- Bitcoin is sitting on the 61% Fibonacci “golden stage,” a zone merchants watch intently for attainable reversal setups after deep pullbacks.

- Regardless of a small bullish candle, BTC nonetheless holds a bearish construction, with attainable dips towards $88K–$84K and even $77K–$74.5K if promoting continues.

- ETF outflows and profit-taking add stress, however shrinking change reserves trace {that a} restoration bounce remains to be attainable if momentum shifts.

Bitcoin is brushing up towards a kind of ranges merchants obsess over—the 61% Fibonacci retracement, the so-called golden stage that tends to spark reactions whether or not the market’s feeling courageous or scared. After a reasonably shaky couple of weeks full of sharp dips, ETF outflows, and tons of volatility, BTC simply printed a bullish every day candle proper at that golden zone… which has folks questioning if momentum could be attempting to flip, even when just for a breather.

BTC Market Overview: Wild Swings, Large Quantity

BTC spent a lot of the day bouncing between $94K and $97.5K, sort of jittery and not sure of what temper it desires to be in. It’s down almost 7% on the week and about 14% on the month-to-month chart, so momentum positively hasn’t been fairly. However that newest inexperienced candle—small because it was—did catch dealer consideration as a result of bounces off deep retracements aren’t unusual after these steep pullbacks.

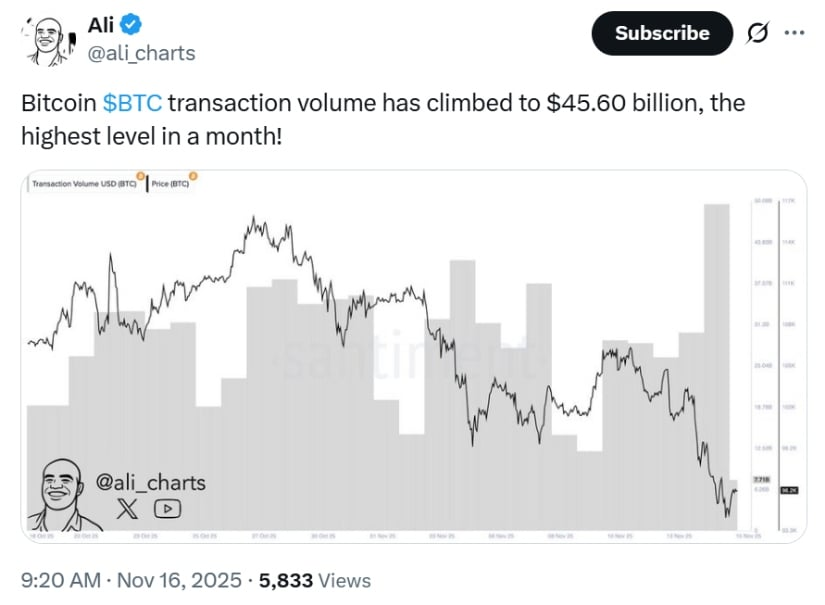

On-chain exercise acquired weirdly busy too. IntoTheBlock knowledge reveals Bitcoin’s transaction quantity hit $45.6 billion on Nov. 15, the very best in a month. Greater than 516,000 BTC moved throughout that window, which alerts… nicely, one thing massive—simply not essentially bullish. Analyst Ali Martinez famous the spikes have recently lined up with worth declines and ETF outflows, that means it appears to be like like profit-taking slightly than accumulation. Nonetheless, quantity is quantity, and markets normally get up round it.

The 61% Fibonacci Zone: A Response Level, Not a Magic Wand

Fibonacci retracements are a kind of instruments merchants love as a result of markets appear to respect them in unusual, virtually poetic methods. The golden stage at 61.8% marks the purpose the place a majority of the earlier rally has been erased, and consumers typically present up right here sniffing for worth.

Technical strategist Ted says this zone acts extra like a psychological choice level: you’ll see consumers defend it to check the waters, whereas short-term merchants bail out to lock in no matter income they nonetheless have. Basically, it’s a stress level—markets hardly ever go via it quietly.

Proper now BTC is sitting proper in that pocket, and yesterday’s bullish candle hints at the potential for a continuation transfer… although nothing assured. That is extra of a “watch intently” space than a “again up the truck” second.

Technical Construction Nonetheless Bearish, With Bounce Potential

Zooming into the every day chart, Bitcoin remains to be in a bearish construction. It printed a decrease low, and the break of construction underneath $98K confirmed fading bullish power. Trendlines have snapped too, which normally alerts the uptrend’s legs are getting drained.

Based mostly on liquidity mapping, BTC might drift towards deeper zones like $88K–$84K if sellers keep aggressive. In a extra aggressive flush state of affairs, the chart even factors towards the $77K–$74.5K area the place historic liquidity clusters sit. These aren’t predictions—simply zones merchants watch as a result of liquidity tends to tug worth round like gravity.

However, flip facet? A retest of previous trendlines might push BTC again towards $98K–$100K if momentum companies up a bit. Analysts say the likelihood for that’s reasonable however not but convincing as a result of quantity patterns nonetheless lean defensive.

Sentiment Break up as ETF Outflows Add Strain

Institutional flows haven’t been pleasant this week. U.S. spot Bitcoin ETFs logged greater than $1B in outflows, with BlackRock alone seeing $532M pulled. Ted and others word that these outflows can contribute to promoting stress, particularly when mixed with heavy transaction spikes.

On the identical time, change reserves hold shrinking to multi-month lows—that means fewer cash are sitting on exchanges able to be bought. Lengthy-term holders are tightening provide, which is normally a superb signal for the macro image, even when the short-term feels tough.

Quick-Time period Bitcoin Predictions: Bounce or Breakdown?

Some merchants suppose Bitcoin might need discovered a short lived ground round $94K, particularly with the golden ratio lining up proper right here. Others imagine the structural breakdown hints at extra ache earlier than reduction, doubtlessly towards $74K if volatility kicks up once more.

Analyst Maxwell Mutuma factors to CME gaps close to $92K and lingering Wyckoff distribution indicators—each of which recommend the market may need yet one more sweep down earlier than an actual reversal can stick.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.