Let’s not sugarcoat it – the crypto charts are ugly proper now. Bitcoin’s slide from its October excessive has dragged the complete market down, however Ethereum (ETH) appears to be taking the hit more durable than most. We’ve watched the second-largest crypto asset shed almost 40% of its worth from its summer time peak.

Over $20 billion in leveraged positions was worn out lately, forcing a cascade of promoting that crushed open curiosity. Once you mix that with liquidity freezing up and spot ETFs seeing extra redemptions than inflows, there hasn’t been sufficient new capital to halt the slide.

However we’ve seemed on the market construction – and our Ethereum worth prediction means that whereas the ache isn’t fairly over, the underside is loads nearer than it appears. The information factors to a possible liquidity seize beneath the $3,000 stage, which might set the stage for an ETH rally again to $4,000.

Not everybody’s ready round for ETH to backside, although. Loads of merchants are rotating into lower-cap tasks that might run even more durable. One which’s getting a number of consideration proper now could be PEPENODE (PEPENODE), which is growing a brand new “Mine-to-Earn” recreation.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Ethereum Value Prediction – Why ETH May Dip Beneath $3K Earlier than Rallying

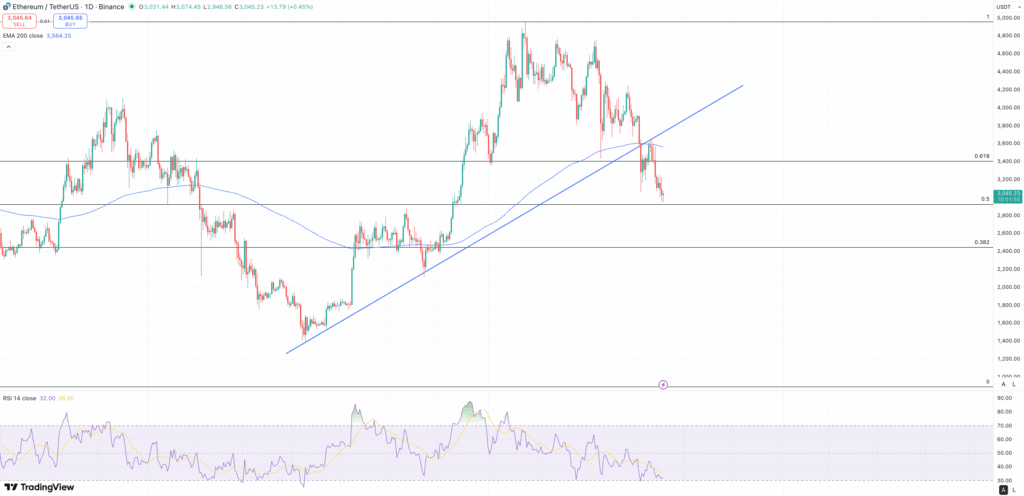

Ethereum has misplaced an enormous multi-month ascending trendline that dates again to April’s low. Once you break a trendline that vital, you hardly ever simply V-shape again up instantly. As an alternative, worth retests the breakdown stage to verify it as resistance – which is what we’re seeing play out.

The every day chart isn’t providing any aid both, with decrease highs and decrease lows nicely beneath the 200-day EMA. Plus, the RSI is now hovering simply above oversold, which is a harmful spot. It typically comes earlier than an “acceleration section” – one remaining flush to wreck the final batch of longs earlier than a reversal.

If Ethereum drops beneath $3,000, the $2,800-$2,900 zone will likely be an vital one to observe. It’s a high-volume node from earlier this yr, and contours up completely with the 0.618 Fibonacci retracement of the complete bull leg. That could be a clear demand zone.

Tagging that zone may set off violent imply reversion – merchants typically visualize it as a rubber band snapping again. That’s why a clear bounce from $2,800 or $2,900 places a transfer again to $4,000 on the desk for Ethereum.

Ethereum’s Fundamentals Align for a Reversal

Ethereum’s Fusaka improve hits mainnet on December 3 – simply weeks away. This improve expands future blob capability with PeerDAS and successfully drives Layer-2 charges towards zero. Traditionally, main upgrades mark native bottoms for ETH.

Plus, the timing couldn’t be higher for establishments. Institutional ETF inflows have been minimal above $4,000 ETH, as huge gamers have a tendency to not chase highs. So, a dip beneath $3,000 provides them the entry they’ve been ready for, mirroring the Bitcoin ETF accumulation we noticed in 2024.

December’s Fusaka improve is a serious step in Ethereum’s roadmap.

It is proof that Ethereum can evolve responsibly, scaling to satisfy international demand with out compromising decentralization.

Learn the way Fusaka will unlock the following wave of progress: https://t.co/3TOda5KjY2 pic.twitter.com/jjckxKB28H

— Ethereum (@ethereum) November 12, 2025

The availability facet of ETH can be extremely tight. Over 35% of all ETH is now staked and locked, leaving the liquid float – the cash truly available for purchase – decrease than ever. The sell-side liquidity merely isn’t there to help a longer-term bear development.

This creates an thrilling situation. Any demand shock – like a bigger Fed charge reduce than anticipated – will hit a market with no provide to offer. When that occurs, Ethereum’s repricing may very well be explosive.

Might PEPENODE Supply Greater Returns Than ETH? New Mine-to-Earn Challenge Raises $2.1M

All that mentioned, for many who don’t need to wait weeks for an Ethereum rebound, PEPENODE (PEPENODE) may very well be a viable different. It solves a particular boredom drawback in crypto: as an alternative of shopping for a token and simply passively holding, you’ll be able to truly do one thing with it.

PEPENODE successfully turns the advanced (and costly) world of crypto mining right into a browser-based technique recreation. You be a part of the presale to purchase PEPENODE tokens, which you need to use after the sport goes dwell to construct and improve digital “Miner Nodes” in a digital facility.

The gameplay loop is easy: higher nodes equal larger hashrates, and better hashrates imply extra crypto rewards. These rewards are paid out in PEPENODE and different established meme cash, like FARTCOIN and PEPE.

To date, PEPENODE’s presale has raised $2.1 million, with the present token worth sitting at $0.0011546. For yield hunters, there’s additionally a staking protocol providing an APY of 595%. That’s an incentive to lock up provide early.

And there’s even a deflationary mechanic. Each time a consumer upgrades their digital mining rig, they burn PEPENODE tokens – making a system by which gameplay instantly helps the token worth. So, if holding by an ETH dip beneath $3,000 looks as if a troublesome problem, tasks like PEPENODE may ship the sort of upside that Ethereum can’t.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.