Within the high-velocity world of cryptocurrency exchanges, having deep, dependable liquidity is nothing lower than mission-critical. With out it you threat slippage, fragmented order books, delayed fulfilment, and in the end sad customers. For platforms searching for to maximize buying and selling quantity, partnering with the proper liquidity supplier (LP) could make or break your service.

Beneath we evaluate the seven most compelling liquidity suppliers (LPs) in crypto, highlighting what units every aside — beginning with ChangeNOW, whose B2B infrastructure presents a full suite of companies — after which six different sturdy choices you need to consider.

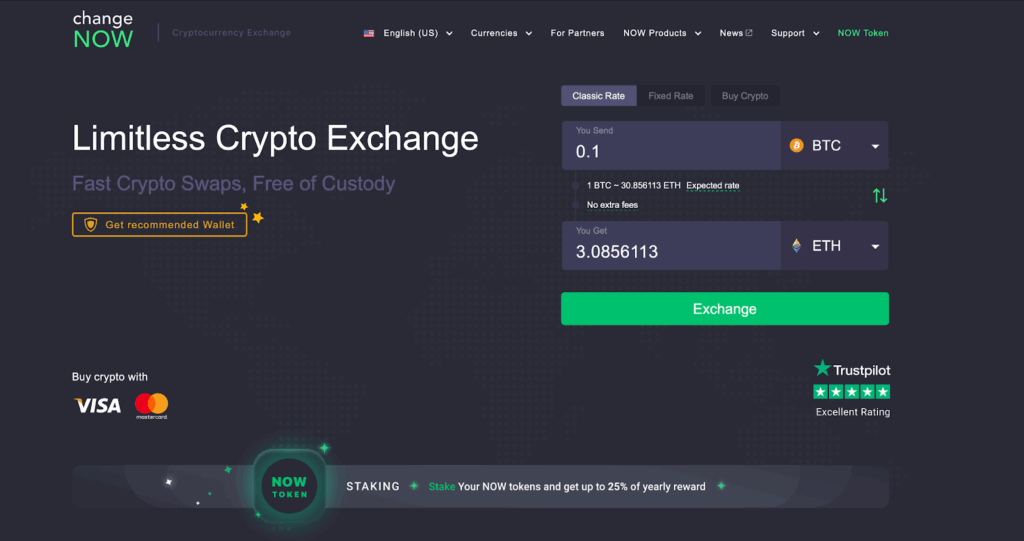

1. ChangeNOW For Enterprise

ChangeNOW.io

Overview & key differentiators:

ChangeNOW For Enterprise positions itself as an all-in-one liquidity and trade infrastructure associate tailor-made for SMEs and enterprises.

Their providing contains crypto funds, trade flows, asset custody, token itemizing, liquidity provision and multichain bridge, with an enormous asset base: over 1,500 cash, 110+ networks, 70+ fiat cash supported and tens of millions of transactions each month.

Their liquidity is sourced from each centralized and decentralized exchanges, enabling cross-chain swaps and a excessive degree of asset flexibility.

Why it issues for buying and selling quantity acceleration:

- The broad asset help means you’ll be able to record and route quite a few token pairs, enabling extra trades and better quantity.

- Fastened-rate + standard-rate trade flows enable for various quoting fashions relying on your enterprise.

- + Licensed with SOC-2 and ISO 27001 requirements; 99.99% availability, ~350 ms response instances — these efficiency metrics are important when high-frequency trades or giant quantity flows are concerned.

- Integration ease (API + widget) and white-label options cut back time-to-market, which suggests you’ll be able to spin up new markets sooner.

Preferrred use-case:

Fintechs, wallets, neobanks or gaming/iGaming platforms that want a turnkey liquidity associate to allow crypto trade flows with out constructing full infrastructure in-house.

2. Binance

What they create:

Binance continues to be the trade with the most important world buying and selling quantity and correspondingly deep liquidity throughout tons of of buying and selling pairs. Its institutional/trade APIs additionally allow associate platforms to faucet into this depth.

Key strengths:

- Huge order-book depth reduces slippage for high-volume trades.

- Broad world protection and plenty of buying and selling pairs, which suggests you’ll be able to service various token markets.

Issues:

Whereas deep and broad, integration might contain managing custody or trade relationships, probably larger regulatory burden relying on area.

3. Cumberland (DRW)

What they create:

A veteran OTC liquidity supplier, Cumberland is thought for dealing with giant‐block trades around-the-clock. It’s usually a go-to for institutional slightly than purely retail flows. (CoinCodex)

Key strengths:

- Potential to execute giant trades with minimized market influence.

- World attain and 24/7 operation means platform continuity.

Preferrred for:

Exchanges or platforms that count on institutional flows, need over-the-counter liquidity alongside commonplace e-book liquidity.

4. GSR Markets

What they create:

GSR is a acknowledged market-maker and liquidity supplier for each exchanges and token tasks. It helps spot, derivatives, and tailor-made liquidity options.

Key strengths:

- Customised help for smaller exchanges or tokens wanting market-making + liquidity depth.

- Expertise throughout each spot and derivatives markets.

Issues:

Might require larger minimums or bespoke phrases relying on undertaking dimension.

5. B2Broker

What they create:

B2Broker specialises in offering multi-asset liquidity (crypto, foreign exchange, commodities) and is standard amongst regulated brokers who additionally want crypto pairs.

Key strengths:

- Multi-asset functionality offers flexibility if platform needs to supply extra than simply crypto.

- Helps crypto CFD brokers and controlled environments.

Preferrred for:

Platforms that mix crypto and conventional property, or regulated brokers integrating crypto pairs.

6. Galaxy Digital

What they create:

Galaxy Digital is a publicly listed firm that gives liquidity throughout spot, futures, choices, and lending/asset-management companies. (margex.com)

Key strengths:

- Institutional-grade infrastructure and broad asset protection.

- Repute and regulatory visibility can reassure companions and counterparties.

Issues:

As a big agency, integration might contain larger operational complexity or counterpart threat.

7. Uniswap (v3 & past)

What they create:

Whereas not a “conventional” liquidity supplier within the centralized-exchange sense, Uniswap’s AMM mannequin (particularly v3’s concentrated liquidity) presents a decentralized route for platforms that need non-custodial or on-chain liquidity choices.

Key strengths:

- Permissionless, broad token protection, and entry to on-chain liquidity.

- Helpful for platforms that need to combine DEX liquidity as a part of their providing.

Issues:

AMM liquidity should contain slippage, and on-chain prices (fuel) can have an effect on execution effectivity in comparison with centralized order-books.

Which LP must you select (and when)?

Selecting the “proper” liquidity supplier is determined by a number of components:

- Buying and selling quantity & dimension of flows: Giant institutional flows demand deep order-books and low slippage (e.g., Cumberland, Galaxy).

- Asset protection & flexibility: For those who record many altcoins or cross-chain pairs, broad protection (e.g., ChangeNOW, Uniswap) turns into important.

- Integration & infrastructure price: APIs, widgets, white-label options matter — ChangeNOW for instance emphasises low-friction integration.

- Regulatory & custody issues: Custodial vs non-custodial fashions, cross-border regulation, threat administration.

- Platform enterprise mannequin: Retail-facing trade vs fintech pockets vs institutional buying and selling desk will form which LP suits greatest.

Closing take-aways

- ChangeNOW For Enterprise leads as a versatile, all-in-one liquidity associate suited to trade platforms wanting speedy market entry with broad asset help and powerful API infrastructure.

- In case your quantity, clientele or institutional profile is giant, you’ll doubtless consider heavy-duty liquidity corporations like Binance, Cumberland or Galaxy.

- For newer or area of interest exchanges specializing in altcoins, derivatives or hybrid property, GSR or B2Broker might present match.

- Don’t low cost decentralized liquidity (Uniswap) in case your mannequin leans on on-chain/p2p flows and also you’re snug with AMM mechanics and on-chain charges.

In abstract: nice liquidity equals extra trades, tighter spreads, decrease slippage, and happier customers — making it a pillar for scaling an trade enterprise. Select correctly, combine neatly, and your platform will likely be well-positioned to seize buying and selling quantity within the aggressive crypto panorama.