XRP confronted intense promoting strain at key help ranges earlier than a dramatic, high-volume V-shaped reversal signaled potential exhaustion of downward momentum.

Information Background

The decline unfolded in opposition to a backdrop of combined institutional indicators and heightened macro uncertainty. Crypto markets stay trapped in a medium-term downtrend, with sentiment pinned within the worry zone as volatility spikes throughout majors.

Canary Capital’s newly launched U.S. spot XRP ETF (XRPC) registered $58.6 million in first-day quantity, far exceeding analyst expectations of $17 million. But the sturdy debut didn’t stabilize XRP, as derivatives markets flashed stress indicators. Roughly $28 million in XRP liquidations hit inside 24 hours, with lengthy positions accounting for practically $25 million of the wipeout.

Market analysts warn that institutional flows stay conflicted—ETF inflows present curiosity, however broader risk-off strain continues suppressing crypto liquidity and momentum.

Worth Motion Abstract

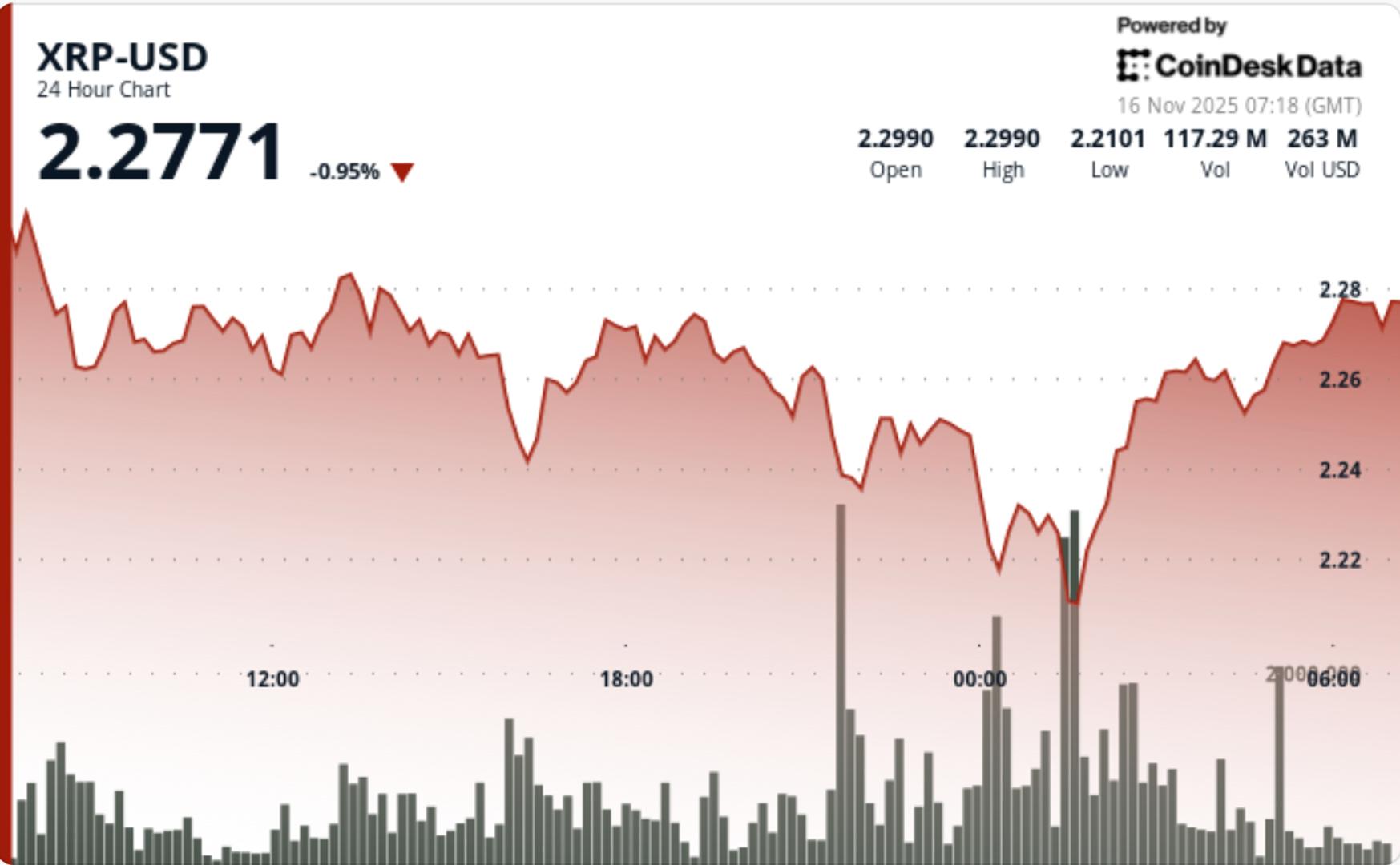

XRP dropped 4.3% from $2.31 to $2.22 in the course of the 24-hour session ending November 16 at 02:00 UTC. The decline carved a $0.10 vary with a transparent sequence of decrease highs confirming bearish construction.

Probably the most aggressive promoting hit at 00:00 UTC, when 74M XRP traded—69% above the 24-hour common—breaking the $2.24 help. Worth slid to $2.22, marking the session low. Three separate quantity spikes above 57M throughout decline phases validated sustained distribution.

Regardless of the ETF catalyst, the selloff accelerated as value rejected $2.31 and failed to search out help close to prior consolidation zones. The pair settled into a good $2.22–$2.23 consolidation after the breakdown.

Technical Evaluation

Assist/Resistance:

- Major help: $2.22 (capitulation low)

- Speedy resistance: $2.23–$2.24 breakdown zone

- Crucial Fibonacci help: $2.16 (0.382 retracement) — lack of this degree dangers swift drop towards $2.02–$1.88

Quantity Profile:

- Breakdown quantity: 74M XRP (+69%) confirming capitulation

- Two reversal-phase spikes (01:39, 01:46): 4.7M every, signaling promoting exhaustion

- Restoration noticed normalized however regular quantity, in step with bottom-fishing curiosity

Chart Construction:

- In a single day value hammered into help, printing a textbook V-shaped reversal

- Greater lows fashioned at $2.209 → $2.217 → $2.227, indicating momentum shift

- Nonetheless, broader downtrend from $2.31 stays intact pending resistance reclaim

- Failure to interrupt $2.23–$2.24 zone limits upside follow-through

Momentum Indicators:

- Intraday oversold situations triggered reversal, however every day pattern bias stays bearish

- 50D/200D construction slopes downward, including overhead strain

What Merchants Ought to Know

XRP sits at a tactical pivot after a dramatic washout:

- Holding $2.22 is essential — failure exposes direct transfer towards $2.16, then $2.02–$1.88

- A confirmed reclaim of $2.24, adopted by $2.31, is required to rebuild bullish construction

- ETF flows will affect volatility — comply with early XRPC quantity at U.S. market open

- The V-shaped rebound offers short-term aid, however main resistance overhead limits rapid upside

- A sustained break above $2.48 is required to shift pattern bias again towards $2.60+ targets