In response to remarks made at Yahoo Finance’s Make investments occasion, Eric Trump instructed attendees he expects a significant shift in how cash flows between conventional shops of worth and newer digital belongings.

Associated Studying

He stated Bitcoin’s mounted provide of 21 million cash and rising institutional shopping for are key drivers. In a separate interview with Fox Enterprise in late September, he forecasted a long-term worth goal of $1 million per Bitcoin, a prediction that underscores how bullish his view is.

Bitcoin Seen As A Quicker Mover Of Worth

Eric argued that Bitcoin – which he referred to as the “biggest asset” ever – strikes worth quicker and cheaper throughout borders than steel that should be hauled and locked away.

He referred to as Bitcoin “digital gold,” and pushed the concept its code-based provide offers it a bonus over bodily bullion.

Primarily based on stories, he additionally framed crypto as a hedge towards inflation, corruption, and weak financial coverage — causes he stated clarify rising adoption across the globe.

JUST IN: 🇺🇸 Eric Trump says a gold-to-Bitcoin rotation is imminent

“The ratio will disproportionately shift to Bitcoin.”

“It’s been the one biggest asset we’ve ever seen.” pic.twitter.com/4TYY1qALlm

— Bitcoin Archive (@BitcoinArchive) November 14, 2025

American Bitcoin’s Fast Rise

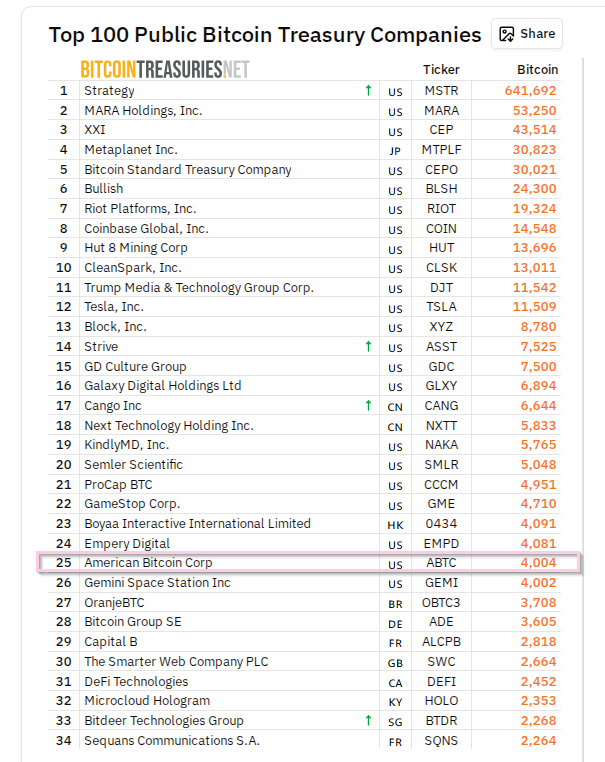

Eric and his brother Donald Trump Jr. co-founded American Bitcoin (ABTC), which went public in September and now carries a market valuation approaching $4 billion.

The agency has expanded shortly after merging with Gryphon Digital Mining. In response to Bitcoin Treasuries, ABTC is the Twenty fifth-largest public firm holder of Bitcoin within the US.

Firm officers say their West Texas mines profit from low vitality prices, permitting them to supply Bitcoin at roughly half of the present spot worth.

Supply: Bitcoin Treasuries

Firm Development And Dangers

Development has been quick, however analysts and critics warn of clear dangers. Mining companies achieve when costs rise, they usually can undergo when costs fall. Some fear {that a} mixed ABTC-Gryphon enterprise faces bigger swings in earnings and asset values as a result of crypto markets stay unstable.

There are additionally issues about mixing political ties with finance; World Liberty Monetary, a Trump family-affiliated challenge, manages a WLFI governance token and a USD1 stablecoin, and a few observers have flagged transparency questions.

A Lengthy Report Versus A Younger Community

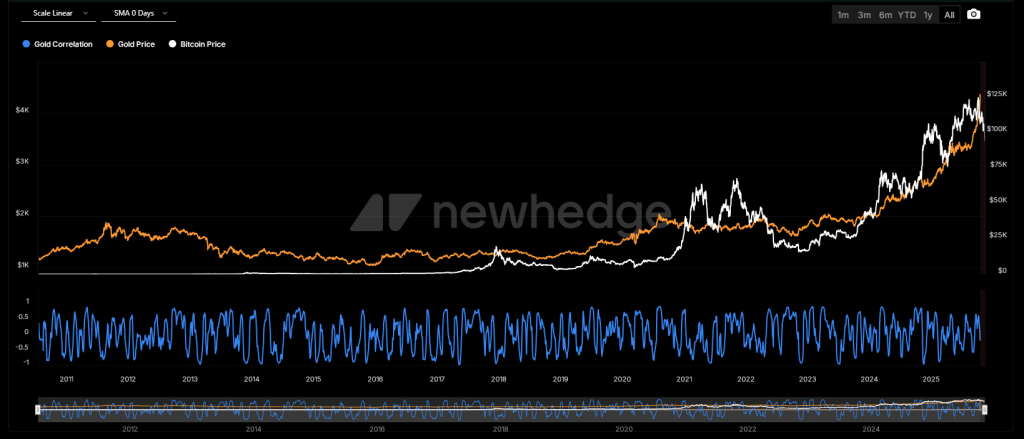

Gold has centuries of use as a retailer of worth and broad international acceptance. Bitcoin has existed since 2009 and reveals speedy worth strikes that may create large winners and massive losers.

Historic information factors to sharp shifts: in the course of the 2017 rally, the Bitcoin-to-gold ratio hit document highs earlier than it fell again when costs corrected. That historical past is commonly used to remind traders that beneficial properties will be adopted by steep pullbacks.

The correlation between the 2 has shifted over time, with every asset responding to completely different market pressures.

Bitcoin and gold correlation. Supply: Newhedge.

What Analysts And Critics Warn

Battle of curiosity is one frequent critique: executives who publicly reward Bitcoin also can profit instantly when their corporations maintain or mine extra cash.

Forecasts that put a single Bitcoin at $1 million are seen by many as speculative fairly than sure. Regulatory adjustments, tax guidelines, and coverage strikes within the US or overseas might change market circumstances shortly, and people prospects are burdened by cautious commentators.

Associated Studying

Eric Trump’s stance is obvious: he believes capital will shift from gold to Bitcoin over time. Markets will resolve if that prediction proves true. For now, each belongings stay a part of the dialog, every with completely different dangers, prices, and histories that traders should weigh.

Featured picture from Alamy, chart from TradingView