Be part of Our Telegram channel to remain updated on breaking information protection

Ethereum is starting the identical “supercycle” that despatched Bitcoin hovering 100x, in accordance with BitMine Chairman Tom Lee.

However Lee, who additionally a co-founder of Fundstrat World Advisors, mentioned the trail greater for Ethereum shall be unstable and urged his 559.8k followers on X to “HODL.”

“The primary takeaway from Bitcoin’s run is that to learn from a 100X cycle, you needed to abdomen existential actions to HODL,” Lee mentioned, including that “crypto costs are discounting an enormous future,” and that ”doubts create volatility.”

He mentioned that since he first beneficial Bitcoin to traders 8.5 years in the past, BTC has seen 9 substantial worth drops, six of them with declines of greater than 50% and three of greater than 75%.

Bitcoin is a unstable asset.

We first beneficial Bitcoin to Fundstrat shoppers in 2017 (1%-2% allocation)

– Bitcoin 2017 ~$1,000Since then (previous 8.5 years), $BTC:

– 6 declines > -50%

– 3 declines > – 75%2025, Bitcoin 100x from our first advice

TAKEAWAY:

To have… pic.twitter.com/xtIRGLdnWM— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) November 16, 2025

Lee’s feedback come at a troublesome time for ETH, which has plummeted 11% up to now week and greater than 19% within the final month. CoinMarketCap knowledge exhibits it’s down 1.2% up to now 24 hours to commerce at $3,127 as of 10:34 a.m. EST.

BitMine Reportedly Buys The ETH Dip

BitMine is the biggest company holder of ETH and it seems to be backing Lee’s phrases with motion by shopping for the dip.

Citing on-chain knowledge from Arkham Intelligence, the X account Whale Insider mentioned yesterday that the agency purchased one other 67,021 ETH for $234.47 million from Galaxy Digital, FalconX, and Coinbase.

JUST IN: Up to now week, Bitmine Immersion purchased one other 67,021 $ETH ($234.47 million) from Galaxy Digital, FalconX and Coinbase – Arkham. pic.twitter.com/d7ipQYHykx

— Whale Insider (@WhaleInsider) November 16, 2025

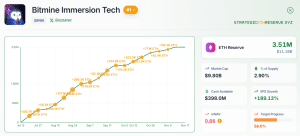

In line with knowledge from StrategicETHReserve, BitMine holds 3.51 million ETH on its stability sheet valued at roughly $11.16 billion.

BitMine ETH holdings overview (Supply: StrategicETHReserve)

BitMine says its purpose is to accumulate 5% of ETH’s whole provide as a part of its “Alchemy of 5%” technique, and the agency is already midway there.

The StrategicETHReserve knowledge exhibits that BitMine presently holds round 2.90% of the altcoin’s provide, which is 58% of its goal.

Lengthy Time period Accumulators’ ETH Balances Have Grown

Amid the ETH worth drop, CryptoQuant contributor Burak Kesmeci mentioned in a latest observe that long-term ETH holders have “chosen accumulation over panic” this yr.

The analyst mentioned that round 17 million ETH has flown into “accumulation addresses” to date in 2025.

Kesmeci additionally mentioned that the altcoin is simply 8% away from touching the “accumulation realized worth degree,” which “represents the typical price foundation of long-term accumulators.”

The analyst mentioned that in its complete historical past, ETH has solely dropped beneath that degree as soon as. This was throughout the April 2025 Trump tax-tariff disaster, which the analyst mentioned was “one of many highest worry durations in trendy market historical past.”

“Traditionally, this zone has been one of many strongest long-term accumulation alternatives in Ethereum’s market construction,” the CryptoQuant contributor wrote. “My private view: Even when ETH briefly dips beneath $2,900, it’s unlikely to remain there for lengthy.”

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection