Bitcoin (BTC) has surged practically 100x since Fundstrat really useful it close to $1,000 in 2017, enduring six corrections exceeding 50% and three over 75%. Tom Lee, Fundstrat’s Chief Funding Officer, now factors to Ethereum following an analogous path.

In the meantime, Bitwise CEO Hunter Horsley notes that Bitcoin’s $1.9 trillion market cap stays comparatively small in comparison with the lots of of trillions in world property.

Sponsored

Sponsored

Tom Lee Makes the Case for Bitcoin and Ethereum’s Subsequent Surge

Tom Lee’s expertise with Bitcoin goes again nearly a decade, anchored by Fundstrat’s early name round $1,000.

In accordance with the Fundstrat government, the preliminary place has delivered roughly 100-fold returns regardless of intense corrections that shook investor confidence.

Lee emphasizes that capturing such exponential positive aspects requires enduring what he calls ‘existential moments, that means instances of pessimistic sentiment and main sell-offs.

As of this writing, Bitcoin’s market capitalization was roughly $1.91 trillion. The broader cryptocurrency market reached $3.23 trillion.

But, these numbers are small in comparison with conventional asset courses, highlighting the sturdy development potential trade leaders typically point out.

Lee attributes present weak point in crypto to market makers going through steadiness sheet pressure and compelled gross sales. He argues these are technical, not elementary, challenges inside a large-scale supercycle.

Sponsored

Sponsored

Towards this backdrop, the Fundstrat CIO advises in opposition to leverage, noting it will increase draw back danger during times of excessive volatility.

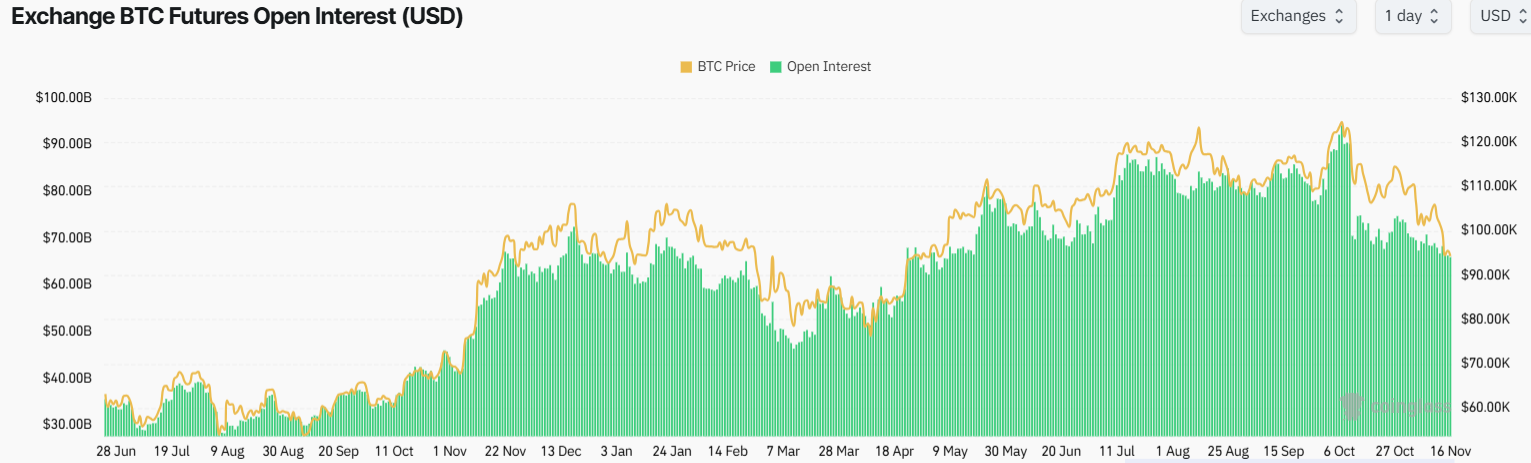

Knowledge on Coinglass reveals that Bitcoin futures Open Curiosity is close to 100,000, indicating new positions are opening and presumably signaling bullish sentiment. Nevertheless, larger Open Curiosity also can sign short-term volatility as merchants react to shifting momentum.

Ethereum’s Supercycle and Volatility

Fundstrat’s outlook shouldn’t be restricted to Bitcoin. The agency believes Ethereum is coming into its personal supercycle, noting that Ethereum’s progress is not going to be linear. Primarily based on this, they advise buyers to count on volatility as the value appreciates in the long run. This development mirrors Bitcoin’s historical past of sharp declines between rallies.

Sponsored

Sponsored

Lee’s level about “stomaching existential moments” is equally related for Ethereum buyers. The asset has skilled its personal vital drops, at instances dropping over 80% from its peaks.

However, buyers who held on had been rewarded with sizeable positive aspects, strengthening the case for affected person capital in high-conviction digital property.

Bitwise’s Horsley Challenges the 4-12 months Cycle Fantasy

Elsewhere, Bitwise CEO Hunter Horsley contextualizes Bitcoin’s potential by evaluating its dimension with conventional markets.

Horsley factors out that Bitcoin’s $1.9 trillion market cap is minimal subsequent to $120 trillion in equities, $140 trillion in mounted revenue, $250 trillion in actual property, and $30 trillion in gold.

Sponsored

Sponsored

Given this context, Bitcoin makes up solely a fraction of investable world property. Even small reallocations from conventional property to crypto may considerably enhance Bitcoin’s valuation.

Because the launch of spot Bitcoin ETFs in early 2024, institutional adoption has elevated, with pension funds, endowments, and company treasuries allocating capital to Bitcoin.

Horsley additionally touches on Bitcoin’s cycle, usually influenced by halving occasions. He argues that pre-2026 promoting may disrupt these patterns, presumably paving the best way for a powerful bullish part in 2026.

12 months-to-date, Bitcoin is up 2.5% for 2025, based on obtainable knowledge, pointing to constructing momentum.

A number of components, together with restricted provide, rising institutional curiosity, and Bitcoin’s tiny share of world wealth, create a powerful funding thesis.

Each Lee and Horsley word that persistence is required, as risky markets can tempt buyers to promote early.