- Ethereum held close to $3,200 at the same time as Binance and BlackRock reportedly bought round $1B in ETH, with patrons repeatedly absorbing promote strain at assist.

- Whale exercise spiked, with massive spot orders returning to exchanges and mirroring early 2024-style accumulation phases.

- Key ranges now sit at $3,380 and $3,700 on the upside, whereas a drop beneath $3,146 may ship ETH towards $3,050–$2,900 if promoting resumes.

Ethereum spent a lot of the session hovering across the $3,200 zone, however beneath that quiet floor, the market was completely chaotic. Heavy flows hit main exchanges, with recent whale demand colliding instantly in opposition to aggressive promoting from Binance, BlackRock, and several other market-making desks.

Whale Strikes Slam Into ETH Help — However Patrons Hold Absorbing the Strain

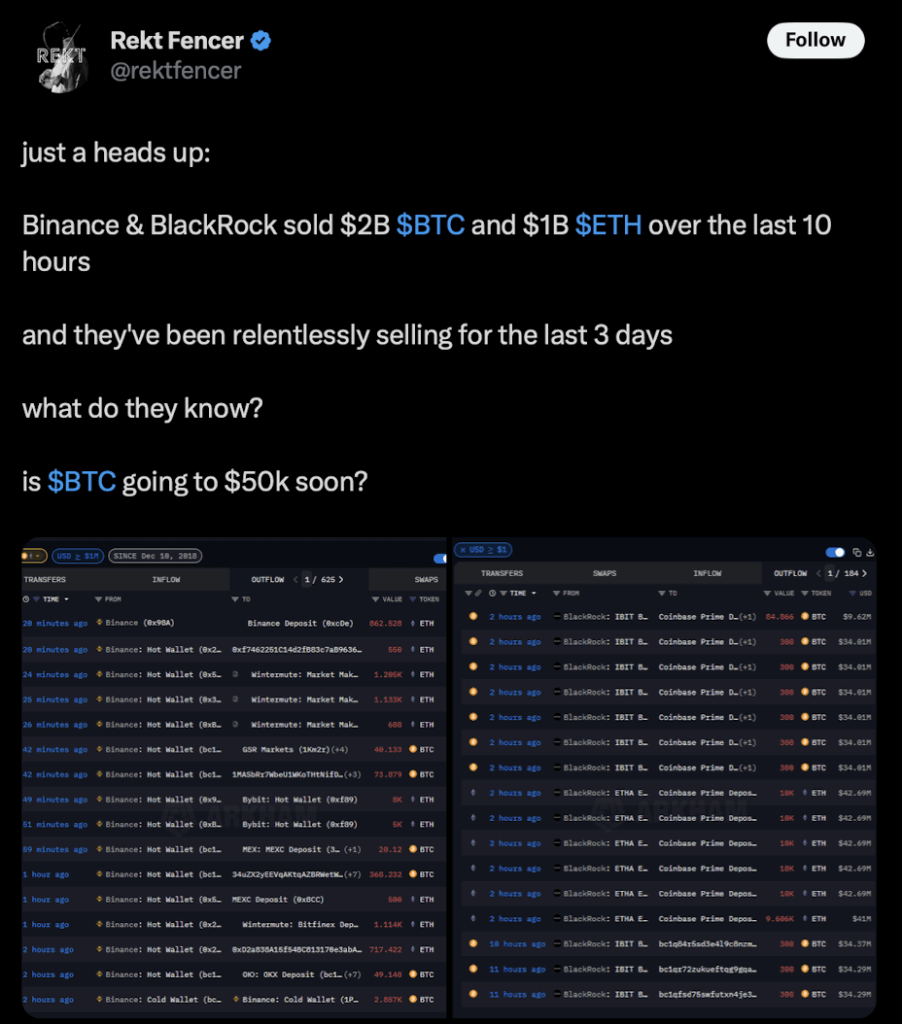

Arkham flagged an extended string of huge ETH transfers leaving Binance’s scorching wallets and shifting into well-known market-maker addresses. These scorching wallets are used for energetic flows — not long-term storage — so seeing a number of transfers above 1,000 ETH every was an enormous sign that critical repositioning was underway.

Tokens have been repeatedly despatched to Wintermute, Bybit, and different settlement accounts, which often occurs when market makers want stock to cite either side of the e-book. In keeping with onchain analyst Rekt Fencer, Binance and BlackRock offloaded roughly $1 billion in ETH in about ten hours — a large quantity of provide to hit the market in such a good window.

He added that each companies had been trimming publicity for 3 days earlier than this transfer. BlackRock’s involvement drew explicit consideration for the reason that agency has turn into a significant participant in ETH flows over the previous 12 months.

What stunned many merchants is that, even with that promoting wave, Ethereum barely cracked beneath its assist zone. Each time worth drifted towards the decrease edge, recent patrons stepped in — absorbing provide the second it hit order books.

On the similar time, Binance stored transport mid-sized batches to OKX and MEXC deposits, suggesting much more sell-side liquidity was lining up. Analysts stated the regular drumbeat of outflows turned ETH’s assist vary right into a battlefield the place whales and establishments stored testing one another.

Huge Spot Orders Return — Whales Quietly Accumulate Once more

CryptoQuant analyst CryptoGoos highlighted one thing completely different taking place on the opposite facet of the tape: unusually massive spot orders began hitting exchanges once more. These weren’t retail trades — they have been the dimensions that sometimes comes from funds and high-net-worth wallets.

His charts confirmed thick clusters of huge buys after a largely silent quarter, with spot orders now matching and even exceeding a few of Binance’s outflows.

This sample strongly resembled the early 2024 accumulation section, when whales purchased quietly throughout a flat, boring vary earlier than the following large transfer.

Spot shopping for additionally means whales needed direct publicity, not futures. No leverage, no funding spikes, no compelled liquidation danger — simply tokens delivered instantly. That’s often the strategy whales take after they assume a worth zone affords a “clear entry” with out extreme draw back noise.

Smaller retail orders barely confirmed up; a lot of the circulate was massive wallets hitting dimension.

Technical Ranges Level to a Coiled Market Earlier than a Volatility Burst

Chart analyst TedPillows mapped out a good construction across the present ETH vary. On the four-hour and each day charts, the primary assist band sat proper round $3,200, the identical space that stored holding regardless of heavy promoting.

He flagged response zones round $3,380 and $3,700 — each areas the place sellers beforehand stepped in and compelled ETH downward. These will probably be the primary ceilings bulls must clear if momentum flips.

On the flip facet, if change promoting intensifies once more, ETH may drift towards the following assist layers at $3,050 and even $2,900, each zones the place patrons stepped in throughout earlier selloffs.

For now, ETH is buying and selling inside a compressed vary, the sort of tight coil that always breaks into sudden volatility as soon as one facet overpowers the opposite. The query is whether or not the following large transfer belongs to the whales shopping for quietly within the shadows — or the establishments unloading provide into the market.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.