Bitcoin is ending the week on shaky footing, sliding to the mid-$95,000 vary as a cluster of bearish alerts intensifies.

After months of regular upward momentum, a number of key metrics have turned towards the market on the similar time, reinforcing a rising sense of warning amongst merchants.

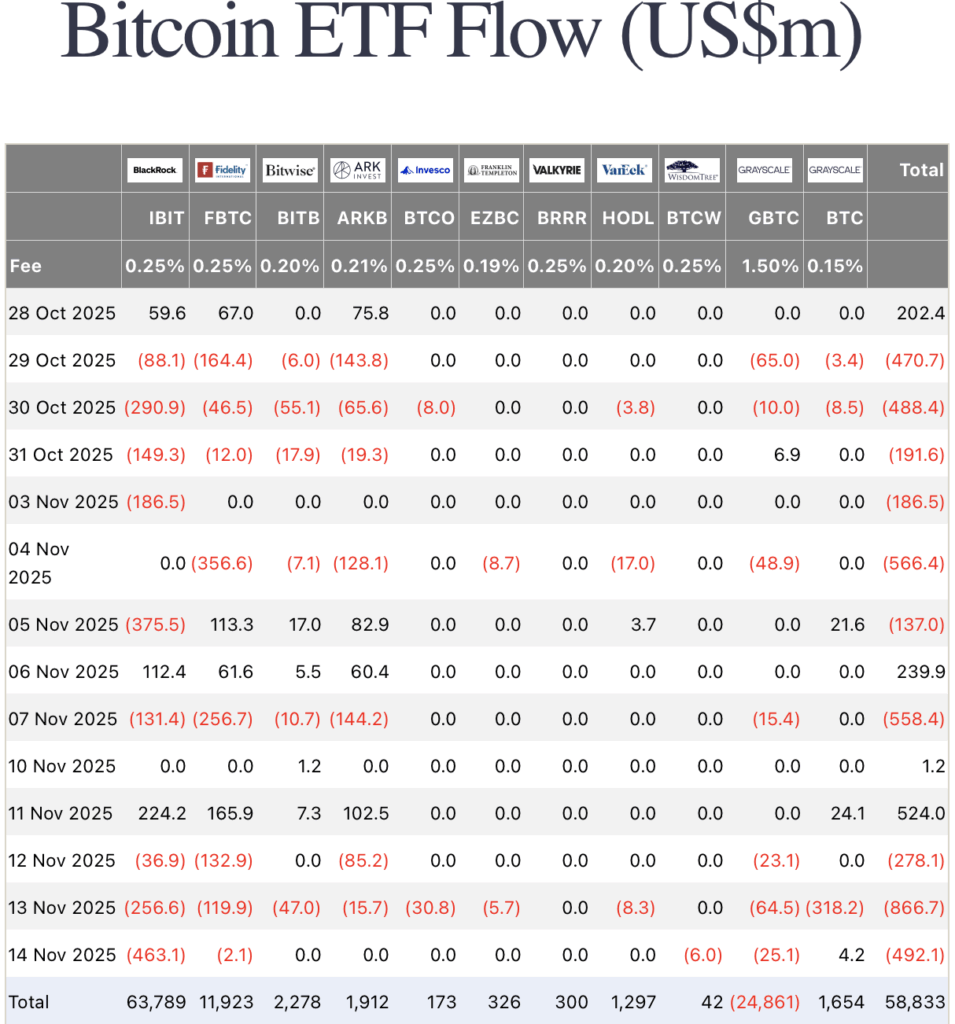

Contemporary analysis signifies that BTC has slipped beneath each its short-term and medium-term shifting averages – ranges which have traditionally acted as early warnings earlier than deeper corrections. The downturn has been magnified by aggressive promoting from massive holders, with whales decreasing positions simply as U.S. spot Bitcoin ETFs started recording a few of their greatest outflows in months. For establishments that had been persistently accumulating by means of a lot of the yr, the shift marks a notable cooling in urge for food.

Macro circumstances are including further weight to the selloff. Bitcoin’s relationship with main fairness indices has tilted unfavorably, with the asset reacting extra sharply to downturns in tech shares than to rallies. This uneven sensitivity has saved volatility elevated, particularly as international equities face renewed strain. Charge-cut expectations and ETF optimism, as soon as sturdy tailwinds, are proving inadequate to counter broader risk-off sentiment.

Buying and selling knowledge reinforces the weak spot. Bitcoin’s break beneath $100,000 has lacked convincing buy-side help, and the most recent makes an attempt at restoration have been shallow. Momentum indicators replicate the identical story: the MACD has plunged deeper into unfavorable territory, the RSI is hovering simply above oversold ranges, and quantity stays subdued outdoors of sharp promote spikes. These patterns counsel consumers are hesitant to step in aggressively, even at decrease costs.

Bitcoin (BTC-USD is beneath the 7-day shifting common -> bearish, and is beneath the 30 day shifting common -> bearish, with 1 week change of -6.7%) slipped beneath the $100,000 mark as massive holders (“whales”) started promoting, marking its worst weekly drop in months.

Outflows from U.S.… pic.twitter.com/wB2mRqDwLW

— 10x Analysis (@10x_Research) November 15, 2025

For the second, Bitcoin’s outlook hinges on whether or not bulls can regular the market within the $95,000 vary. Shedding this space may open the door to a slide towards the low $90Ks, the place thicker liquidity beforehand supported the market. A significant restoration would require a decisive reclaim of the 30-day shifting common, indicators of renewed institutional inflows, and a reversal in whale habits from distribution to accumulation.

Till these circumstances emerge, merchants are bracing for continued turbulence as Bitcoin navigates certainly one of its weakest stretches in current months.