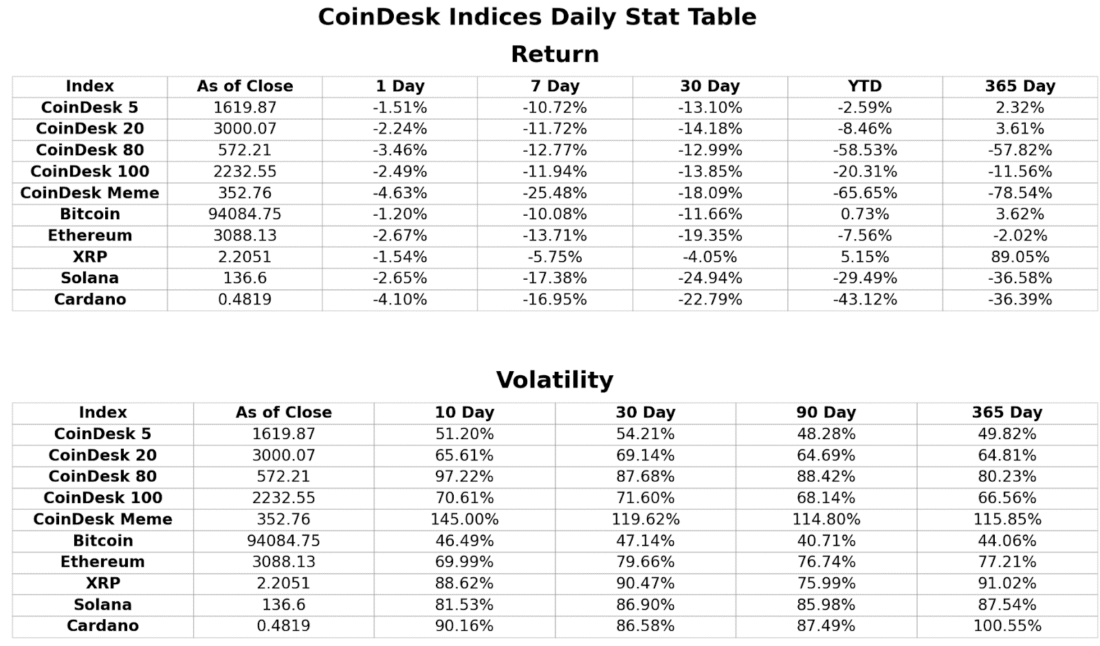

Within the final one year, XRP elevated 89 %, in comparison with BTC, ETH, and CoinDesk 20 Index (CD20). The investor curiosity in its future has been triggered by regulatory victories and new ETFs.

XRP has been within the headlines with an 89 % return final 12 months, whereas large crypto equivalent to Bitcoin (BTC), Ethereum (ETH), and the CoinDesk 20 Index (CD20) have little or adverse returns.

It is a distinctive efficiency that would depart XRP as the one main token with a powerful constructive momentum in a low-energy market in CoinDesk knowledge.

In distinction to BTC and ETH, which barely reached single-digit development by 3.6% and three.6% respectively, the XRP enhance is supported by vital advances.

The brand new settlement of the SEC lawsuit towards Ripple eliminates a big regulatory barrier within the U.S. that clears the best way in direction of better institutional adoption and mainstream utilization in funds.

Ripple’s Rising Edge Sparks Curiosity

The rise of XRP can also be pegged on technical developments, together with the introduction of XRPL EVM sidechain and the discharge of the Ripple RLUSD stablecoin that swiftly reached a market valuation of greater than a billion {dollars}.

Strategic collaborations in main markets, such because the Center East, have enhanced the standing of Ripple, making XRP extra enticing than funds to decentralized finance (DeFi).

The launch of the Canary Capital spot XRP ETF within the U.S. has elevated investor pleasure and ranks as the most important day one quantity of any ETF this 12 months.

The ETF is seen as an entry level to institutional capital getting into XRP, accessing the $100 trillion of conventional finance getting into the blockchain.

XRP stands out on one year as BTC, ETH, and different indices lag. (CoinDesk Indices)

Though XRP turns into extra unstable than BTC, specialists imagine that long-term, fixed funding by establishments would remove the heavy swings within the worth and hold the bullish development afloat.

Associated Studying: XRP Information: XRP Whales Dump 200 Million Cash -Crash Incoming?

Bitcoin, Ethereum, and Different Cryptos Lag.

As XRP elevated by 89, Bitcoin and Ethereum barely rose by 3.6%. Different tokens, equivalent to Solana and Cardano, incurred losses of over 36%.

The CoinDesk Meme Index fared the worst, falling 78 %, which indicated stress in additional dangerous crypto property.

XRP is 36 % off its latest all-time excessive however is performing properly as the one massive crypto with constructive year-to-year returns, which suggests a powerful potential to resist the tumultuous market.