- ETH is down practically 20% in November, revisiting the $3,000 help zone.

- The Mayer A number of dropped under 1, traditionally marking robust accumulation phases.

- Liquidity information reveals deeper long-liquidation pockets under $3,000, hinting at attainable additional draw back earlier than a backside varieties.

Ethereum’s native token has slipped practically 20% in November, dropping from $3,900 to retest the $3,000 stage for the primary time since mid-July. The transfer confirms a pointy day by day downtrend outlined by decrease highs and decrease lows, inserting ETH in a fragile short-term construction regardless of rising indicators of long-term accumulation. With merchants rising uneasy concerning the broader market slide, the most recent worth motion has break up sentiment between concern and cautious optimism.

Mayer A number of Drops Under 1 — ETH Reenters the Historic “Purchase Zone”

One of many strongest long-term alerts is coming from Capriole Investments’ Mayer A number of (MM), a metric evaluating ETH’s worth to its 200-day shifting common. A studying under 1 means ETH is buying and selling at a reduction to its long-term pattern — a stage traditionally related to main accumulation home windows.

ETH’s MM is under 1 for the primary time since June, placing the asset again into what has typically been a precursor to multi-month recoveries. Exterior of the 2022 bear-market collapse, sub-1 readings have reliably aligned with early-cycle resets quite than long-term breakdowns. With MM removed from the overheated 2.4+ distribution zone, long-cycle positioning nonetheless leans bullish.

Liquidity Flushes Counsel ETH Might Not Have Bottomed But

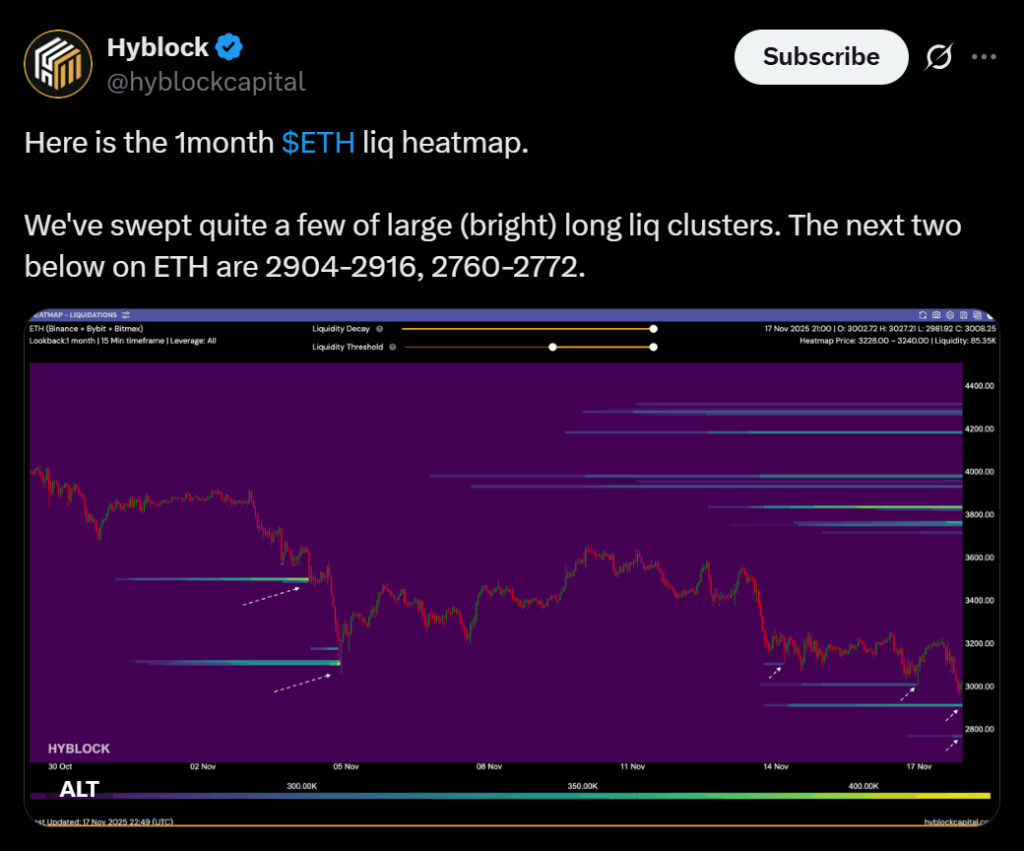

Quick-term construction stays weak. Hyblock Capital information reveals ETH swept main long-liquidation ranges at $3,000 however nonetheless hovers above dense clusters between $2,904–$2,916 and $2,760–$2,772. Markets typically transfer towards these liquidity pockets earlier than forming sturdy reversals.

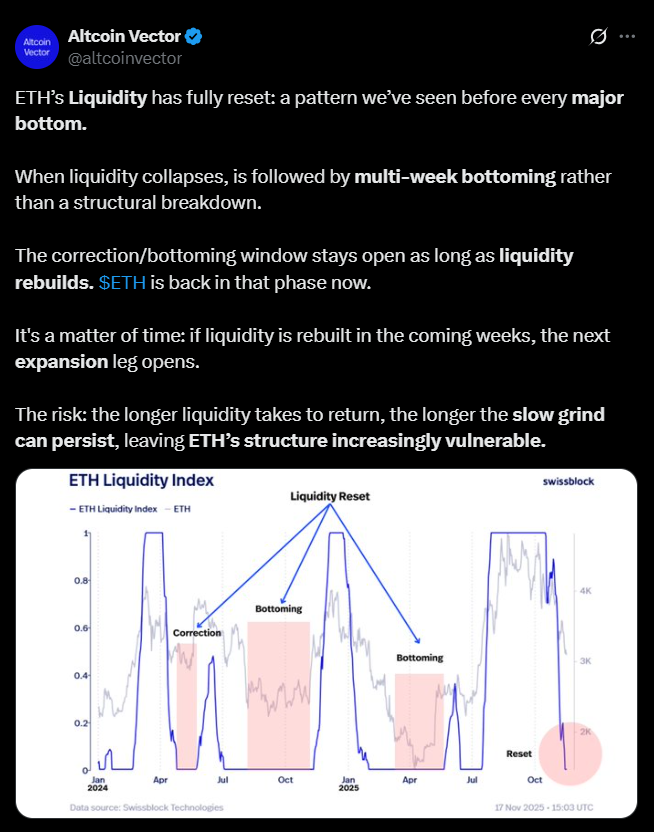

Altcoin Vector additionally famous that Ethereum’s liquidity construction has “totally reset,” a situation traditionally current earlier than each main backside. These resets usually unfold over a number of weeks, suggesting any sustained restoration will take time to develop — and that ETH could dip deeper earlier than momentum turns again up.

A Reset, Not a Collapse — If Liquidity Rebuilds Quickly

The broader image factors towards reset circumstances quite than structural decay. If liquidity begins returning throughout the subsequent a number of weeks, ETH could provoke its subsequent enlargement section. But when liquidity stays skinny for too lengthy, the correction window widens — exposing the market to additional draw back volatility. For now, Ethereum sits in a uncommon intersection: short-term fragility however long-term alternative.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.