The crypto market opened the week deep within the purple, with a wave of promoting stress hitting practically each main asset.

In accordance with the most recent market information, complete crypto market capitalization has slipped to $3.14 trillion, down 1.74% on the day, whereas sentiment has cratered to one among its lowest readings of the 12 months.

The Worry & Greed Index has collapsed to 17, signaling “Excessive Worry”, as merchants pull liquidity from threat markets and brace for additional draw back. The industry-wide RSI additionally sits at 37.82, firmly in oversold territory, reflecting heavy capitulation throughout main pairs.

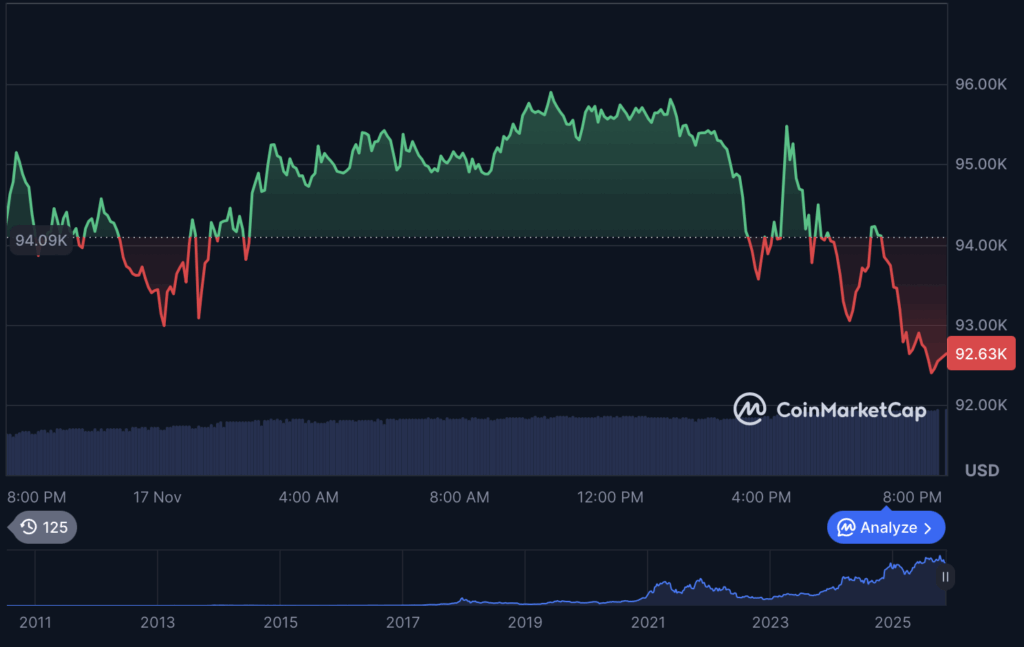

Bitcoin Falls Towards Key Help

Bitcoin is main the downturn, sliding to $92,861, down over 12% on the week. The drop has erased most of November’s positive factors and pushed BTC dangerously near a crucial help area below $92K. Regardless of buying and selling quantity above $87 billion previously 24 hours, patrons are struggling to soak up the regular wave of promote orders.

Onchain metrics present Bitcoin’s circulating provide at 19.95 million BTC, however the present downturn has overshadowed the milestone as panic promoting grows.

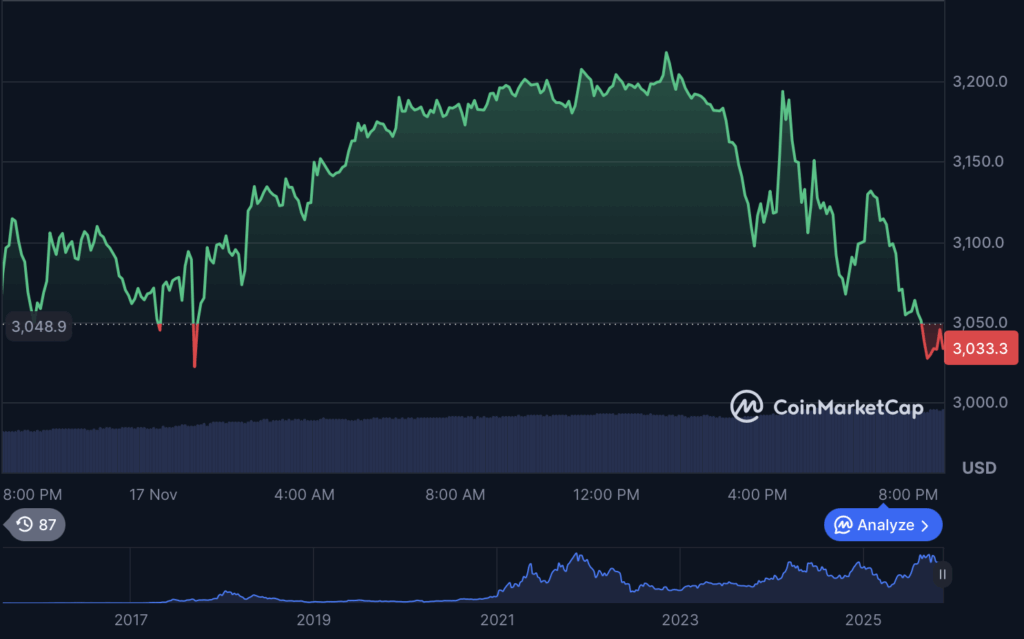

Ethereum and Altcoins Hit Even More durable

Ethereum can also be below heavy stress, falling to $3,045 after a 14.33% weekly decline. With volumes topping $38 billion, ETH has adopted Bitcoin’s trajectory however with even sharper intraday swings.

Different majors are seeing comparable or worse harm:

- Solana (SOL) has dropped to $131, bleeding 21.25% in seven days.

- XRP is at $2.16, dropping over 15% this week.

- BNB slipped to $910, down 7.66% over the identical interval.

- TRON (TRX) stays one of many few property holding comparatively steady, displaying solely minor weekly losses.

Stablecoins similar to USDT and USDC stay anchored close to $1 regardless of the turbulence, with USDT recording $147B in every day buying and selling quantity – an indication of heavy capital rotation and defensive positioning.

Market Nonetheless Trying to find a Backside

Altcoin season indicators present a studying of 31/100, suggesting Bitcoin is outperforming a lot of the market even because it declines. Analysts warn that this dynamic typically seems throughout late phases of downturns, when capital concentrates into BTC earlier than broader restoration makes an attempt.

With concern at excessive ranges, RSI oversold throughout the board, and liquidity draining from high-beta property, merchants are anticipating stability indicators from macro markets and ETF movement information.

For now, all the crypto sector stays on edge – and volatility seems removed from over.