Be part of Our Telegram channel to remain updated on breaking information protection

Main Bitcoin treasury agency Technique has 174% upside potential and nonetheless presents traders with a horny choice to achieve Bitcoin publicity, says funding financial institution TD Cowen.

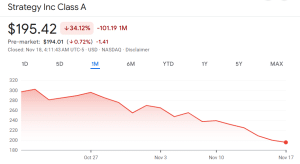

It maintained a $535 worth goal even after MSTR plunged greater than 34% and Bitcoin 15.5% previously month, arguing the drawdown displays market volatility slightly than a breakdown within the agency’s BTC accumulation mannequin.

MSTR share worth (Supply: Google Finance)

”Technique stays a horny car for these trying to create Bitcoin publicity,” stated analysts Lance Vitanza and Jonathan Navarrete.

MSTR is down greater than 52% previously six months whereas Bitcoin has tumbled greater than 27% from the all-time excessive (ATH) of $126,841.89 that it set on Oct. 6, 2025, in line with CoinMarketCap information.

Amid the drops, Technique’s Market Web Asset Worth (mNAV), which is the worth of the corporate’s whole market cap to the worth of its holdings, had dipped beneath 1. Nevertheless it has since recovered and at the moment stands at 1.21, in line with Technique’s web site.

Schiff Says Technique’s Enterprise Mannequin A “Fraud,” Challenges Saylor To A Debate

Whereas TD Cowen analysts preserve their bullish outlook on Technique, gold advocate and BTC critic Peter Schiff stated on Nov. 17 that Technique is a ”fraud.”

“MSTR’s enterprise mannequin depends on income-oriented funds shopping for its ‘high-yield’ most well-liked shares,” he wrote on X.

MSTR’s enterprise mannequin depends on income-oriented funds shopping for its “high-yield” most well-liked shares. However these printed yields won’t ever truly be paid. As soon as fund managers notice this they’ll dump the preferreds & $MSTR received’t have the ability to difficulty any extra, setting off a dying spiral.

— Peter Schiff (@PeterSchiff) November 16, 2025

“However these printed yields won’t ever truly be paid. As soon as fund managers notice this they’ll dump the preferreds & $MSTR received’t have the ability to difficulty any extra, setting off a dying spiral,” Schiff added.

Schiff challenged Saylor to a debate throughout Binance Blockchain Week in Dubai in December at which each are scheduled to attend. Saylor has not replied.

Technique Continues Bitcoin Accumulation In Market Downturn

Technique began shopping for Bitcoin in 2020 and has turn out to be the biggest company BTC holder globally, with 649,870 BTC on its stability sheet, information from Bitcoin Treasuries exhibits.

The corporate’s most up-to-date buy was introduced yesterday, when Technique’s founder Michael Saylor stated in submit on X that the agency purchased 8,178 BTC for roughly $835.6 million at a median worth of $102,171 per Bitcoin.

Technique has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK https://t.co/HI1TeYOvQ9

— Michael Saylor (@saylor) November 17, 2025

The newest buy was made utilizing proceeds from at-the-market gross sales of the corporate’s perpetual Strike most well-liked inventory (STRK), perpetual Strife most well-liked inventory (STRF), and perpetual Stretch most well-liked inventory (STRC). The corporate additionally used proceeds from its recently-unveiled, euro-denominated most well-liked inventory (STRE).

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection