sturdy.

If the VanEck ETF formally launches within the coming days, it may carry one other wave of consideration, liquidity, and institutional demand into Solana’s orbit.

The put up VanEck’s Solana ETF Appears to be like Prepared for Takeoff — Ultimate SEC Submitting Clears the Runway first appeared on BlockNews.