- Rumors of a $1B MicroStrategy Bitcoin sale had been false, with analysts confirming the pockets transfers had been inside and never despatched to exchanges.

- Michael Saylor reaffirmed the corporate’s long-term BTC accumulation technique, stating MicroStrategy remains to be shopping for each day regardless of market volatility.

- MSTR inventory is nearing a key help degree across the 200-week SMA as Bitcoin trades beneath $94K, making it extremely delicate to additional BTC value motion.

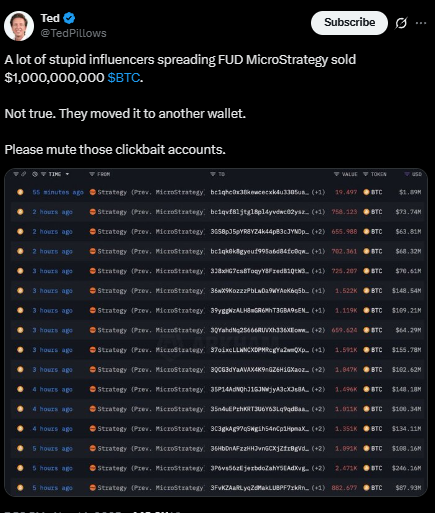

MicroStrategy discovered itself on the middle of contemporary market drama after giant transfers from its Bitcoin wallets triggered hypothesis of an enormous $1 billion BTC sell-off. As quickly as blockchain watchers flagged the actions, social media influencers rushed to border them as proof that the corporate was exiting a good portion of its place. This narrative rapidly fueled concern amongst retail merchants already on edge from Bitcoin’s newest value drop. In actuality, nonetheless, the story was constructed on misreading on-chain information fairly than any confirmed liquidation.

On-Chain Analysts Affirm: No Bitcoin Was Bought

On-chain analyst Ted, generally known as @TedPillows, stepped in to chill issues down and dismantle the rumor. He clarified that the transactions in query had been inside pockets transfers, not flows to exchanges sometimes related to promoting. In keeping with Ted, there was no information backing claims of cash shifting to buying and selling platforms, a key signal that an actual exit was going down. His warning to merchants was easy however essential: confirm pockets exercise and locations as a substitute of amplifying sensational headlines that may distort market sentiment.

Saylor Doubles Down on Bitcoin Accumulation

Amid the noise, MicroStrategy founder Michael Saylor as soon as once more strengthened his long-term Bitcoin technique. In a current televised interview, he acknowledged Bitcoin’s volatility, describing sharp drawdowns as a part of the journey fairly than a cause to desert the asset. He highlighted Bitcoin’s historical past of deep corrections adopted by sturdy recoveries, arguing that its long-run efficiency nonetheless eclipses many conventional investments. Saylor additionally revealed that MicroStrategy has saved shopping for by way of the turbulence, noting on X that the agency “purchased Bitcoin each day this week,” signaling zero intention to decelerate accumulation.

Lengthy-Time period Horizon vs Brief-Time period Panic

Saylor’s message focused buyers shaken by value swings and social media rumor cycles. He pressured that Bitcoin needs to be considered by way of a multiyear lens, not a day-trading timeframe, particularly throughout excessive volatility intervals. His metaphor captured the mindset required: if you wish to journey the rocket, you must be prepared for the G-forces. Regardless of chatter about MicroStrategy’s steadiness sheet threat, his public feedback counsel the corporate is structurally dedicated to BTC, not in search of an exit on the first signal of market stress.

MicroStrategy Inventory Tracks Bitcoin and Approaches Key Assist

Whereas the Bitcoin sale rumor has been debunked, MicroStrategy’s inventory (MSTR) remains to be feeling the strain of BTC’s draw back volatility. With Bitcoin buying and selling beneath the current help space round $94,000, MSTR has drifted towards a essential technical degree on the weekly chart. Analysts watching information from Inventory Dealer Hub word that the inventory is nearing its 200-week easy shifting common, a zone that usually acts as long-term help throughout deep pullbacks. If Bitcoin fails to stabilize, MSTR may retest help close to the $138 space, holding the inventory extremely delicate to each main transfer in BTC’s value.

Market Volatility, Narrative Danger, and What Comes Subsequent

The episode underscores simply how rapidly narratives can spiral when giant on-chain transactions are noticed with out context. Just a few misinterpreted pockets transfers become a full-blown rumor of a billion-dollar sell-off, shaking confidence and including to present volatility. For now, the info and direct statements from each analysts and Saylor level in the other way: MicroStrategy remains to be accumulating, not dumping. As Bitcoin value motion stays uneven and MSTR hovers close to key ranges, merchants will probably be watching each the charts and the wallets intently, hopefully with a extra cautious method to unverified claims.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.