Coinbase to launch a regulated prediction markets platform with Kalshi, and is giving customers event-based buying and selling throughout a number of sectors.

Coinbase is increasing once more. The corporate is growing a prediction markets platform that can supply event-based buying and selling throughout a number of sectors.

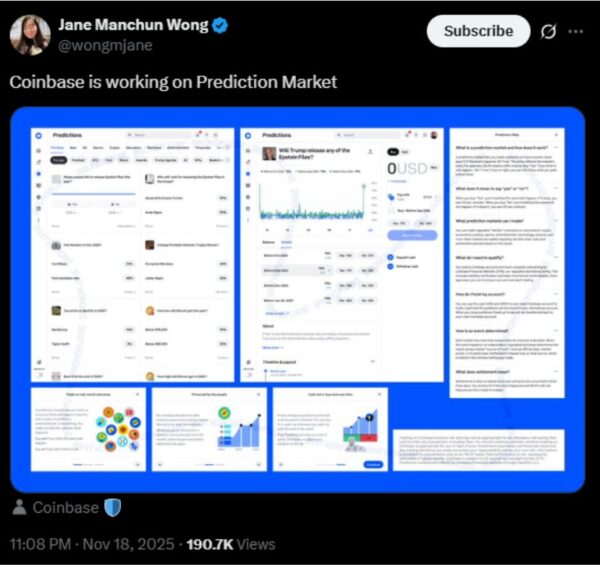

Leaked photos shared by tech researcher Jane Manchun Wong present the upcoming service and point out that Coinbase plans to hyperlink the product on to Kalshi. That is one other step in Coinbase’s push to change into a whole trade for each crypto and conventional monetary merchandise.

Coinbase Prediction Markets Deliberate By means of Kalshi

Screenshots posted by Wong present a transparent view of Coinbase’s new interface.

The photographs embrace a branded prediction market structure, an FAQ part and a information that explains how occasion contracts work. A discover within the screenshots states that the platform is obtainable by Coinbase Monetary Markets, the derivatives division of Coinbase.

Kalshi seems all through the interface because the regulated accomplice supporting the occasion contracts.

Kalshi operates beneath the supervision of the Commodity Futures Buying and selling Fee and its regulatory standing permits it to supply event-based buying and selling inside a managed framework.

Coinbase plans to depend on that construction in order that customers can commerce occasion contracts by means of a platform that follows United States guidelines.

One screenshot signifies that customers will be capable to take part with USDC or common US {dollars}. Coinbase already works with Kalshi because the custodian for its USDC-backed occasion contracts. It shops the stablecoin reserves in chilly storage, which provides the partnership an added layer of safety.

This collaboration signifies a transparent objective. Coinbase needs to place itself as a unified trade for crypto, derivatives and event-based markets.

Change Ambition By means of Regulated Occasion Buying and selling

Buying and selling volumes for prediction markets have grown not too long ago. Kalshi reached greater than 4 billion {dollars} in month-to-month quantity.

Polymarket additionally reported will increase as customers flocked to commerce outcomes tied to elections, coverage selections and main public occasions. Notably, different exchanges are shifting in the identical route. Crypto.com now gives a prediction platform that hyperlinks to Trump Media.

Gemini is working by itself product as half of a bigger plan to construct a brilliant app and it even not too long ago submitted filings to change into a delegated contract market by means of the CFTC.

Coinbase sees a gap right here, and is probably going making an attempt to reap the benefits of it. A prediction markets product would give the trade a solution to attain new customers and broaden its base.

By combining occasion contracts with USDC help, Coinbase can ship a buying and selling possibility that’s acquainted to crypto customers and accessible to newcomers.

The leaked screenshots present classes like sports activities, science, economics, politics and know-how and new markets look like added commonly.

This suits Coinbase’s plan to create a extra versatile trade the place merchants reply to world occasions as simply as they commerce crypto belongings.

Associated Studying: Kalshi Customers Acquire Safe USDC Buying and selling By means of Coinbase Custody

Utilizing Kalshi’s Framework To Guarantee Compliance

Coinbase Monetary Markets will run the prediction market beneath Kalshi’s regulatory umbrella.

This setup means customers can commerce occasion contracts by means of a safe and supervised system. Kalshi already gives regulated occasion buying and selling so Coinbase positive factors a powerful basis with out constructing new compliance buildings from the bottom up.

Coinbase’s function as custodian for Kalshi’s USDC reserves strengthens this hyperlink. Holding the stablecoin provide in chilly storage gives transparency and safety. It additionally helps each corporations keep belief in a section that usually faces authorized questions.

The partnership may also seemingly cut back friction for customers. Occasion contracts can be obtainable by means of a well-known Coinbase interface and merchants can use their present USDC or greenback balances as an alternative of switching platforms.

This method combines conventional finance and crypto buying and selling right into a single surroundings.